Still No Closure On Foreclosure Crisis | Shorts sales dominate the local market

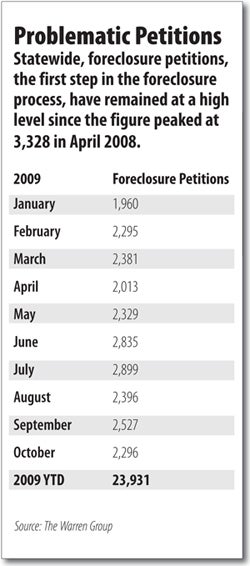

The volume of home sales is up and foreclosure petitions – the first step in a foreclosure process – are down month to month. But that doesn’t mean the foreclosure crisis is over.

“It’s still hurting out there, and it’s not getting any better,” said Sara Kelleher Sears, a Worcester-based Coldwell Banker realtor.

Kelleher Sears said when foreclosures began to rise in late 2006, she was hoping the crisis would remain isolated to properties in which the homeowners had defaulted on their loans.

Now, the crisis has spread to the overall real estate market putting downward pressure on all home values. “The foreclosure market has become the real estate market,” she said.

“Foreclosures and short-sales are dominating the market.”

The impact: While single family home sales increased by 17 percent this October compared to last year, prices are down 2 percent from September last year to this year, and they’re falling. Home sales took an 8 percent dip from August to September.

Increased Demand

Tim Warren, CEO of the real estate tracking firm The Warren Group, said volume picking up in recent months could indicate that demand for residential homes may come back, which could eventually lead to higher prices.

Also encouraging is a shift in the reason foreclosures are happening. Nontraditional factors that led to foreclosures ballooning in 2007 seem to be running their course.

Adjustable rate mortgages that homeowners could not afford and eventually defaulted on are not causing new foreclosures anymore, said Kevin Cuff, executive director of the Massachusetts Mortgage Bankers Association, a trade group representing mortgage lenders in the state.

Instead, the ongoing foreclosures today are happening for more traditional reasons. Homeowners lose their job, have a major unexpected expense, or have a significant loss in savings.

So then, Cuff doesn’t expect the foreclosure crisis to ease until the national economy improves. Unemployment figures and home prices are the statistics Cuff said he’s watching to monitor a turnaround.

Furthermore, Cuff said the federal government has attempted to stabilize foreclosures and help spur new home sales.

The Home Affordable Modification Program, or HAMP, encourages banks to refinance loans that homeowners cannot afford.

In late November the government announced it will be stepping up its efforts to ensure that banks that refinance mortgages make those changes permanent in an effort to curb the number of foreclosure filings.

Other state programs have required lenders to give homeowners a 90 day grace period before beginning a foreclosure filing.

Foreclosure deeds, which represent a completed foreclosure, rose almost 30 percent in October versus September of this year. But, they are down 8.5 percent from October 2008 to October 2009.

The federal government’s first-time homebuyer tax credit has also helped fuel the real estate market, said Rick Healey of Foster-Healey Real Estate in Fitchburg.

Plus, Healey said there could be a silver lining for the larger foreclosure crisis.

In North Central Massachusetts, large multi-family residential units were hit especially hard by the first wave of the foreclosures. Many of the homes owned by absentee landlords had not seen city building and health inspectors for years. Now, before a sale is finalized a building is brought up to code, improving some blighted areas.

New World

Still, for real estate agents like Kelleher Sears, the industry has taken a dramatic shift.

Peter Haley, vice president of the Central Massachusetts region for the Massachusetts Association of Realtors, said more than 1,000 registered real estate agents in the state have taken a voluntary Loss Mitigation Certificate class, which teaches them how to deal specifically with foreclosures and short-term sales.

He said at a recent state-wide conference in Worcester, he’s noticed that while the number of agents in the state has remained steady, some are picking up second jobs to help supplement their reduce income from real estate.

“Some people are seeing it as not a part-time job, but a dual career,” he said.

0 Comments