Massachusetts is among a growing number of states with legalized cannabis products for both medicinal and recreational use.

Get Instant Access to This Article

Subscribe to Worcester Business Journal and get immediate access to all of our subscriber-only content and much more.

- Critical Central Massachusetts business news updated daily.

- Immediate access to all subscriber-only content on our website.

- Bi-weekly print or digital editions of our award-winning publication.

- Special bonus issues like the WBJ Book of Lists.

- Exclusive ticket prize draws for our in-person events.

Click here to purchase a paywall bypass link for this article.

Massachusetts is among a growing number of states with legalized cannabis products for both medicinal and recreational use. Indeed, all six New England states have some type of legalized cannabis – either medical, recreational, or both. As a result, this is a growing industry in our region’s ever-evolving economy.

However, because marijuana is still classified as an illegal controlled substance under federal law, these legitimate, licensed businesses are unable to open bank accounts or access certain services — such as insurance policies — key to any businesses stability and success. Instead, they have no choice but to operate as cash only-businesses, and thus incur a whole host of associated risks. They are susceptible to theft, money laundering, tax evasion, and other safety concerns. At the same time, their customers — many of whom are purchasing cannabis to alleviate a wide range of medical issues — are limited in payment options, and local financial institutions are missing out on new business.

Fortunately, there is legislation pending before Congress to address this problematic discrepancy between state and federal law. The Secure and Fair Enforcement Banking Act of 2021 would establish protections for depository and insurance institutions to provide financial services to legal cannabis-related business, as well as their service providers.

This bipartisan proposal is gaining momentum on Capitol Hill. The legislation was introduced during the previous session of Congress and was passed by the House of Representatives in September 2019. Unfortunately, it was not taken up in the Senate. It was recently re-introduced in both the House and Senate and, just last week, the House of Representatives passed the bill by a vote of 321-101, with all nine Massachusetts representatives voting in support.

In the Senate, Senators Ed Markey and Elizabeth Warren join 30 of their colleagues in co-sponsoring the bill. Gov. Charlie Baker has also expressed concern about the cash-only nature of legal cannabis, and joined a bipartisan group of governors urging Congress to pass this legislation.

The New England Council, the nation’s oldest regional business association, has endorsed this bill, and wrote to our region’s Congressional delegation just a few weeks ago to express our concern about the current situation and support for the SAFE Banking Act. Regardless of your stance on legal marijuana, the fact is that in Mass. and many other states, it has in fact been legalized and represents a new growth industry. We must now take the necessary steps to ensure the appropriate business supports are in place to ensure this new sector’s success, and to ensure that it is able to operate in a safe, secure manner. We are grateful for the House’s swift action on this commonsense proposal, and urge the Senate to follow suit as soon as possible.

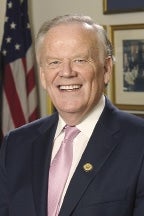

James T. Brett is the president & CEO of The New England Council, a regional alliance of businesses supporting economic growth and quality of life in New England.