MetroWest office, industrial markets strong

Grant Welker

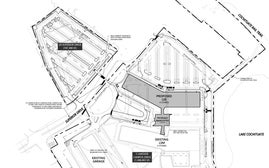

Construction on a new MathWorks campus off Route 9 in Natick.

Grant Welker

Construction on a new MathWorks campus off Route 9 in Natick.

The market for MetroWest office, industrial and manufacturing space remained strong in the second quarter, according to a report issued Tuesday by the commercial real estate firm NAI Hunneman.

Several signs pointed to a strong market between Boston and Worcester: the vacancy rate for industrial space in the I-495 corridor between Hudson and Holliston was just 5.3 percent, about half the rate of the rest of the I-495 belt. Manufacturing space in the nine-town area that NAI Hunneman calls "495 West" boasted a 5.4-percent vacancy.

The 495 West area has added more occupied office space - 281,000 square feet - than any other Boston-area region so far this year.

It also lead the whole 495 belt in attracting the highest manufacturing-space rent, and has the most manufacturing space under construction, according to the report.

More broadly, MetroWest also had notable leases and sales in the second quarter, including CPI Radant's move into 128,000 square feet at 4 Bonazzoli Ave. in Hudson, LBF Corp.'s new 65,000-square-foot space in Marlborough, and Tegra's 81,000-square-foot expansion at 9 Forge Parkway in Franklin. In one of the largest manufacturing expansions, Southwest Management Corp. leased 60,000 square feet at 130 Constitution Blvd. in Franklin.

The Framingham-Natick area had a vacancy rate of 8.4 percent, and a middle-of-the-pack average rent. The area, which also includes Ashland, Sherborn and Sudbury, had an even higher office vacancy rate, at 16.2 percent. Average leasing prices for office space was $24.09, trailing the Boston-area average of $33.60.

Boston-area suburbs in general trailed the city proper in vacancy rates, according to report NAI Hunneman released last week.The rate of 7.4 percent was the highest since the first quarter of 2016.

0 Comments