The state fund designed to help entrepreneurs from communities disproportionately harmed by marijuana prohibition saw a major infusion of money over the past year, bringing in more than $29 million in new funding while doling out $26.5 million in grants to 181 businesses.

The $26.5 million in awards is over 10 times the amount granted in the fiscal year 2024, the first grant cycle since the Massachusetts’ Cannabis Social Equity Trust Fund was established. The state awarded $2.3 million to 50 recipients in the first grant cycle.

An annual legislative report filed last week shows the fund started fiscal 2025 with $27.3 million, then received a $29 million transfer from the Marijuana Regulation Fund in April, along with about $12,000 in donations. By year’s end, the fund had a $29.6 million uncommitted balance after awarding its largest round of grants.

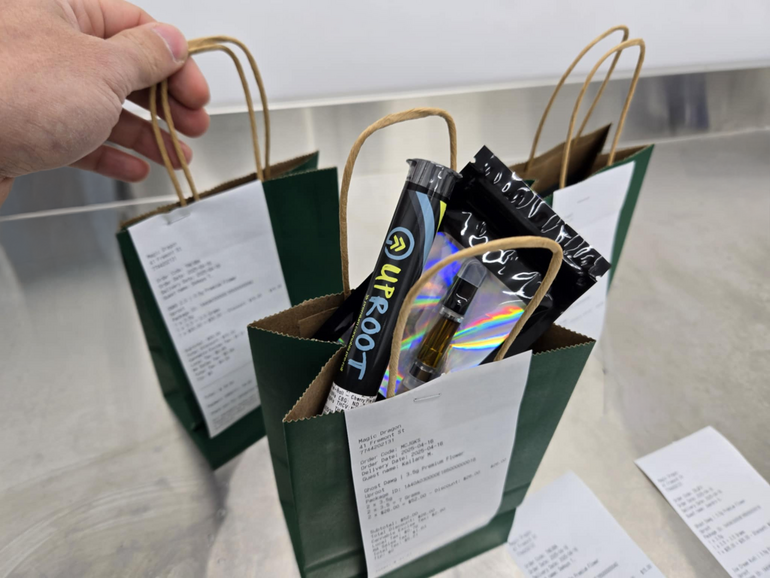

Created in 2022, the trust fund is meant to chip away at barriers to entry for smaller cannabis businesses, especially those owned by people of color, women, and individuals impacted by past enforcement policies. But local store owners say the industry remains tilted toward well-capitalized corporate operators who had an early foothold through the state’s original medical marijuana program.

Some mom-and-pop shops are closing, owners say, unable to match the resources of companies with more capital. For them, annual grants from the state fund can be the difference between survival and shutting down.

“This drastically changed our position and outlook on our business, at least for the next 12 to 24 months,” said Edson Charles, CEO of Gas Bus in Middleborough, who received $500,000 in the fiscal 2025 grant cycle, and $50,000 the year before. “But it is really an uphill battle.”

The fiscal 2025 program, the second major funding initiative since the fund’s launch, awarded grants ranging from $17,000 to $500,000. The money can be used for rent, payroll, taxes, construction, professional services, licensing fees and equipment purchases. Recipients must submit documentation for reimbursement and meet reporting requirements.

Applications opened last September, drawing 278 submissions from social equity or economic empowerment license holders, as designated by the Cannabis Control Commission. These are businesses owned by racial minorities, women, veterans and LGBTQ+ folks, and others. The state awarded 181 grants, with the largest shares going to businesses in Boston.

For Charles, the latest $500,000 award will help refinance the building his business operates in, replacing high-interest loans with a traditional mortgage and cutting monthly payments by more than half.

“Our biggest challenge right now, as small operators in this market, is dealing with a massive lack of capital or access to capital,” he said. “That kind of puts us on the back foot with all of our competitors, especially the ones that either have major investments or are large corporations.”

Price compression in the retail market — with wholesale cannabis dropping from about $14 a gram to just over $3 — is squeezing smaller operators the most, Charles said. He believes some companies who can afford to operate at slim margins are intentionally keeping prices low to drive out competitors.

“They doled out $27 million, but one financial operator is about to give a loan to one operator upwards of $30 or $40 million. There’s no way the grant fund can ever keep pace with that,” he said. “Then all of the social equity businesses are fighting over scraps while a bunch of the larger operators have essentially an unlimited budget.”

Caroline Pineau, owner of Stem Haverhill, received her first social equity grant this year, also at the maximum $500,000 level. She is using it to upgrade her 1876 building to prepare for a future social consumption license, adding an elevator, new stairwell and a rooftop lounge space.

“With market compression and the instability of the cannabis market in Massachusetts, this grant will be instrumental in the future success of our single-entity, woman-owned small business,” Pineau said. “We’re seeing mom-and-pop businesses across the commonwealth going out of business every month. It’s a really scary time to be a cannabis operator.”

Pineau, one of the state’s earliest economic empowerment license holders, said the grant helps level the playing field — but only somewhat. She is planning a $1.5 million to $2 million renovation, meaning the award will cover only a fraction of the cost.

“It’s really exciting for small businesses like myself, who are doing our best to compete with well-capitalized groups,” she said.

Charles agreed that while the program is helping, structural issues remain. He said more legislative protections are needed to prevent financial institutions from charging cannabis companies higher costs or refusing service altogether.

“I had several financial institutions tell me my deal makes sense, it works for them, but they just won’t do it,” he said, describing a two-year struggle to refinance his property before receiving grant money.

The Cannabis Social Equity Trust Fund was created with the intent of transferring 15% of the state’s Marijuana Regulation Fund each year to support eligible businesses. That parent fund draws its revenue from the state’s marijuana excise tax, licensing and application fees, civil penalties and interest.

A 2022 state law also allows the trust fund to accept donations from private sources. A public donations portal launched in April, though contributions have so far totaled only about $12,000.

The fiscal 2025 grant program was structured into four tiers, providing aid to applicants at different stages: pre-licensed startups, provisional and final license holders in urgent need, operators seeking to begin business, and existing businesses looking to expand.

The report shows 113 businesses received the lowest-tier funding of $25,000 each, except Bulrush LLC in Northampton, which received $17,000. That category of pre-licensed startups accounted for $2.79 million in aid. The second tier — for provisional and final license holders needing urgent operational support — went to six businesses at $50,000 each. Twenty-eight operators seeking to launch their businesses shared $7.25 million in grants, while the highest tier, for existing businesses planning to expand, awarded $15.7 million to 33 companies.

About 100 businesses that applied for grant funding received none.

Charles said he knows multiple delivery operators who were denied grants this year and have since closed.

“One guy, as soon as they sent out the letters, he was like, ‘We’re out of business. We can’t do this anymore,'” he said. “Some of my customers have already told me that a couple of other operators in our area have gone under.”

For Pineau, the prospect of ongoing grant rounds over the next five years offers hope. She said her business is prepared to “hit the ground running” as soon as final regulations for social consumption establishments are approved.

The next round of funding could prove decisive for businesses fighting to hold their place in a volatile market.

“It’s been a great help to my business, personally,” Charles said. “But the task is very daunting.”