From Tech To Toys, MetroWest Firms Aim For Education Market

It's hard to think about any aspect of life that hasn't been changed by information technology in a meaningful way over the last 20 years. But in the education technology field, the biggest changes may lie in the years ahead.

Companies in the industry have seemingly endless opportunities to take processes that high schools and higher education institutions use and make them digital, streamlining them and eliminating cumbersome paperwork that costs precious time and money.

Take it from Roger Novak, who makes a living betting on businesses in the information technology industry.

Novak, an owner of Maryland-based Novak Biddle Venture Partners, said there's a burgeoning "bubble" in the education technology sector as the rise of mobile devices and online education begins to transform the way education is delivered.

"You no longer have to sit in front of a desk," Novak said. "You can be anywhere and be educated, theoretically."

Novak said between 10 and 15 venture capitalists have been investing in the field steadily in recent years, but an influx of new players is now rushing to the scene. According to Novak, 110 companies received financing that totaled about $1.4 billion in 2011 from venture capitalists

"My guess is we're way beyond that now," Novak said.

Financing On The Rise

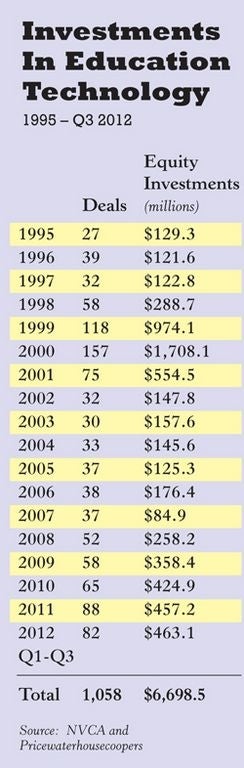

The National Venture Capital Association (NVCA), a Virginia-based trade organization, cites different numbers from Novak's, but they clearly illustrate the rapid growth in the industry.

The NVCA's MoneyTree Report, which uses data collected by Thomson Reuters, shows that investment in education technology more than doubled between 2008 and 2012.

According to the report, investments totaled $258.1 million in 2008, and rose to $463 million in the third quarter of 2012. Investments are the highest they've been since 2000, when $1.7 billion was invested in the industry due to the Internet boom.

It was about that time when FolderWave Inc., a Westford company that offers cloud-based services for high schools and colleges, got its start. CEO Bruce Ryan said FolderWave formed to help its first client, Boston College, improve its financial aid information system, a task too large for the college's IT department. Through that endeavor, company founders discovered the ingredients to a successful, computer-based system for education clients.

"Make it simple, make it easy to install, make it easy to use," Ryan said.

Today, the company offers 10 cloud-based services crucial to operations for its roughly 2,000 education clients, which include installation and support. Ryan said the breadth of FolderWave's services is what sets the company apart from others that offer fewer services — and that distinction is important in a market being infiltrated by new players.

More Applications, More Opportunities

For the first time, FolderWave is looking for outside investment to grow. The self-funded company is preparing to expand sales and marketing, as company officials eye the junior college market which Ryan said is experiencing increased enrollment, and as applications for college, in general, have increased.

"What we've done is make it easier for the school to handle that increase without hiring any additional staff," Ryan said.

One of FolderWave's prominent local clients is Worcester Polytechnic Institute (WPI), which buys cloud-based admissions services from Folder Wave, according to Deborah Scott, the school's chief information officer.

As Scott explains it, there are hundreds of processes a university must administer. Now, there are ample opportunities for vendors like FolderWave to get a piece of the pie.

It's no small task to identify the most qualified vendors, Scott said, and she has to be careful that companies know the particular needs of higher-education clients. For example, companies must offer services that comply with privacy laws.

Scott also offered insight into how the industry is transforming. A few years ago, vendors were selling software licenses, and IT personnel generally managed the processes after purchase. Now, companies have switched to offering cloud-based services, which they install and manage for their clients. This allows IT staff to work on other projects — overall a positive shift, according to Scott.

Consumers Demand More Electronic Options

The consumer is expecting more web-based options in education, too, according to those who work in the learning products industry.

"Online programming is certainly becoming more profitable," said Brian Emerson, executive director of e-learning at The Princeton Review, headquartered in Framingham.

For the test preparation materials company, the latest generations of customers are those who grew up using the Internet and are more comfortable with online applications than any group before them. That has translated into more online course offerings across all standardized tests — such as the SAT, LSAT, ACT and GRE — according to Emerson. He said the company will continue to fill expectations for more online materials as technology-savvy students transition to higher education.

For Sharon DiMinico, founder and CEO of Devens-based Learning Express, offering more electronic learning products at franchise stores across the country is a necessary evil.

DiMinico is concerned that as children gravitate toward computerized toys, they're missing out on important developmental and social skills.

"I'm not particularly excited about the category," DiMinico said.

But customers want to see items like e-readers on store shelves for their tech-savvy children.

DiMinico recalled seeing a friend's toddler pressing the pages of a magazine expecting them to turn as a computer screen would — evidence that a toy shop needs to be on the cutting edge. She said Learning Express will add about a half-dozen new tablet products to its offerings in 2013.

"I think they are going to become more important, and if it's what our customers are looking for, we have a responsibility to stay relevant," DiMinico said.

Read more

0 Comments