Despite concerns about impacts of tariffs and cuts to federal incentives, heat pumps are becoming standard equipment in the heating and cooling business.

Get Instant Access to This Article

Subscribe to Worcester Business Journal and get immediate access to all of our subscriber-only content and much more.

- Critical Central Massachusetts business news updated daily.

- Immediate access to all subscriber-only content on our website.

- Bi-weekly print or digital editions of our award-winning publication.

- Special bonus issues like the WBJ Book of Lists.

- Exclusive ticket prize draws for our in-person events.

Click here to purchase a paywall bypass link for this article.

Once dismissable as a heating-and-cooling technology considered overly expensive and only useful in particularly constructed homes and particular environments, improvements in technology, government incentives, and new energy-use mandates have helped heat pumps become a standard sight at both newly constructed and older buildings.

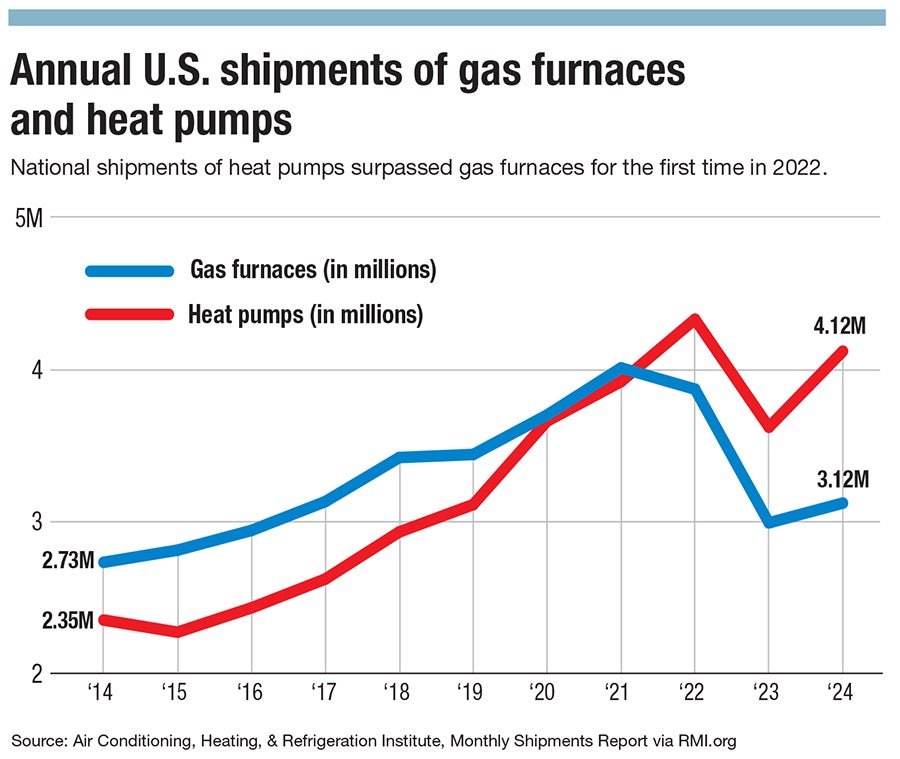

For the first time ever, the amount of heat pumps shipped throughout the U.S. in 2022 surpassed the amount of traditional gas furnaces. Demand in Central Massachusetts is now spiking, as customers rush to take advantage of incentives and prices amid plans to cut federal funding.

“Heat pumps are highly efficient,” said Erik Bishop, owner of Erik Bishop Plumbing & Heating in Holden. “Now the government is pushing electric, electric, electric. The only way to get that is to go through heat pumps, because they've used such a low amount of electricity. They produce so much energy out of low electricity. On new construction, it's a no-brainer.”

Heat pumps work by pulling heat from an outside source, which could either be air, water, or the ground, and bringing it inside to heat homes, or doing the opposite to cool a home. The technology can be traced back more than 170 years but has gained traction this century as a way to reduce reliance on fossil fuels and increase energy efficiency.

Despite concerns about impacts of tariffs and cuts to federal incentives, heat pumps are becoming standard equipment in the heating and cooling business, helping the state meet energy goals while bringing Central Massachusetts’ older residential and commercial buildings closer to modern times.

Technology and installation

The median age of a Greater Worcester home is 55 years, with half of the region’s housing stock having been built before 1967, according to a study released by Construction Coverage in January 2024. This median figure is 14 years older than the nationwide number of 41 years.

While updating insulation in older homes is critical for energy savings regardless of heating and cooling sources, newer technology can help modernize Greater Worcester’s older housing stock, said Bishop.

“In the past with older houses, you would need a second source of heat,” he said, “Now with this brand new refrigerant we’re transitioning to right now, it can keep up with demand.”

While the name of the technology might make people think more about heat pumps’ heating ability, Central Massachusetts customers are more interested in their cooling ability, said Caroline Staudt, home comfort advisor at Elephant Energy, a Denver-based home electrification firm serving Central Massachusetts from a Greater Boston location.

“We have a lot of homes in Massachusetts that don't have any central cooling,” she said. “People are still relying on window units. Heat pumps do both. A lot of people will come to us because of their cooling needs.”

While heat pumps can help keep older houses warm in the winter and cool in the summer, existing electrical infrastructure in these homes can often be a hurdle needing to be overcome, Staudt said.

“We're always evaluating the electrical system, because we're adding, with a heat pump, a big electrical load to a home,” she said. “Fossil fuel systems don't have a big electrical draw. So electrifying a home in Massachusetts is complicated, because sometimes we're dealing with homes that are 200 years old.”

In addition to coolant, other new technologies are improving heat pumps’ usefulness, said Aslam Kolia, an electrification consultant at Eversource Energy, the Boston-and-Hartford-headquartered utility company serving parts of Central Massachusetts. This includes quieter technology, duel-fuel systems that plug into gas lines when needed, or valuable speed pumps, which can be more efficient and lead to a more comfortable environment than older systems, which can only switch between being on at full blast and off.

If buildings have existing duct work, heat pumps can be plugged directly into that infrastructure. If they don’t have ducts, they can still find a different way to utilize pumps, said Kolia.

“The good thing about heat pumps is there's duct-less or ducted options,” he said. “It can be a retrofit, depending on what you have on site, or it could be a whole new layout just to accommodate the business’ needs.”

Incentives and costs

Massachusetts has strong heat pump incentives for homeowners compared to other markets, said Staudt.

Through the state’s Mass Save program, homeowners are eligible for rebates of $3,000 per ton for a whole-home installation or $1,250 per ton for a partial-home installation, with a maximum of $10,000, according to the program’s website.

For low-income households, an income-based program allows for up to $16,000 in rebates. The standard incentives could bring a whole-home installation cost down from $22,000 to $12,000, while income-based incentives could bring that cost down to $6,000, not including potential federal tax credits.

Through Mass Save programs, customers can receive 0% interest financing for heat pump installation costs, up to $25,000.

Massachusetts “is one of the best programs in terms of the rebates that are available,” Staudt said. “To have a rebate of up to $10,000 is not common in other states.”

Specifics vary, but incentives are available for multi-family properties.

Incentives are strong in Massachusetts on the commercial business side of things, said Kolia.

“Massachusetts incentives are pretty generous when you look at the project cost and then the money reimbursed,” he said. “It's larger than Connecticut and a lot of competing states.”

Commercial incentives vary by heat pump type, ranging from $2,500 per ton for air-source heat pumps to $4,500 per ton for ground-source pumps.

Outrunning the tariffs

While state-level incentives are strong, federal tax credits for heat pumps are being targeted by Republican lawmakers.

The Federal 25C Energy Efficient Home Improvement Credit, an incentive signed into law in 2005 by President George W. Bush and providing up to $2,000 in credits towards heat pump systems, is targeted for elimination in the budget bill passed by House Republicans on May 22, according to clean energy news site Canary Media.

The trade wars embarked upon by the President Donald Trump Administration may impact the heat pump industry. China is responsible for 95% of the world’s heat pump compressors in 2023, according to a February report from the International Energy Agency. About 40% of global heat pump manufacturing happens in China, with a further 15% happening in the European Union, another potential tariff target.

While the potential end of federal incentives and rising costs due to tariffs may lead to a cooling of the heat pump market, right now it’s having the opposite effect, as consumers rush to get their installations done before changes are implemented.

“Uncertainty on tax credits has actually driven some demand, because people think ‘I want to get this done when I know I have that tax credit available,” Staudt said. “With tariffs, right now we have equipment that’s available to us right now in the U.S. on the ground. When I’m speaking to homeowners, I’m telling them that if we come back in the fall, we don’t know what the equipment is going to cost us.”

Eric Casey is the managing editor at Worcester Business Journal, who primarily covers the manufacturing and real estate industries.