Solid Financial Footing Can Carry Startups A Long Way

The finer points of owning a business, like setting your own schedule and creating wealth, entice hundreds of thousands of entrepreneurs to launch their own businesses each year.

But far fewer survive, and local business advisors say the financial health of an entrepreneur can make all the difference.

Curt Feldman, partner at Worcester-based Shepherd & Goldstein, an accounting and consulting firm, said one of the most prevalent problems that plague small-business startups is cash shortfall for owners who run out of money before revenue becomes reliable.

"It's like driving on the highway and running out of gas," Feldman said.

According to the U.S. Small Business Administration (SBA), plenty of businesses across the United States run out of cash each year, with about half of all startups making it five years or more and just one-third surviving a decade or longer.

The appetite for risk seems to have waned in recent years, due to the Great Recession, according to the SBA. It cited data from the U.S. Bureau of Labor Statistics that showed the number of new startups fell 12 percent, from 844,000 to 742,000, between 2007 and 2010.

But the allure continues. Feldman typically advises would-be small business owners, as well as those who are already in business. When an entrepreneur comes to him looking for advice on how to get off the ground, he poses a fundamental question: Why do you want to go into business and what are your goals?

"The ones who have good answers for those questions are the ones who are much more likely to be successful," Feldman said.

Feldman said the answers to those basic questions help lay the foundation for a sound business plan, which is required for any owner of a startup who needs financing. But that's just the beginning. He said entrepreneurs must be ready to invest a certain amount of their own money, as banks don't give cash to those without considerable skin in the game, "so they would feel some pain if they lost it."

Finding Startup Money

Coming up with startup cash may be one of the most challenging aspects of launching a business, but there's more than one way to do it. John Rainey, regional director of the Small Business Development Center (SBDC) at Clark University, said securing private investors, specifically family members, can be a good option.

"It's always better if you don't have to pay people back or you can get a lot more lenient terms," Rainey said.

Of course, borrowing from family members can become complicated if a business doesn't perform well early on, Rainey noted, though it's better than defaulting on a bank loan, and it may be the only option for entrepreneurs who need to come up with their share of the initial investment.

Banks lend money to untested entrepreneurs as an exception, and certainly not a rule, added Michael Crawford, chief operating officer at Commerce Bank in Worcester. If a candidate has the right mix of talent and strategy, Crawford said a bank might take a chance on a loan, but more often than not, people starting out in business for themselves begin by borrowing money from family or taking out home equity loans for start-up cash.

Learning The Lending Ropes

The SBDC provides business consulting services to aspiring entrepreneurs, and Rainey said that many times, people are unaware of all that's involved to obtain a bank loan for a business. Advisors at the SBDC teach clients "the five Cs of borrowing" to familiarize them with standard requirements, Rainey said. They include credit history, character (a person's ability to run a business), cash flow, collateral and commitment (an initial investment).

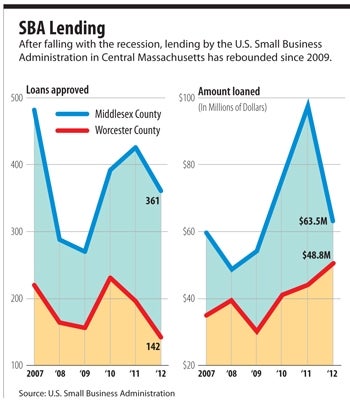

Proving that one meets the merits of an ideal loan recipient is challenging at best and impossible for some, Rainey said. In cases in which banks find a loan candidate too risky to lend to, Rainey said alternative loan programs, like SBA-backed loan guarantees and state-sponsored small business loan programs, are good alternatives as they often have less stringent requirements.

"We help (clients) navigate that minefield," Rainey said.

In some instances, there are no financing options available to would-be business owners. Usually, they have good ideas but don't have enough money to put down on a loan — banks usual require 20 to 25 percent, Rainey said.

"We tell them to go live like a monk for a year and then come back and start over," Rainey said.

Sometimes, a person just isn't meant to be a business owner, said Richard Patient, of Patient CPA and Associates in Worcester.

Despite national trends that show fewer people are launching startups, Patient said the idea has been popular post-recession.

"There's been so many layoffs and a lot of people are thinking of trying to start a business up on their own," Patient said. "And a lot of people don't have the acumen to grasp what's involved," he said, noting that government regulation alone is enough to stump even the most seasoned professionals.

There are factors aside from financial readiness that will give a lender pause when faced with a business loan application, Patient said. During an initial consultation with a client who's looking to go into business, Patient is usually able to glean whether someone has the character Rainey referred to.

"It's about the person themselves, and sometimes it's difficult to read that … but I'll tell you, a lot of times it's very easy," Patient said, adding that if he doesn't think a person is cut out for self employment, he lets them know — delicately, of course.

Worcester Success Story?

But for every ill-fated proposal and business that folds in the first five years, one survives. Oriola Koci, owner of Livia’s Dish, an Italian eatery that opened on Main Street in Worcester last year, hopes she’ll be a success story.

After receiving assistance from the SBDC, Koci said her business plan was so sound that she had two banks fighting to lend her money. But getting to that point was an eye-opening experience for Koci, a business major who previously worked in the corporate world.

“I don’t think anything really prepares you for what’s about to come when you open your own business,” Koci said.

With a year under her belt, Koci said she and her husband, Enton Mehillaj, a professional chef who works with her, feel like they’ve found their footing, with the initial struggles related to opening behind them and operations running smoothly today.

Armed with business savvy and industry expertise, Koci said coming up with the concept for her eatery was no problem, but convincing a bank that her business would be profitable was a different story. She suggested would-be entrepreneurs seek out the appropriate professional help to make their case, as she did with the SBDC.

Koci said the most important factor in getting financial backing was understanding all the nuanced information banks required on her venture’s profitability to agree to a loan. “It’s the ability to walk up to the bank and be able to say to them, ‘I’m going to borrow this money and I’m going to be able to pay it back,” she said.

0 Comments