Bay State Firms Need Break In Jobless Fund Payments

Unemployment compensation has provided a critical financial lifeline to workers who, many through no fault of their own, wind up jobless. Massachusetts is among the most generous states when it comes to aiding the unemployed, providing a maximum of 30 weeks of income, about four more weeks than most states. The Bay State also pays among the highest weekly benefit amounts, dolling out up to $674 per recipient.

But now, as businesses are ratcheting up hiring, the state's unemployment rate is continuing to trend downward, it's time the Legislature and the Patrick administration take some bold steps to ease the financial burden on businesses that pay into the unemployment compensation system.

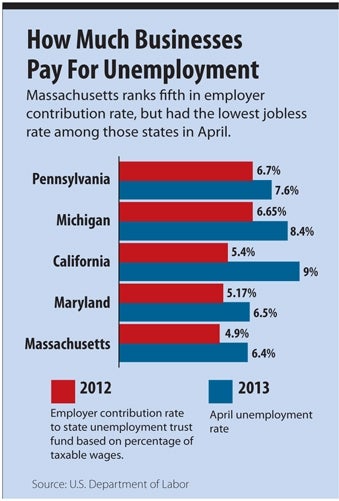

While the commonwealth has frozen the contribution rate for businesses the last few years – a necessity during a recession and subsequent recovery – Massachusetts still has the fifth-highest employer contribution rate among the states (4.99 percent of taxable wages), trailing only California, Pennsylvania, Michigan and Maryland, each of which had higher jobless rates in April.

While the state's unemployment peaked at 8.8 percent in December, 2009, it has continued a steady drop the last couple years to 6.4 percent in April. With the emergency over, policymakers must train their sights on fostering and sustaining business growth. Fortunately, that discussion began recently when two key lawmakers expressed a desire to reform the state's unemployment insurance system.

State Sen. Daniel Wolf and Wayland Rep. Thomas Conroy, both Democrats who chair the Legislature's Committee on Labor and Workforce Development, said the unemployment system needs reform after efforts to block increases in contribution rates have not impacted the solvency of the state's unemployment insurance trust fund. That fund, in fact, is projected to grow from nearly $500 million as of September 2012 to $1.55 billion by the end of 2016, according to October 2012 estimates by the Massachusetts Executive Office of Labor and Workforce Development.

Officials may think twice at first about cutting the maximum number of benefit weeks from the current 30, but they should seriously consider it if and when the unemployment rate falls below 6% percent. Certainly, there should be special consideration for workers in more economically distressed areas, but that should be a targeted exception to a real tightening of benefits, and not the rule.

As a state that believes in investing in its economic future, Massachusetts should look more closely at suggestion from Wolf to tap the unemployment insurance fund to train unemployed workers for private-sector jobs that are not being filled. For many workers, it's not hard to discover when their industries are fading into obsolescence, forcing them to think — sometimes painfully — about other skills they'll need to develop to remain viable in today's job market. Anyone who finds themselves in that situation should have access to career counseling and training that can help them transition and develop new skills. This is especially important for those who are within a decade of retirement but must continue working.

Massachusetts businesses have long lobbied for easing their tax burden. Yet many also recognize the "social compact" between the state and its citizens. To have a future in which everyone thrives, the state must strike the right balance between helping businesses and lifting the common good of all citizens.

Read more

Devens Succeeds In Reinvention

0 Comments