Health care industry awaits fate of Partners deal

In the health care world, all eyes are on Martha Coakley as the state's attorney general revisits an agreement that would allow Partners Health Care, Massachusetts' dominant health care system, to expand.

Partners and Coakley, who is also a candidate for governor, were closing in on an antitrust agreement this summer that would allow Partners to grow, bringing South Shore Hospital and its physician group, as well as Hallmark Health System's hospitals in Medford and Melrose, under its umbrella, while imposing price caps on the system to prevent it from raising costs over the next decade at rates that exceed inflation. It also limits Partners' ability to expand by barring it from acquiring more hospitals, with Emerson Hospital in Concord a possible exception.

But Suffolk Superior Court Judge Janet L. Sanders opened a public comment period on the deal to allow stakeholders to voice their opinions on what Partners' plans to buy the hospitals and grow its physician group would mean for cost growth in the Bay State's health care industry.

Meanwhile, Coakley asked Sanders to delay a ruling until September, when the Massachusetts Health Policy Commission is due to issue a final report on the impact on health care spending of the proposed Hallmark acquisition. And while Partners operates primarily in Eastern Massachusetts, anchored by Massachusetts General and Brigham and Women's hospitals in Boston, the deal would likely have a reverberating impact in Central Massachusetts and throughout the state.

Reliant COO: Why let the biggest get bigger?

So says Eric Buehrens, chief operating officer at Reliant Medical Group. A member of Newton-based Atrius Health, the Worcester-based physician group is part of a coalition of health care providers that has questioned the proposed deal, saying in a June press release that it would allow “unprecedented expansion” of Massachusetts' biggest health care system. Atrius was expected to submit formal comment to Judge Sanders last month on behalf of Reliant and its other members, which also include Worcester-based VNA Care Network & Hospice.

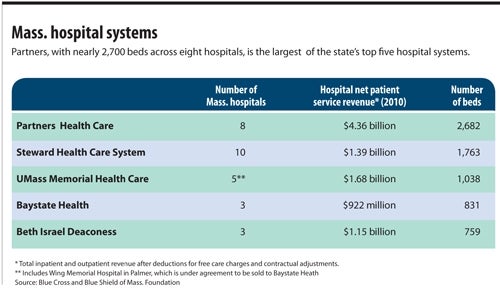

Noting that Partners already has about half of the Massachusetts market, Buehrens said allowing the system to grow will probably hurt consumers by decreasing competition, giving already higher-priced Partners more power to negotiate prices with insurance companies to their advantage.

“We can't imagine any justification for the biggest player to get bigger,” Buehrens said.

Buehrens also raised concerns about a portion of the agreement that would allow Partners to acquire up to 600 new physicians — no small figure, given that physician groups are already struggling to find doctors to work for them, particularly in primary care.

State: Each acquisition carries hefty price tag

It's likely that Atrius and other coalition members are primarily concerned with protecting their interests in the face of a larger Partners system, but when it issued cost-impact reports on the mergers, the Health Policy Commission (HPC) corroborated the premise that costs would rise if Partners is allowed to expand.

According to the HPC, annual health care spending by the state's three largest health insurers would increase by as much as $26 million if Partners were to acquire Weymouth-based South Shore Hospital, along with its affiliated physician group, Harbor Medical Associates. And the planned acquisition of Hallmark Health would likewise boost spending by up to $23 million, according to the HPC.

Although the 2012 cost containment law directs the HPC to review and report data on transactions that could increase health care spending, the commission won't take an official position on the proposed merger, according to Stuart Altman, chairman of the HPC.

Altman acknowledged the coalition opposing the Partners deal, saying its members would have preferred the deal go further and prevent Partners for expanding indefinitely rather than 10 years.

“They have very strong views about the fact that Partners, even with this agreement … will still have the price (advantage) over all the others, and it puts them at a big disadvantage,” Altman said.

Since Judge Sanders can halt the deal from proceeding if she finds it conflicts with public interest or is unlawful, the agreement isn't certain to be approved. And Coakley has suggested she may amend the deal, based on public comments and HPC's findings on cost growth.

Altman said he's unsure what the outcome will be.

“I can honestly say I don't know. We've never had a situation like this before, in the history of Massachusetts,” Altman said.

This new experience comes at a delicate time for Coakley, who finds herself trying to negotiate a deal that avoids an antitrust lawsuit in which she might not prevail, while still protecting consumers. Republican candidate Charles Baker said in an interview with the Boston Globe last month that he opposes the deal as written, and one of Coakley's Democratic primary rivals, State Treasurer Steven Grossman, called it a “bad deal” a week earlier, the Globe reported. Both Baker and Grossman initially supported the agreement.

AG's office says component pricing important

Brad Puffer, a spokesman for Coakley's office, said that despite the criticisms, the agreement would take important steps toward reducing Partners' market power. Puffer did not dispute concerns about the potential to boost costs, but said the agreement seeks to control them.

“Our own … reports have shown how the market power of Partners has contributed to higher prices, and that work has informed our approach in this case. This consent judgment will control health costs and alter Partners' business practices for the next 10 years, accomplishing more than a lawsuit would have,” Puffer said in a statement.

Specifically, Puffer said a provision that would introduce component pricing, which would require Partners to negotiate one contract for community and teaching hospitals, and another for South Shore and Hallmark, is an important measure in keeping costs down. Puffer said that in the past, Partners has declined to negotiate separate contracts.

Partners spokesman: Expansion is vision of ACA

But Rich Copp, spokesman for Partners, offered a much different perspective. Copp suggested that the HPC's cost-growth projections are incorrect, and he said Partners believes it will reduce spending by bringing community hospitals into the fold.

Copp said Partners will be able to reach patients at medical groups and community hospitals, and coordinate their care in a way that will improve their outcomes. That will decrease the need to send them to Partners' Boston hospitals for more extensive — and expensive — treatment. Copp noted that this type of system is already being piloted at Partners through the federal Pioneer Accountable Care Organization (ACO) program that uses population health management for Medicare patients. In 2013, that program saved $14.4 million, according to Partners.

“This is the vision of the federal Affordable Care Act … and the state cost containment law,” Copp said.

But Copp added that the proposed agreement also presents “significant challenges” for Partners.

“Under this agreement, Partners will become the most regulated health-care system in the state, if not the nation,” Copp said.

0 Comments