Just four years ago, Fitchburg-based company Rev Clinics was one of the biggest players in the Massachusetts marijuana industry, with its products available in about 75% of the then-200 dispensaries across the state.

Get Instant Access to This Article

Subscribe to Worcester Business Journal and get immediate access to all of our subscriber-only content and much more.

- Critical Central Massachusetts business news updated daily.

- Immediate access to all subscriber-only content on our website.

- Bi-weekly print or digital editions of our award-winning publication.

- Special bonus issues like the WBJ Book of Lists.

- Exclusive ticket prize draws for our in-person events.

Click here to purchase a paywall bypass link for this article.

Just four years ago, Fitchburg-based company Rev Clinics was one of the biggest players in the Massachusetts marijuana industry, with its products available in about 75% of the then-200 dispensaries across the state.

Nearing 400 employees, Rev Clinics had a massive Fitchburg manufacturing and cultivation facility and operated dispensaries with high-profile locations, including one in Cambridge’s Central Square and a Somerville location a short walk from Assembly Square.

Inc. magazine ranked Rev Clinics as the fourth-fastest growing company in the country in 2021, with a reported three-year growth rate of 32,997%.

Just four years later, Rev Clinics is in financial ruin.

The company has been placed into receivership after accumulating millions in debt. Rev Clinic’s 146,000-square-foot Fitchburg facility is closed and available for lease. Its Leominster dispensary is set to be offloaded for $500,000, and it was unable to find a buyer for its once highly sought-after Somerville location.

The firm faces an federal tax audit and upward of $20 million owed to creditors.

Rev Clinic’s demise is a reversal of fortune for a firm which produced a line of cannabis products owned by former Red Sox slugger David Ortiz, which grabbed headlines across the hemisphere but failed to be a hit.

The receivership process has been complicated by a lack of market interest in distressed cannabis assets and the drug’s federally-illegal status, said David Madoff, the court-appointed receiver for Rev Clinics and a lawyer with experience in unwinding failed businesses.

“Being a cannabis business, it's highly regulated and federally illegal,” Madoff said. “Compared to the typical cases you usually work with, there were a lot of challenges.”

The downfall of a company which once attracted $50 million in investment serves as a potent reminder of the difficulties faced by entrepreneurs in the state’s turbulent cannabis economy.

Flying high

Rev Clinics first opened for business in 2017 as the state’s 15th licensed medical marijuana company, later opening for adult-use sales following the 2016 ballot initiative legalizing recreational cannabis.

At its peak, the firm employed more than 213 workers in Central Massachusetts and nearly 400 statewide, according to information provided to the WBJ Research Department and Inc. magazine.

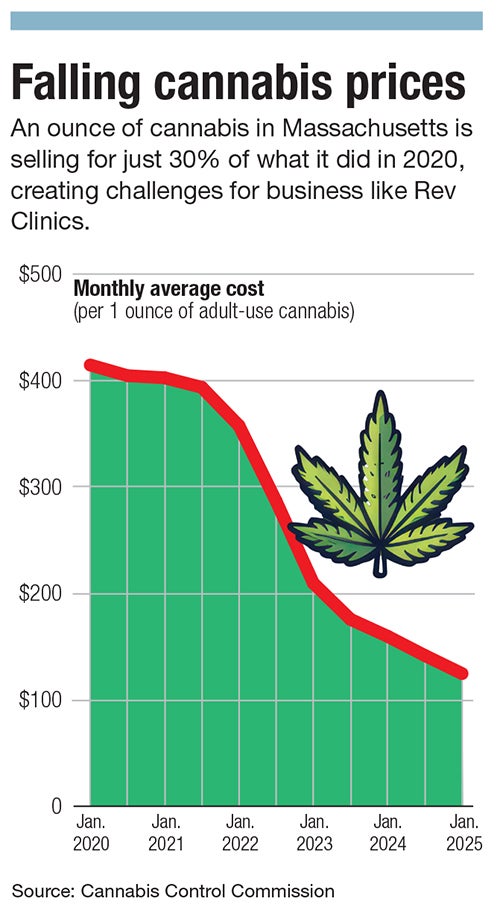

In January 2020, as Rev Clinics was well on its way to becoming a household name among cannabis consumers, when the average ounce of weed was selling to consumers at a price of $415. The company brought in $40.7 million in revenue that year, according to Inc., as it eyed expansion to other states.

A fine that year of $120,000 for selling vaporizer cartridges that exceeded allowed state limits for ethanol did little to slow the company. Neither did the fallout from a 2021 lawsuit against the City of Cambridge, where it challenged a two-year City moratorium allowing only businesses which were part of the state’s economic empowerment certification to receive a permit for recreational sales.

This program was designed to provide access to the industry for those harmed by the negative impacts of the War on Drugs, but Cambridge’s moratorium blocked Rev Clinics from adding recreational sales to its pre-existing medical dispensary. Rev Clinics dropped the lawsuit after pressure from activists, pledging to $4 million to minority-owned businesses, according to MassLive.

The company turned a profit in 2021, a rarity for cannabis businesses at the time, and raised more than $50 million from investors over a four-year period, according to a profile in finance publication New Cannabis Ventures.

That same year, Rev Clinics freed up more capital for expansion via a lease-saleback agreement, which saw most of its Fitchburg site sold to Connecticut-based investment firm NewLake Capital Partners for $8.8 million.

The Fitchburg facility opened in 2017. It was capable of producing 25,000 pounds of cannabis a year. Rev Clinic products were available in 150 of the 200 Mass. dispensaries by 2022, according to New Cannabis Ventures.

Wholesale made up 75% of its revenue. At its peak, Rev Clinics was producing close to 200 different cannabis products, according to Inc., ranging from the standard eighth-of-an-ounce of cannabis flower, to vape pens, to cannabis-infused confectionaries.

At the time, Massachusetts cannabis companies saw endless growth on the horizon, expecting the wave of states legalizing the drug would eventually result in changes to federal law, removing tax burdens and opening up access to traditional sources of financing. Stability for the young industry seemed to be near.

Then, the buzz wore off.

Downfall

As the industry became saturated with entrepreneurs, celebrity brands, and products of varying quality, the difficulties running a business – let alone one that is federally illegal and involves growing a finicky plant at large scale – set in.

Just a year after Rev Clinics announced it was exploring expansion beyond Massachusetts, the company faced an outbreak of microbials among its plants. It had to restart its cultivation operations from scratch in April 2023, according to an article from NBC10.

By that month, an ounce of cannabis was going for $179, just 43% of its January 2020 price, according to Cannabis Control Commission data.

At the time of the outbreak, a company official dismissed rumors to NBC10 the firm was heading toward its demise, saying the firm had laid off 10% of its workforce but expressing confidence Rev Clinics had avoided a total collapse.

It hadn't. By November 2023, the company was struggling to make lease payments to NewLake for the multi-million-dollar property it once owned.

That same year, Rev Clinics CEO Keith Cooper and Co-founder Ryan Ansin departed the company, according to their LinkedIn profiles. Neither responded to requests for an interview.

An amendment to the lease saw NewLake recover a portion of unpaid rent, extend the lease term by five years, reduce future monthly rental payments, and receive ownership of up to 9.95% of Rev Clinics, according to a November 2023 NewLake press release.

Even with amended lease terms, Rev Clinics only paid 50% of its contractual rent to NewLake from June to December 2024, according to a March filing with the Securities & Exchange Commission.

Already facing a lawsuit from its Cambridge dispensary’s landlord and the tumbling price of cannabis, the final blow to Rev Clinics came in December, when its primary noteholder filed a lawsuit demanding payment of $10 million and for a receiver be in charge of the company.

The lawsuit was filed by OPCIV LLC, an entity affiliated with Austin-based Ocho Capital. The private investment firm’s portfolio includes Liquid Death Mountain Water and rocket firm SpaceX.

A tricky wind-down

At the time of receivership, Rev Clinics had 40 grow rooms and about 40,000 plants in various stages of growth at its leased Fitchburg facility, according to a status report filed on July 9 in Suffolk County Superior Court by David Madoff of Madoff & Khoury LLP in Foxborough, the court-appointed receiver.

But just like starting a cannabis business, unwinding one is no simple task. With the drug still being a Schedule 1 illegal substance at the federal level, bankruptcy is not an option.

Everything Madoff has done had to comply with state regulations, he told WBJ. Equipment could be sold to out-of-state buyers, but cannabis products couldn’t. He couldn’t utilize notices of abandonment, a tactic used by bankruptcy trustees when selling an asset would cost more money than its worth.

“We couldn't just walk away from plants in the ground,” Madoff said. “There were times when I would have wanted to just abandon something, when I really couldn't, in good faith or legally. So it ended up costing more than a typical liquidation or restructuring would.”

Madoff estimated Rev Clinics’ debt exceeds $20 million. He said that figure could be substantially higher; with no hope of funds being available, he didn’t go through a claims process with all of the company’s creditors. No one other than the company’s senior creditor will be getting any money back, and those creditors will not be paid in full, he said.

Madoff said the main culprit for Rev Clinics' failure was the its inability to absorb the collapsing price of cannabis.

Big Papi strikes out

Rev Clinics’ receivership marked the end of its relationship with Red Sox legend David Ortiz, a partnership which saw him launch a brand of cannabis products named Papi Cannabis in July 2022. Announced just days after he was inducted into the Baseball Hall of Fame, the launch seemed to mark his transition from ballplayer to business mogul.

Big Papi’s launch of a line of cannabis-infused chocolates, vape cartridges, and pre-rolled cannabis blunts created controversy in his socially-conservative homeland of the Dominican Republic, with one Dominican sports writer joking it was a sign the end of the world was near. But it made Ortiz the biggest celebrity name to get into the cannabis game in Massachusetts, further legitimizing an industry still dealing with stigma. Ortiz made personal appearances at multiple dispensaries to promote the products.

While Papi Cannabis was available across the state, it didn’t end up being a home run. By the time Madoff was installed as receiver, the brand wasn’t being manufactured anymore.

“Nobody was buying it," Madoff said. “It wasn’t very popular.”

Madoff signed an agreement which saw Ortiz take back control of the branding in exchange for any financial claims he had against Rev Clinics.

“I didn't want it. I didn't think it had value,” Madoff said. “So as a courtesy, we gave it back to him.”

David Ortiz’s representation did not respond to requests for comment. Papi Cannabis products still appear on dispensary menus in Maine, where they are produced by a different manufacturer.

Fitchburg facility

Most of the company’s assets have been auctioned off or offloaded, but the receivership process is ongoing.

Composed of four floors, the 140-year-old former shoe factory which served as Rev Clinics’ grow and manufacturing facility in Fitchburg is listed for lease by Thomas Bodden and Drew Higgins of Kelleher & Sadowsky Associates in Worcester. Rev Clinics retains ownership of a small part of the building containing storage and offices, said Madoff.

Madoff’s status report said production at the facility, once employing upward of 150 workers, ceased operations in July. By the end of that month, all facility employees were laid off.

The company is owed between $3 million and $4 million by other firms, with Madoff noting in his filing Rev Clinic’s closure may make collections more difficult, and debtors who owe money to the company may be in financial trouble.

With the financial state of many companies in the industry, fights over unpaid bills are a common sight on court dockets. Rev Clinics is involved in lawsuits seeking funds owed, as well as lawsuits targeting the company for unpaid debt.

Rev Clinic’s Leominster dispensary at 130 Pioneer Drive is still open, but the facility is part of a purchase agreement worth $500,000 subject to price adjustment, according to Madoff’s report.

State licensing requirements will result in a delay of several months in the transfer. While that awaits approval from the state, the parties have entered into a management agreement, which sees the buyer take over operations.

For now, the dispensary continues to operate under Rev Clinic’s branding, the last public remnants of the company.

Rev Clinics’ Somerville dispensary has seen little interest from potential buyers due to its high cost of rent, Madoff wrote in his court filing. He has entered into an agreement to sell the license of the facility for $350,000.

Madoff wrote the company was hoping to receive a $1.5-million Employee Retention Tax Credit, which it had applied for prior to his taking control. However, since filing for the credit, the company has been alerted by the Internal Revenue Service its 2021 tax return is under audit. He noted possible tax liabilities from the audit could offset the potential tax credit.

With Rev Clinics’ demise, Sanctuary Medicinals, a company with a cultivation and production facility in Littleton and a dispensary in Grafton, is now Central Massachusetts’ largest cannabis firm with 200 employees, according to the WBJ Research Department.

Industry woes

Rev Clinics is hardly the only cannabis company with a Central Massachusetts presence facing financial failure.

Miami-based Ayr Wellness has closed its 217,800-square-foot cultivation facility in Milford, laying off 157 workers in the process. Ayr’s stock has plummeted, going from $36.54 per share in February 2021 to being worth just two cents as of Aug. 28 in over-the-counter trading.

4Front Ventures, the Phoenix-based operator of Mission Worcester cannabis dispensary, filed for receivership in May, according to a press release from 4Front. The company’s Worcester dispensary has remained open. Its receivership filing in Suffolk County Superior Court said the company has debts of $59 million.

Despite difficulties caused by oversaturation of product and a decline in cannabis prices, new businesses are still opening in Central Massachusetts, as the state passed the $8-billion mark in total adult sales in July. Since 2020, Worcester County has seen $1.2 billion in adult-use sales, while Middlesex County has seen $903.5 million, according to CCC data.

Madoff’s advice for cannabis business owners to survive is to take every step possible to avoid debt service.

“It seems like the people that can withstand saturation are the people who have really deep pockets,” he said. “It does not seem like there’s room for mom and pops, at least at the manufacturing level. I hope that changes.”

CLARIFICATION: This article has been updated to clarify Ryan Ansin was among six co-founders of Rev Clinics.

Eric Casey is the managing editor at Worcester Business Journal, who primarily covers the manufacturing and real estate industries.