A recession coinciding with the start of the coronavirus pandemic last spring sent the American economy into its largest contraction in modern history. Now bankers are wondering, will pent-up demand lead to explosive economic growth? Or are people saving more than ever out of worry or survival?

Get Instant Access to This Article

Subscribe to Worcester Business Journal and get immediate access to all of our subscriber-only content and much more.

- Critical Central Massachusetts business news updated daily.

- Immediate access to all subscriber-only content on our website.

- Bi-weekly print or digital editions of our award-winning publication.

- Special bonus issues like the WBJ Book of Lists.

- Exclusive ticket prize draws for our in-person events.

Click here to purchase a paywall bypass link for this article.

A recession coinciding with the start of the coronavirus pandemic last spring sent the American economy into its largest contraction in modern history.

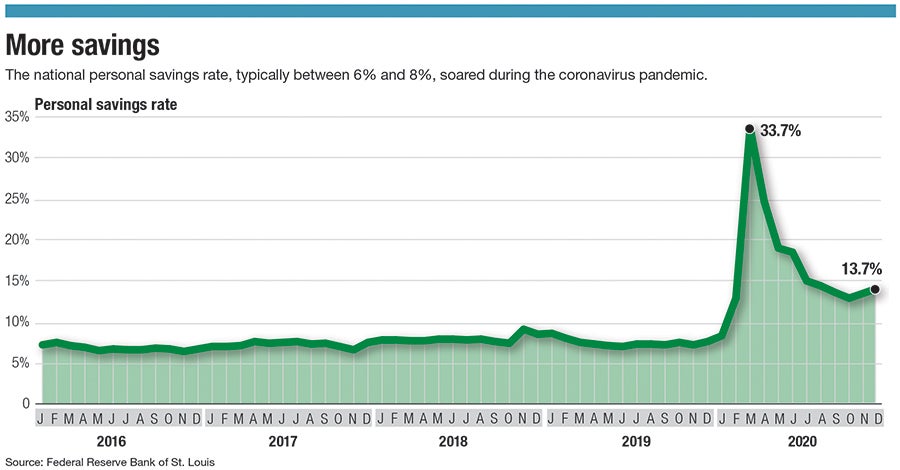

While the economy shrunk by roughly a third, banks quickly noticed something else happened: most consumers started pouring savings into their bank accounts.

Almost a year later, banking leaders are struggling to figure out what will happen once the pandemic – or at least the worst of it – is over. Will pent-up demand lead to explosive economic growth? Or are people saving more than ever out of worry or survival?

“There are a lot of folks waiting to see what’s going to happen,” said Brian McEvoy, senior retail banking officer at Webster Five Cents Savings Bank.

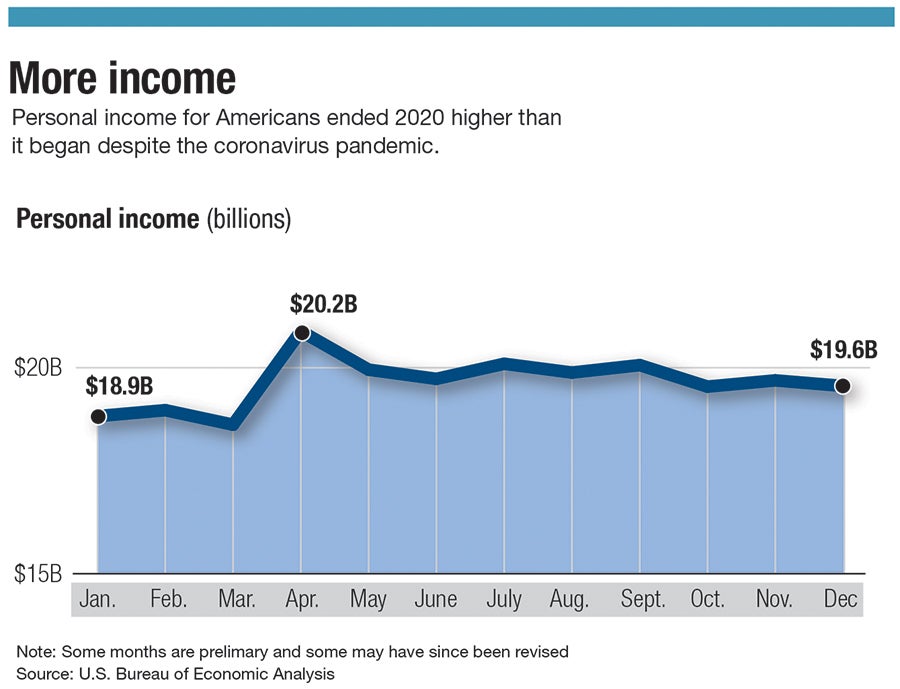

Through some mix of reasons, Americans saved more in 2020 than they ever had on record. Bankers say much of it has to do with federal CARES Act funds households and businesses received, which typically went into bank accounts and stayed there. Other signs indicate people remain cautious about their spending. For others, there simply aren’t any trips to book, games to go to, or restaurants and bars to frequent.

No matter the cause, households are saving more than they have at any point since at least the late 1950s, according to the Federal Reserve Bank of St. Louis. Last April, the national savings rate ballooned to 33.7%, doubling its previous high on record, and pushing far past a high of 8.2% during the 2008 recession. Savings remain sky high at 13.7% in December, roughly doubling its typical rate.

A lot of those savings are piling into banking accounts, where the security of an insured account outweighs the turbulence of the stock market. Deposits in Massachusetts banks rose by 16% in one year through the end of the third quarter of 2020, according to the Federal Deposit Insurance Corp.

“They want to make sure their savings are safe,” said Kathleen Murphy, the president and CEO of the Massachusetts Bankers Association.

Lingering worries

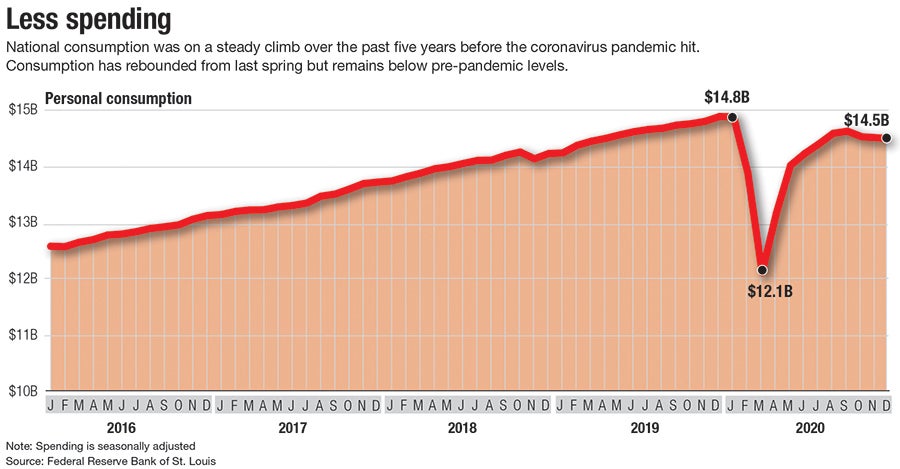

Savings rates have soared because of two contrasting trends: income has not taken nearly as great of a hit during the pandemic because most people still have their jobs, and people generally are spending far less than they were before the pandemic.

The unemployment rate in Massachusetts spiked to 17.7% last June, and through December remained at 7.4% – drastically above the rate a year prior of 2.8%. Even for those who’ve found work again, the financial scars often remain, said Marty Connors, the president and CEO of Fitchburg-based Rollstone Bank & Trust.

“That group knows what it’s like to be unemployed, and they’re not going to forget about that quickly,” Connors said.

Consumer sentiment nationally generally improved as last year went on, but polls still found a lot of uncertainty among consumers, indicating savings may continue to pile up for some time to come.

Roughly 40% of Americans said they didn’t expect their finances to return to normal until the latter half of 2021 or even 2022, according to a December report by the global consulting firm McKinsey & Co. Another 40% said they are more mindful of how they spend their money compared to before the pandemic, with only 6% indicating they were paying less attention to such spending.

Nearly half, or 46%, said they were unsure in the country’s economic recovery from the pandemic – an even slightly worse rate than the 43% who gave that sentiment last March when the pandemic first began causing major behavioral shifts across the country.

A similar poll conducted each month by the University of Michigan found consumer confidence lower in December than it was in April. Confidence was worst among the lowest-income households.

Post-pandemic educated guesses

Already, bankers are asking each other what savings and spending trends will look like as soon as this summer, when enough people are vaccinated and virus case numbers could be low enough for some semblance of normalcy.

No one knows the answer.

Some consumers are worried about a double-dip recession. Others are itching to find something to spend on, McEvoy said.

“You’re always going to have that across your customer base, a spectrum from risk tolerance to conservatism,” he said.

The U.S. Federal Reserve forecast in December a 4.2% jump in gross domestic product, up from 4.0% when it made its previous prediction last September, and the American Bankers Association is predicting 4%. The Conference Board, a New York consortium of dozens of mostly current and former major-corporation CEOs, gave itself a wide range: anywhere from 0.8% growth to 6.4%, depending on how effectively the pandemic is brought under control.

Michelle Meyer, a managing director and head of U.S. economics for Bank of America Global Research, said in a Worcester Business Journal economic forecast event Feb. 11 so much money is being saved – $1.6 trillion above pre-pandemic levels nationally – a post-pandemic spending spree is likely.

“It’s remarkable how much cash is out there,” Meyer said.

Brian Stewart, the CFO of Middlesex Savings Bank, is less confident. Deposits at the Natick-based bank have risen at the sharpest rate he’s seen in his 25 years there, he said, and people are likely to hold onto the savings they’ve built up may not be likely to evaporate once the pandemic does.

“That becomes the big question,” Stewart said. “Is this a temporary thing, and it’s all going to go flying out the door? I’m not sure it is.”

Despite that uncertainty, there’s already some consideration given to whether the pandemic recession will lead to longer-term changes in consumer habits, such as higher savings rates, or even people looking to seize the day and spend more lavishly.

“It could certainly go either way,” Murphy said.