Nonprofit's One Mortgage program has lenders looking for value

Lenders are finding themselves walking a tightrope between providing lower-income Americans with quality housing and keeping their fiscal houses in order.

Massachusetts' newest first-time homebuyer program has appealed to previously uninvolved small community banks, but lost the backing of Bank of America, the state's largest mortgage lender.

Experts were unanimous in their belief that the Massachusetts Housing Partnership's (MHP) One Mortgage program — which was launched in January — offers the best deal to any prospective homebuyer making less than the local median income, which for a family of four ranges from nearly $68,000 in North Central Massachusetts to more than $96,000 in towns such as Milford and Southborough.

Under the program:

• Participating lenders must offer a mortgage rate that's 0.3 percent below the market average;

• Borrowers only have to put forward a down payment equal to 3 percent of the home's value; and

• Most importantly, buyers don't have to pay for private mortgage insurance, which can run upwards of $200 per month.

In addition, purchasers making less than 80 percent of area median income can qualify for subsidies during their first seven years of ownership.

“This is a really good way to reach out to low- and middle-income borrowers,” said Debra Colonna, vice president of mortgage operations at Clinton Savings Bank.

But finding a participating lender isn't easy.

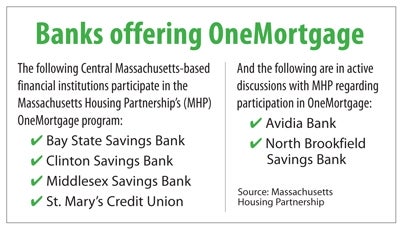

Of the 53 banks and credit unions based in Central Massachusetts, only Worcester's Bay State Savings Bank, Clinton Savings, Middlesex Savings Bank in Natick and St. Mary's Credit Union in Marlborough offer One Mortgage, though MHP officials said Avidia Bank in Hudson and North Brookfield Savings Bank are considering joining.

MHP executive director Clark Ziegler said a small staff and limited budget have made marketing and explaining the One Mortgage program to lenders a challenging process.

“Whenever we've been able to sit down with those small banks … the conversations very often result in the bank signing up,” he said.

Larger banks with a Central Massachusetts presence, such as Citizens and Santander, also participate in One Mortgage, Ziegler said. However, Bank of America — the area's largest bank with 39 local branches and more than $3.3 billion in local deposits — announced its withdrawal from the program in early June.

“Bank of America leaving the program will make a huge impact,” said Tom Callahan, executive director of the Massachusetts Affordable Housing Alliance. “It's going to be a major loss for their customers.”

Given the bank's presence in low-income, urban neighborhoods, Callahan is worried customers might not be aware they can likely get a better deal elsewhere.

“Our fear is that borrowers will still go to Bank of America for a mortgage,” he said. “For some people, that will be the difference between affording a home or not.”

Bank of America and the Boston-based banks it acquired were responsible for some 7,000 — or more than 40 percent — of the loans made through the MHP's SoftSecond program, which predated One Mortgage and ran from 1991 to 2013.

BofA: Not a fit for us

But Bank of America spokesman T.J. Crawford said offering one-off products on a state-by-state basis doesn't align with current efforts to simplify the bank. More than 40 percent of Bank of America's 2013 Greater Worcester home loans were to low- and middle-income borrowers, and Crawford said the bank expects to remain above industry average in that regard.

Though Bank of America's decision will make it tougher for MHP to reach Gov. Deval Patrick's goal of serving 10,000 homebuyers by 2018, it does provide community banks with a competitive opening.

“The 800-pound gorilla is not in the room anymore, and maybe there's an opportunity for us (smaller banks) to do more business,” Callahan said.

Numerous prospective homebuyers have reached out to Middlesex Savings and become new customers after learning that the bank participates in One Mortgage, said Jon Auger, the bank's senior vice president of retail lending. In just six months, it has emerged as the bank's most popular affordable housing product.

“These are feel-good loans,” Auger said. “I can get people into a home that I might not be able to get them in otherwise.”

Boost for new college grads

At Clinton Savings, One Mortgage loans have accounted for $740,000 — or nearly 5 percent — of the $15.5 million in home loans originated this year, Colonna said. She said the loans are particularly helpful for recent college graduates who haven't yet begun to climb the salary ladder.

Both Colonna and Auger concede, however, that One Mortgage isn't a major moneymaker, and there are potential risks involved.

The below-market mortgage rates required on One Mortgage loans could pose a problem if interest rates were to rise to a point where a lender was paying more to depositors than it was collecting from its loan portfolio, said Don Frost, Avidia Bank's senior vice president of residential lending.

“There is a financial consequence to doing that,” he said.

Banks are also prohibited from selling off any One Mortgage loans they originate. Therefore, an institution taking on too many of these loans could end up with an insufficiently diversified asset mix, Frost said.

Still, Frost said Avidia is considering offering One Mortgage loans since some bank customers would likely benefit from the terms.

“We want to keep our loan options competitive in the marketplace,” he said. “We definitely see the value.”

0 Comments