Locked, loaded primed to sell: Fully leased properties with marquee tenants draw investor interest

In the face of stagnant interest rates, investors looking for long-term returns are dropping their money into commercial real estate filled with tenants holding long-term leases.

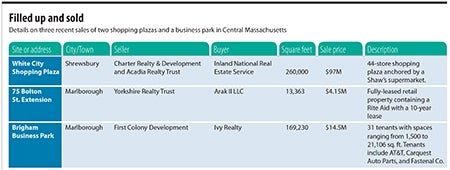

The recent sale of White City Shopping plaza in Shrewsbury for $97 million represents the fully-leased investment property that has proven popular in the last two years, according to Michael Smith, a managing director and principal at Avison Young, a commercial real estate firm. Anchored by a Shaw’s supermarket, the property has national brands with long-term leases that will provide the new owners, Inland National Real Estate Service, of Illinois, with a steady income.

“What really brings value to real estate is tenancy … you feel confident that a Walgreens, a CVS or a Home Depot are always going to be good for the money,“ says Nat Heald, senior vice president and partner with CBRE New England, which helped sell White City. “Generally, people buy a piece of commercial real estate for the existing leases that are similar to (long-term) bonds.”

Competition for investment properties has been growing, Smith said, due to historically low interest rates that have delivered relatively lower returns on such vehicles as bonds and money market funds. Enthusiasm for investment properties is statewide, he said, with new, foreign investors focusing on Boston properties pushing many of the historically active Boston investors to explore other markets in Massachusetts.

“Worcester is not Boston, but if you’ve got the right asset with the right tenants and the right lease structure, you’ll have a much higher probability of getting that deal done today than you did five years ago,” Smith said.

That investment proposition extends throughout all types of commercial property, including offices and warehouses. Triple net leases — in which tenants are paying the real estate taxes on the leased properties, along with the costs of building insurance, and maintenance of the common area — are the most desirable as they free the owner from responsibility with physical problems at a property, Smith said.

Smith was part of a team that sold the Brigham Business Park in Marlborough in December. The 169,230-square-foot site has industrial, office, warehouse and manufacturing space with 31 tenants at the time of the sale. Smith credited the property’s diverse mix, high-quality tenants such as AT&T, and low vacancy as factors that drove interest among prospective buyers.

There have been a number of investment sales in the office market over the last two years, added Phil DeSimone, managing director at JLL Boston. These properties tend to come up for sale in cycles, with a new crop of improved and leased properties appearing every five years. Many of the properties being sold now have been ready for sale, but the Great Recession put the sales on hold, he said. So, the last two years of sales have been filled with a glut of re-tenanted properties, those on the normal cycle and those whose sales had been postponed.

Why they invest

But commercial properties are not being sold solely for investment purposes, as some buyers are looking for more than just steady income. Whether they’re looking for a bigger return or simply want to build something, there will always be a market for “value added” properties, DeSimone said.

Investors can get them for a lower price, with the trade-off being the higher risk they assume. For example, a shopping plaza built in the 1970s that needs physical improvements to attract a company with a national brand could result in a high return if the new owner can land an “anchor” tenant for the property and get it fully leased.

These purchases by opportunistic buyers happen across all types of commercial property, DeSimone said, and as someone who lists them, he believes it becomes a matter of knowing which buyers are pursuing what type of investment.

“They believe they can add a lot of value and tenants and then sell it,” he said.

White City Plaza is an example of adding value to a property, Heald said. When it was purchased in 2010 for $56 million, Charter Realty & Development and Acadia Realty Trust set out to not only improve the physical plaza, but also secure national tenants. The tenant base transformed this 260,000-square-foot site from a local fixture to an investment property.

“Suddenly you have this brand new product that will attract national tenants and that is exactly what they did (at White City),” Heald said. “They recognized that this property at some point in the future could be something more than it was when they bought it in 2010 and that is exactly what they were able to achieve in the last five years.”

What's in the mix of stores?

But, there is more to a shopping experience than one major anchor store or filling a property with national chains, Heald said. A shopping center needs a mix of different types of retail that will allow people to get much of their shopping done in one location.

Even more specific than a mix of store types, Heald said, there is value in having local stores in the plaza mix. While most investment properties feature 75 percent or more national stores, he said, having local businesses be part of the plaza helps make it a part of the community, which benefits the investment in the long term.

“National tenants are fantastic from a risk minimization point of view and the local tenants are important from a shopping experience point of view,” Heald said. “Local tenants are really desirable for creating a sense of place or a unique shopping experience … and making it a part of the community that it serves.”

0 Comments