Vice competition: The local beer industry is confident recreational pot won't chip away at its market

Pretty soon, two of the Massachusetts most sinful industries will compete for the same kind of customers.

With recreational marijuana already legal in the state and set to begin retail sales this fall, breweries are optimistic, armed with data showing the weed and beer markets complement each other. However, competing data shows there is a limit to how much legal depressants people will buy, with pot eating into alcohol sales.

Keith Sullivan of Hudson's Medusa Brewing Co. said he has seen no decline in brewery success or any kind of customer shift since recreational marijuana first became legal in 2016.

“It almost seems as though the two help one another while still catering to different audiences,” said Sullivan, in an email to WBJ. “I anticipate that this will also be the case here in Massachusetts.”

However, in Massachusetts, legal adult-use cannabis has only been available if people grew it themselves at home. With the state Cannabis Control Commission having now approved licenses to retailers like Cultivate in Leicester, marijuana products will soon become more widely available, as sales are expected to begin by November.

Positive data from brewers

Bart Watson, chief economist of the national trade group Brewers Association, said little data suggests any kind of a relationship between the weed and alcohol markets, but beer seems to be doing well in states where cannabis is legal.

States allowing adult-use cannabis are reported a 1.1-percent decline in beer shipments per capita through July. In states with just medical marijuana, that decline was 1.8 percent. In states with no legal marijuana of any kind, that decline in shipments was 2.3 percent.

For now, brewers are focused on consumer preferences, demographics and competing with other brewers, he said.

“I wouldn't say this 100 percent means that cannabis isn't having an effect on beer, but it's pretty hard to construct an argument about how it's having a purely negative effect when the beer trends are the best in recreationally legal states,” Watson said.

But maybe it's not so positive

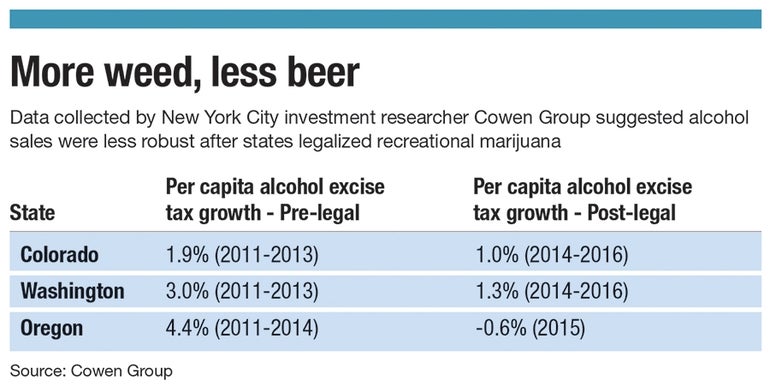

Data from New York City financial services firm Cowen Group suggests local craft brewers might want to get ready to take a hit from the cannabis market.

In an April 2017 report, Cowen said alcohol consumption could be under pressure for at least the next decade, partly due to cannabis, as per capita alcohol tax growth dipped in Colorado, Oregon and Washington in the years following the legalization of weed. The figures coincide with consumer preferences in those states.

In Colorado, where cannabis sales began in January 2014, cannabis incidence among consumers aged 18 to 25 increased about 70 percent in 2014-2015 compared to 2003-2004.

Alcohol incidence over that same time period fell from an all-time high of about 71 percent in 2007-2008 to about 68 percent in 2014-2015.

In another study from this April, Cowen Group researchers found states with adult-use cannabis binge drink 5 percent less frequently per month than medical cannabis states and 13 percent less frequently than non-cannabis states.

Cannabis could be a “substitute social lubricant for alcohol, and will likely continue to present an incremental headwind to alcohol sales, in particular beer,” the 2018 Cowen report said.

Beer consumption has been falling for years while cannabis use continues to rise, according to data Cowen pulled from the National Survey on Drug Use and Health and the National Institute on Alcohol Abuse and Alcoholism.

According to the survey, almost 45 percent of respondents said they consumed cannabis in 2015, which is up from below 30 percent in 1979.

On a per-capita basis, beer consumption has fallen from about 1.35 barrels to about 1.1 barrels.

On the ground, in Colorado

In Colorado, with legal recreational pot since 2012, beer industry experts say consumers choose both vices.

Since legalization in Colorado, the beer industry has continued to thrive, said Andres Gil-Zaldana, executive director of the Colorado Brewers Guild.

Sure, the business of pot has nearly tripled since legalization, but the beer industry is no slouch in the state.

There were 126 breweries in 2012. Now, that number is approaching 400, said Gil-Zaldana.

“The two markets kind of exist side by side,” he said. “They don't syphon off customers from each other.”

However, less than five years of a sample size out of Colorado is not enough to truly gauge the impact of weed on beer sales, said Jeff Nowicki on of Connecticut-based Bump Williams Consulting.

Nowicki said consumers would drink less alcohol if they began smoking recreational marijuana, but any impact so far has been minimal and perhaps just a reflection of the beer industry already beginning a slowdown of growth.

The real impact, Nowicki said, could be when cannabis finds its way into beer.

Beer & weed together, in liquid form

Colorado-based Ceria Beverages, founded by Blue Moon founder Keith Villa, is planning to launch a cannabis-infused non-alcoholic beer, and California's Lagunitas Brewing Co. has a similar product on the market.

Collaboration between the beer and cannabis industry is extremely limited, especially in Massachusetts, as the state Alcoholic Beverages Control Commission ruled in May brewers won't be allowed to brew a cannabis-infused beer as long as marijuana is federally illegal.

However, the interest remains there. Down the Road Beer Co. in Everett attempted to do just that earlier this year, but that drove the ABCC to issue its guidance on the topic, effectively squashing any opportunity to make a pot-infused beer.

Whenever laws become less restrictive, Milford pot company Sira Naturals could be one of those companies looking to partner with a brewer.

“Cannabis and craft beer cannot only coexist, but they can also complement each other,” said Spencer Knowles, vice president of sales and business development for Sira.

Knowles, a wine industry veteran, said both beer and cannabis have been enjoyed together for a long time regardless of legality.

From a production standpoint, there are a ton of similarities between the industries, Knowles said.

“I feel like the consumer would appreciate the amount of work and craft that occurs at a grow facility, much like when you tour a brewery and learn what craft brewers do to make a beer special or unique,” he said.

Consumers just aren't able to see it, as public tours of cultivation centers aren't currently allowed like they are for breweries, per Massachusetts regulations.

Taking a page out of his wine background, Knowles called cannabis a cross between craft beer and fine wine. He compared cannabis strains to the different hops and grapes used to produce differently-flavored beers and wines.

His goal, he said, is to elevate cannabis to the level of a fine cabernet.

The beer and wine industries allow for storytelling between the producer and consumer, and the same could eventually be true in the pot business.

“We'll see more people being educated about the different strains, effects, growing conditions and flavor profiles,” Knowles said. “Those things are not unique to just wine and beer.”

0 Comments