Marijuana technology companies in Central Massachusetts face challenges amid opportunity.

Get Instant Access to This Article

Subscribe to Worcester Business Journal and get immediate access to all of our subscriber-only content and much more.

- Critical Central Massachusetts business news updated daily.

- Immediate access to all subscriber-only content on our website.

- Bi-weekly print or digital editions of our award-winning publication.

- Special bonus issues like the WBJ Book of Lists.

- Exclusive ticket prize draws for our in-person events.

Click here to purchase a paywall bypass link for this article.

Victor Juri spent the early part of his professional career in digital marketing and enterprise architecture, before opting to start his own digital marketing consulting agency.

Five years ago, he was doing work for an undisclosed competitor to food delivery company GrubHub, seeking a better its technology platform. That platform included a web interface to take orders which were routed through a dispatcher who assigned orders to drivers, notified by a mobile app.

That’s when it hit the experienced marijuana user like a ton of bricks.

“Oh my god, this is the future of cannabis,” Juri said. “Everyone is going to want it delivered.”

That idea sparked an entirely new company, Stalk & Beans, of which Juri is CEO.

Breaking through firewalls

The Fitchburg and Natick company offers a full-marketing stack for dispensaries, including a regulation-compliant website, in-house online menus updating in real time, a delivery module and mobile app, product pages including lab test results, and an in-store pickup module with email and SMS marketing functions.

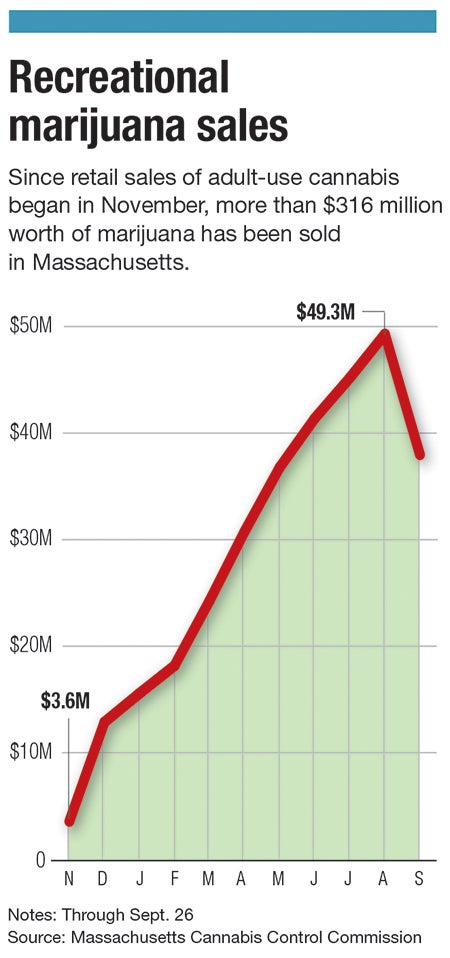

What has Juri most excited, though, is the potential to offer delivery marijuana in Massachusetts, which is just beginning to explore that service for an industry with $316 million in recreational sales since November.

However, with the slow rollout of recreational marijuana in Massachusetts, Juri and other would-be cannabis tech entrepreneurs are facing obstacles on two fronts: a limited number of licensed cannabis companies to do business with, and competition from established tech companies who already have cut their teeth in early-adopting marijuana markets like Colorado and California.

Juri said existing Massachusetts marijuana companies choose to use marijuana websites Leafly and Weedmaps for their online menus, but cannabis companies are in effect losing their customers to those platforms.

“Our model is empowering the dispensary to have their own kind of marketing stack and tools to gain the customer, keep the customer and continue to market to the customer.” Juri said.

Multi-state competition

Cannabis IT and marketing service companies are coming to Massachusetts from the West Coast, where they have had more time to establish their offerings and find clients in existing markets, Juri said.

Noni Goldman, a Worcester-based instructional designer with Atlanta-based cannabis software firm Flourish, said this will continue to be the case until more businesses outside of multi-state operators open in Massachusetts.

Flourish’s entire sales staff is based on the West Coast where hundreds more locally owned operators are looking for a new website vendor, Goldman said. Multi-state operators typically use the same software systems across their holdings.

“If you’re a multi-state operator, you’re going to choose the same software system you’re using in another state,” Goldman said. “We’re playing catch up to a lot of other big software systems.”

As such, Flourish – which offers a wide range of technology services including production management, point-of-sale services and tracking compliance – does not yet have any Massachusetts clients.

Some of the largest cannabis tech companies are either based on the West Coast or entered the market doing business with companies in Colorado, Washington, Oregon and California.

That includes CanPay, a debit payment app based in Colorado with nearly 300 customers across 17 states. Delivery services like Eaze and Greenrush are based in California and have been operating in multiple states for several years.

Colorado and California were much quicker than Massachusetts in allowing existing medical dispensaries to enter the recreational market, so the industry grew at a steady pace and opening the door for ancillary businesses to join the market.

In Massachusetts, the Cannabis Control Commission has authorized 64 out of 540 marijuana business applicants to either begin retail sales or production. In the state, 26 retail stores are open, and another 192 are in the pipeline.

Limited ability to grow

The slow rollout of legal marijuana retailers is not only keeping prices high and the black market alive, but delaying cannabis tech entrepreneurs like Juri from signing up a significant amount of new clients.

So far, he has three clients for the website and technology services, but the transportation aspect of Stalk & Beans could soon grow to six business clients.

That service offers transportation from production and cultivation centers to dispensaries, but soon a warehouse facility Juri is building in Fitchburg will store products for companies and deliver them on a schedule from the facility.

Juri, though, remains most hyped about delivery.

His delivery software is integrated with web orders, in-store kiosk orders and mobile app orders to allow an order to be tracked in real time. Stalk & Beans has been doing limited deliveries for medical customers, but the company have to get creative in order to tap into the recreational delivery market.

The Cannabis Control Commission approved regulations in September calling for delivery license applications for the first two years to be available only to applicants in the social equity program, or those in the marijuana industry that had previously been convicted of a drug offense or living in an area not exceeding 400% of the federal poverty level.

Juri, a Babson College graduate, does not fall under that description.

Now, he has trucks, drivers and the technology to enter the recreational delivery market, but not the regulatory ability.

Juri and his team are looking for social equity applications to partner with or sell the software to those looking to take advantage of the Cannabis Control Commission's new rules.

“We have everything someone would need to do compliant recreational deliveries,” he said.