Avidia Bank branching out beyond Hudson

Avidia Bank has spent its nearly century and a half based right around the Assabet Valley, where it keeps its headquarters in Hudson. But now the bank is making a bet on an eastward expansion toward a much more crowded Boston market.

The bank borrowed $25 million this summer to finance growth that starts with a new branch in Framingham scheduled to open Sept. 25 at 270 Cochituate Road.

“We feel that the opportunities are east of here,” said Margaret Melo Sullivan, Avidia’s executive vice president, chief financial officer and treasurer. “That’s where we feel the opportunities are and where we can grow our business lines.”

The grander plan

The Framingham branch will be slightly bigger than Avidia’s existing locations, a two-story building with a glass facade that marks the company’s new presence closer to Boston. There isn’t yet a plan for even more physical locations. Instead, Avidia plans to move into a denser market with more business and personal lending opportunities.

Avidia plans to focus more on lending areas where it can differentiate itself, Sullivan said, such as commercial and industrial loans, and projects such as solar farms.

“It’s part of the grander plan, if you will, to continue to expand commercial presence,” Sullivan said. Without an immediate expansion of physical branches, the eastward push will rely on billboards, TV and radio spots and other marketing online.

Avidia Bank was formed in 2007 by a merger between Hudson Savings Bank and Westborough Bank, which both opened in 1869. The bank has never ventured far beyond its geographic base, but the merger of the two entities, which didn’t have overlapping territories, gave Avidia a greater economy of scale that has brought accelerated growth in recent years.

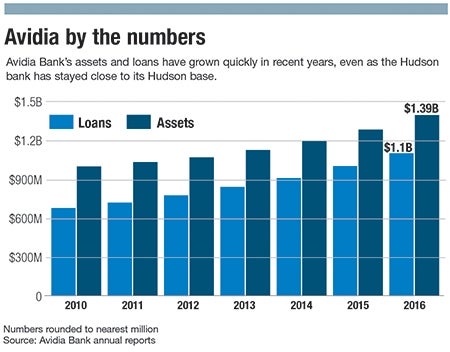

The company has grown to $1.2 billion in assets, a growth of more than $196 million, or 16 percent, in just two years. Deposits hit $964 million last year.

Banks branching out

Avidia isn’t the only area bank looking eastward.

Berkshire Bank, based in the western Massachusetts city of Pittsfield, said it will move its headquarters to Boston, where it has only three branches. Berkshire is buying Worcester’s Commerce Bank but will not change the name of Commerce branches.

Another bank that’s the result of a new merger, Fidelity Bank, has its own expansion plans: southward into Worcester. The 10-branch Leominster bank made a splash earlier this summer by signing a 10-year naming-rights deal for the Worcester Railers’ two-rink facility. The Fidelity Bank Worcester Ice Center will open next month.

Fidelity Bank — whose merger with Barre Savings Bank was completed last year — plans to open its second Worcester branch next spring at the 145 Front at City Square apartment complex. The branch will be at the corner of Front and Foster streets, bringing Fidelity’s name to another high-profile spot.

“For our company, we think there’s great opportunity in Worcester,” said Chris McCarthy, Fidelity’s president and COO. Fidelity’s longtime branch on Shrewsbury Street in Worcester has done especially well, he said.

Opportunity for more growth

A year and a half after Fidelity and Barre merged, the pairing has gone well, McCarthy added, with high retention of consumer and business clients. The bank will entertain merger opportunities in the future, he said.

Two other Central Massachusetts banks are also the result of mergers finalized this year. Cornerstone Bank is the new name of SpencerBANK and Southbridge Savings Bank, and Main Street Bank is the combined Marlborough Savings Bank and North Middlesex Savings Bank.

The merger that created Main Street Bank, with 14 branches from Westborough north to Pepperell, has created new opportunities for growth, but nothing yet specific, spokeswoman Ellen Dorian said.

0 Comments