EMC stays course in face of investor pressure

You might call Hopkinton-based EMC Corp. the reigning patriarch of Central Massachusetts technology businesses. Founded in 1979, the company started out making 64-kilobyte computer memory boards, and it kept on helping firms hold onto data as their demand for storage space grew into the terabytes and beyond.

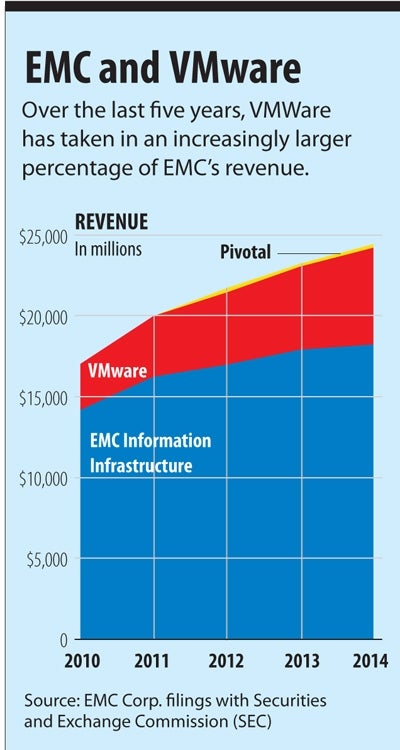

Today, the company remains profitable and it's growing, making a $2.7 billion profit on sales of $24.4 billion in 2014. But, to some investors and analysts, the mature, multinational corporation needs a bit of a push to compete with the rest of the fast-growing tech world. Hedge fund manager Elliott Management Corp., an investor in the company, has been calling for management, led by CEO Joe Tucci, to take drastic steps to drive faster growth. Specifically, the firm wants EMC to spin off its virtualization division, VMware.

EMC bought VMware in 2004 and holds 80 percent of its stock. The subsidiary is growing considerably faster than the parent company, with revenues rising 16 percent over the past year compared with 2 percent for EMC's core information infrastructure business. A third division, the data analytics company Pivotal, is growing quickly but remains a small part of the corporation.

Daniel Ives, an analyst with FBR Capital Markets & Co., said EMC's majority ownership of VMware may make both companies appear less valuable to investors than they otherwise would. Ives noted that other big tech companies, including Hewlett-Packard (HP) and eBay, recently announced plans to spin off divisions, hoping to unlock more shareholder value.

“From an investor perspective, the reason these splits or spinoffs are so important — there's more of a distinct valuation to each piece,” he said. “By owning a majority amount of (VMware), the value really hasn't been captured in EMC's stock price.”

Ives said that, if freed from its ties to EMC, VMware stock would gain value. At the same time, he said, the core EMC business could also benefit from a renewed focus on faster growth in such areas as cloud storage, big data and cybersecurity.

“It's like a football team that's not doing well,” Ives said. “Do you change the players? Change the coach? Something needs to change in the view of the man on the street, just given the sluggishness and the inconsistency we've seen over the last 18 months.”

In response to a question about the demands from Elliott, EMC spokeswoman Katryn McGaughey cited a recent statement by Tucci in which he said management has “a very open dialogue with Elliott, as we do with a lot of shareholders.”

Tucci also defended EMC's current structure when he spoke at an investment conference in November. He argued that the company's array of products and services can be combined to provide better solutions for customers. The company has scheduled a forum on March 10 to discuss strategies and products, though Tucci said it won't involve the structural questions.

In EMC's most recent earnings call, its executives pointed out efforts to grow all parts of the firm. David Goulden, CEO of the Information Infrastructure business, said its 2 percent growth over the past year was better than competitors' performance. He said EMC has benefitted from its ability to help customers move from traditional data centers to new kinds of storage systems. Revenue from the company's “emerging storage” products grew 52 percent for the year.

CFO Zane Rowe also argued that EMC's three divisions add up to more than the sum of their parts.

“The ability of Pivotal, VMware, and EMC Information Infrastructure to work closely together results in differentiated solutions with broad transformative capabilities,” he said. “This integrated solution capability opens up the potential for large $100 million-plus long-term opportunities with customers that would be more difficult to address separately.”

EMC has been looking at various ways to move forward, given the relatively stagnant market for traditional storage. In September, The Wall Street Journal reported that the company had held talks with both Dell and HP about merger possibilities, although nothing came of the conversations.

Meanwhile, in a move similar to ones it made at the start of both 2013 and 2014, the company announced a restructuring plan in January, saying it would cut an unspecified number of jobs during the first quarter of the year. Spokeswoman McGaughey said in an email that EMC is “balancing and organizing our workforce to best align with our key growth opportunities,” but she said the move is “not a cost-cutting exercise.” She said the company is adding positions in fast-growing areas as it cuts from more stagnant divisions, and will work to move displaced employees to the growing parts of the company.

For investment analysts, reaction to that announcement was a collective shrug. Rob Cihra, of Evercore Group LLC, said most interested investors are watching to see what happens with VMware.

“I think it's debatable whether the current ownership structure of owning 80 percent of VMware makes sense long term,” he said. “Obviously management thinks it does, but I think there are valid questions from an investment standpoint whether it does or not. I think most investors would rather spin it out.”

Whether those investors will eventually win out remains to be seen.

(CORRECTION: The original version of this story incorrectly stated EMC's net income in its 2014 fiscal year. It was $2.7 billion.)

0 Comments