UniBank sees a better use for brick and mortar in digital world

When Chris Foley, senior vice president of Whitinsville-based UniBank told Sheri Cesnek about a job opening managing the bank's branches, she knew right away that it was time to try something new.

“It was one of those feelings you get,” Cesnek said. “It's really intangible.”

Cesnek, who joined the bank in November as vice president and branch administration manager, grew up in Whitinsville. Her career took her into management at Shawumut Bank and Fleet Bank, where she managed sales at 22 branches.

In 2000, she retired from banking, transforming herself into a consultant. As her expertise evolved, she worked in project management and lending for real estate attorneys and banks – including, for the past three years, UniBank. That's how Foley got to know her.

“I worked directly with Sheri one-on-one on a lot of large projects,” he said. “Sheri brings not only the banking background, but she also excels in project management. Regardless of what projects she was asked to take on or assist, her tremendous skills were obvious to everyone around her.”

That's important, Foley said, because, in her new position overseeing the operations of all 13 of the bank's branches, Cesnek has to expect the unexpected.

“I see that she almost takes each challenge as a little project,” he said.

UniBank's local growth

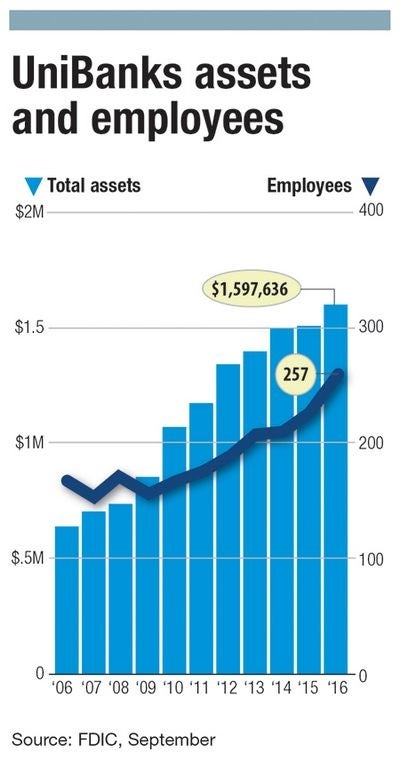

As the changing economy transformed the banking landscape over the past decade, UniBank continued to grow its assets and employee headcount right through the Great Recession.

In 2006, it had 165 employees and $635 million in assets, according to the FDIC. By this past September, it had grown to a staff of 257 and $1.6 billion. Over the past five years, it's opened branches on Gold Star Boulevard in Worcester and in North Grafton, Hopkinton and Sutton.

It's now in the process of building a location in the development at the site of the old Spag's building in Shrewsbury, opening in late summer.

Cesnek now connects local branch managers with various departments at the bank's headquarters, helping to make sure the right procedures and protocols are in place and that everyone adheres to regulatory requirements.

While she liked being a consultant, with her youngest child now 15, Cesnek's work-life balance was shifting, and the offer from UniBank gave her a chance to step into a new kind of work with a more operational focus.

“It was a good challenge,” she said.

The new brick and mortar

With customers now handling simple transactions through ATMs or on the phone, Cesnek and Foley said branches play a different role than they used to.

New locations are smaller – less than half the size of the typical 3,000-square-foot branch you'd find 10 years ago – and they're staffed not by tellers but by universal bankers who can handle complicated transactions as well as simple requests. Foley said each location also has wireless internet and a little café.

“There'll be children playing on the iPad, their guardians getting coffee,” he said. “Sometimes people just know that we have the Wi-Fi and stop in. It also allows us to interact with those clients.”

Foley said personal interaction is a big part of UniBank's business model. Unlike at international banks, if customers have a question or concern they can easily stop and talk with one of the bank's executives, who often get involved in local organizations. Cesnek, for example, is a member of Parent Teacher Association and High School Booster Club in Hopkinton, where she lives. She volunteers with Framingham's Salvation Army.

0 Comments