TJX Takes 2nd Look At E-Commerce | But analysts say it won't be easy for Framingham-based off-price retailer

Click on the website of J.C. Penney, and in about a couple of minutes you can order yourself a $6 tank top in six different colors. And, Old Navy's site has nine styles of girls' leggings to choose from. But head to the site of T.J. Maxx, a store where those types of products would fit perfectly, and there's no way to buy anything except a gift card.

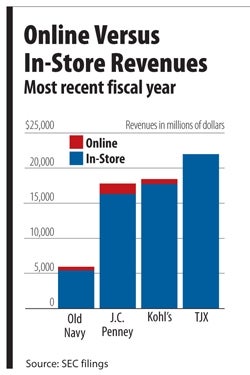

The TJX Cos., the Framingham-based parent company of T.J. Maxx, as well as Home Goods, Marshalls and other discount store brands, has been talking lately about entering the world of e-commerce. But analysts say that, because of TJX's unique business model, that's a surprisingly complicated thing for the company to do.

In an earnings call last month, TJX CEO Carol Meyrowitz called e-commerce a "major opportunity" and said the company has assembled a team of experts to plan how to move forward with it. But she also said that TJX is "not ready to talk timing yet."

Part of the company's caution undoubtedly comes from a previous e-commerce effort six years ago that ended up losing money.

Faster Inventory Turns

Matt Arnold, an analyst who follows TJX for Edward Jones, said he doesn't know exactly what went wrong with that campaign. But, he said, it's easy to see why online sales would be much harder for TJX than for other clothing or home design stores. It comes down to the company's status as an off-price retailer, which forces them to move inventory in and out of stores much faster than a traditional store would.

"They're very opportunistic, and they turn their inventory over significantly faster than most," Arnold said. "It's going to take a very sophisticated system to highlight the right items."

The TJX website describes buyers sourcing products from 14,000 vendors in more than 60 countries, taking advantage of closeouts and cancelled orders from department stores to get goods on the cheap.

"Our stores are truly never the same place twice," the site says. "We offer a continual flow of fresh merchandise."

'Complicated Undertaking'

Paula Rosenblum, a managing partner with Retail Systems Research, said the unpredictable nature of the closeout business means the company would have to move very fast on simple tasks like getting photographs of each item being sold from several angles, something online shoppers have come to expect.

"I would think for them it's a complicated undertaking," she said. "Part of it is technical but most of it's around execution around the business model."

Rosenblum said there could also be some touchy issues concerning competition. Going online could put the company head-to-head against the very people who supply them with closeout products.

Arnold said there might be some conflict around that issue, but he thinks TJX will remain a go-to buyer for anyone looking to get rid of extra product.

"They're already very well scaled up, so when a brand or a chain operator or whatever has a significant position, TJX is one of the buyers of choice that they're going to go to," he said.

No Need To Move Quickly

Arnold and Rosenblum both said e-commerce is becoming more and more of a necessity for retailers. But Arnold said that, for TJX, there's really no need to move quickly.

"They already are differentiated from the rest of retail based on their opportunistic business model," he said.

Indeed, TJX has grown impressively over the last few years. Its stock price, which hit a peak of around $18 a share in 2008 before the financial crash, has risen consistently since then to more than $34 a share.

Arnold said he'll be watching as TJX reveals more details of its e-commerce plans over the coming year, but he said the company probably doesn't have too much to worry about in the short term.

"They're doing extremely well as a company without it right now," he said. "They're sitting in a really good position."

0 Comments