More than 2,000 federal loans were given to Worcester businesses to help survive through the coronavirus pandemic, from as small as $197 to more than $5 million.

In between was a range of businesses, from nonprofits to limited liability corporations, and from manufacturers to healthcare providers. In all, roughly 2,300 loans were given to Worcester businesses, according to the U.S. Small Business Administration, which released details on individual loans for the first time Monday.

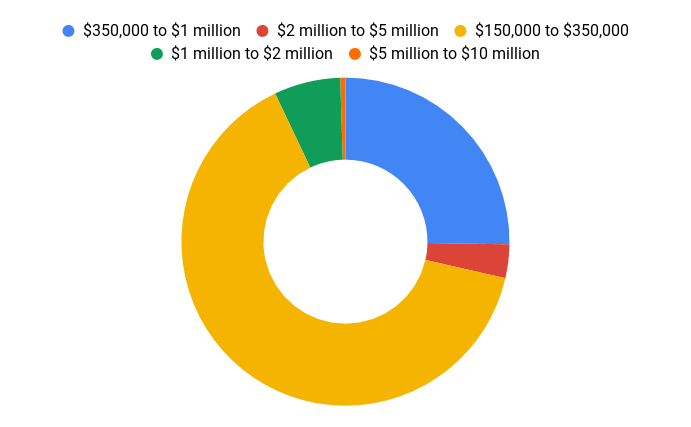

Recipients skewed small, a reflection of both the predominance of small businesses and the aim of the Paycheck Protection Program, which generally leaves out public companies and all those with more than 500 employees.

More than four out of five Worcester businesses receiving aid took in less than $150,000. Exactly 800 received less than $20,000, compared to 439 receiving $150,000 or more.

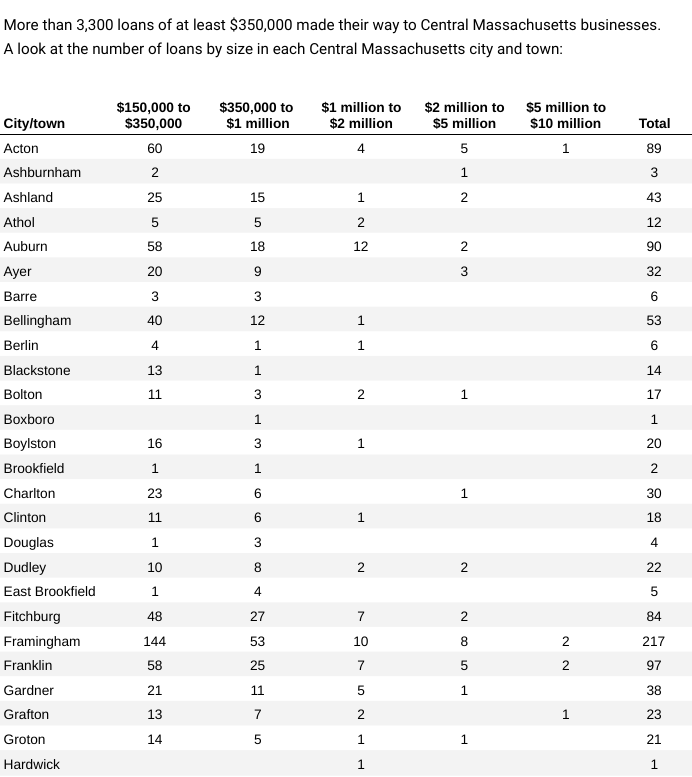

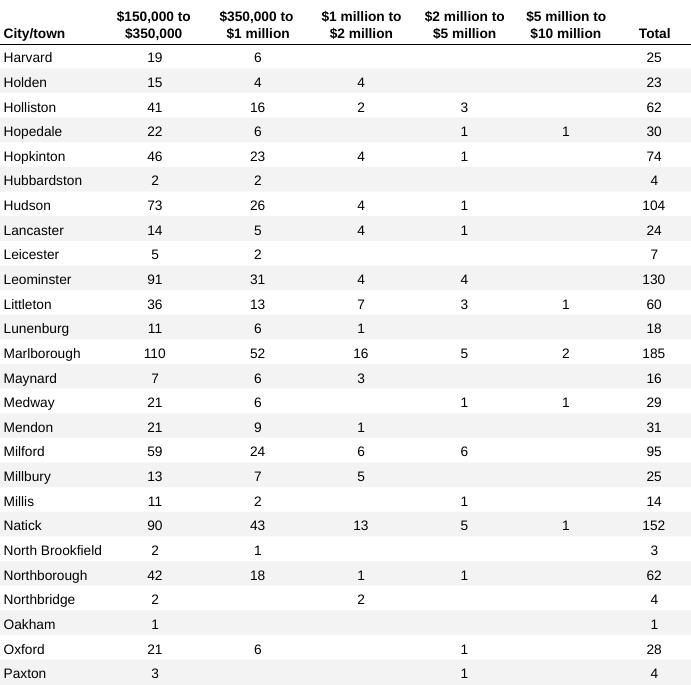

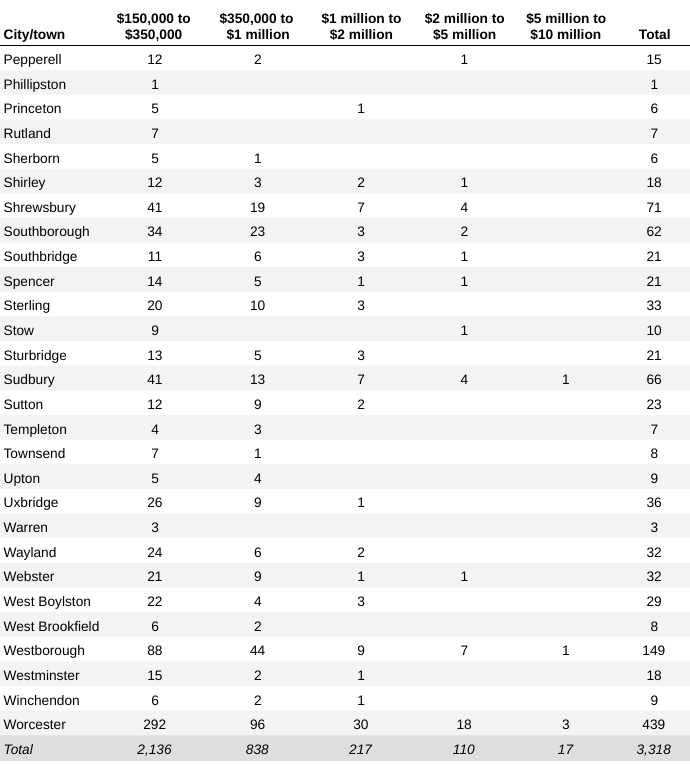

Across Central Massachusetts, more than 3,300 companies received at least $150,000 in loans. Of those, roughly 200 described themselves as nonprofits.

Smaller firms added up to relatively significant job retainment, despite unemployment rates in May hitting 17.6% in Worcester and 14.7% across Central Massachusetts.

[Related: 346 Central Mass. firms received $1M or more from federal bailout]

The nearly 1,800 loans of less than $150,000 to Worcester businesses retained a combined nearly 9,000 jobs, according to the SBA data. In Framingham, the more than 800 such small loans to city companies rained a total of nearly 3,600 jobs. In Marlborough, 515 of those loans is estimated to have retained nearly 2,500 jobs.

At least one prominent study has cast doubt on how much the PPP has saved as many jobs as it claims. Eric Zwick, a finance professor at the University of Chicago, led a study of the first round of PPP loans finding no proof funds flowed to areas more adversely affected economically by the pandemic, including hours worked or businesses forced to close.

“We do not find evidence that the PPP had a substantial effect on local economic outcomes — including declines in hours worked, business shutdowns, initial unemployment insurance claims, and small business revenues — during the first round of the program,” the paper, published July 3, said. “Firms appear to use first round funds to build up savings and meet loan and other commitments, which points to possible medium-run impacts.”

The SBA disclosed all PPP loans nationally Monday, including nearly 116,000 in Massachusetts. Of those, the SBA disclosed the name of the company receiving funds only if they got more than $150,000. If a company landed above that threshold, the price range of the loan — $2 million to $5 million, for example — was included.

Loans were concentrated in many of the region’s larger communities. Worcester accounts for 439 of those relatively larger loans, while 217 went to Framingham companies and 185 went to Marlborough firms. Among others, Natick accounted for 152 business loans, and Leominster for another 130.

Recipients in Central Massachusetts receiving $150,000 or more in loans said they were retaining a combined more than 95,000 jobs.

The PPP loans, which total up to $10 million, can be made forgivable if companies use the funds to keep workers employed.