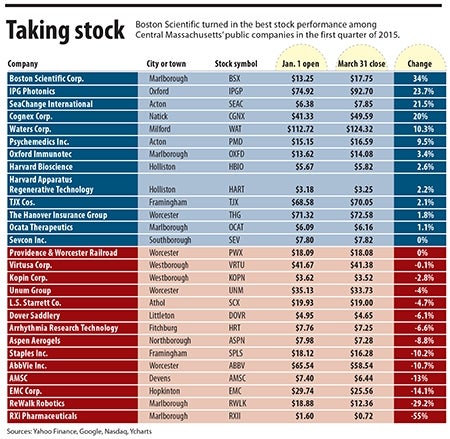

Boston Scientific leads the way to open the year

(Editor's Note: Taking Stock, a new feature, will be published quarterly to highlight the market performance of public companies that are either based or that have a significant presence in Central Massachusetts.)

It's amazing what can happen when you're no longer staring down the barrel of a lawsuit.

Before Boston Scientific (BSX) reached an out-of-court settlement with rival Johnson & Johnson over the 2006 acquisition of Guidant Corp., its stock price had been making steady gains, from $13.25 a share at the start of the year to $14.84 on Feb. 17, up 12 percent.

But on Feb. 17, BSX agreed to pony up $600 million to Johnson & Johnson, avoiding what would have been a much costlier $7.2 billion. In one day, the stock soared 12.4 percent to $16.68, boosting the firm's value as it broke free from the shackles of a potentially huge liability. Just two weks later, BSX announced its largest acquisition since it ponied up $27.2 billion for Guidant: a $1.65-billion deal to buy the urology division of American Medical Systems. That deal will add to BSX's urology treatments line.

Here are first-quarter spotlights on two other stocks:

Staples (down 10.2 percent, to $16.28) – Amid investor pressure, the Framingham-based office supply retailer bought chief rival Office Depot for $6.3 billion. Will it help? It will at least wring out a lot of costs. But the growth of ecommerce has had a major impact on specialty retail segments such as office supplies.

ReWalk Robotics (down 29.2 percent to $12.36) – The manufacturer of the exoskeleton, which helps people with spinal cord injuries walk, hit the market last September at $12 a share. It traded as high as $43.70 before retreating to its quarter-end price, still a 3-percent gain above its IPO launch price. n

0 Comments