Over the course of the last year and a half, the medical and recreational cannabis retailers have grown into two very different yet overlapping businesses, largely coexisting and occasionally competing.

Get Instant Access to This Article

Subscribe to Worcester Business Journal and get immediate access to all of our subscriber-only content and much more.

- Critical Central Massachusetts business news updated daily.

- Immediate access to all subscriber-only content on our website.

- Bi-weekly print or digital editions of our award-winning publication.

- Special bonus issues like the WBJ Book of Lists.

- Exclusive ticket prize draws for our in-person events.

Click here to purchase a paywall bypass link for this article.

Over the last 12 years, Massachusetts voters have turned out in favor of legalizing access to marijuana – first voting to decriminalize it in 2008, then voting to legalize medical marijuana in 2012, and four years later, voting to legalize recreational cannabis for adults.

Each step was momentous in its own right, especially for marijuana advocates and the entrepreneurs looking to capitalize on the expanding – and highly popular – market.

Over the course of the last year and a half, roughly the amount of time since the first recreational dispensaries opened their doors to the public in November 2018, the medical and recreational cannabis retailers – of which there are currently 62, according to the Massachusetts Cannabis Control Commission – have grown into two very different yet overlapping businesses, largely coexisting and occasionally competing.

Keith Cooper, board chair of the industry association Commonwealth Dispensary Association of Massachusetts and CEO of Revolutionary Clinics in Fitchburg, which runs medical dispensaries in Cambridge and Somerville, estimated the recreational market in Massachusetts is eight to 10 times the size of the medical market.

Recreational dispensaries have sold $633 million worth of product since the first two opened in 2018, according to the CCC.

“There’s very few companies today that are going after retail licenses for medical-only stores because of the limit on demand,” Cooper said.

Less than 1% of Mass. residents hold a medical marijuana card, which requires patients obtain a certification from a doctor, then register with the state and pay a fee. For recreational marijuana, anyone with a driver’s license proving one is at least 21 years old can get cannabis. This is what leads to the recreational market being larger than the medical one, Cooper said.

But that doesn’t mean recreational is necessarily the better deal, Cooper said, saying no taxes are levied on medical marijuana sales, medical marijuana is allowed to be sold at much higher dosage points, and medical retail establishments are allowed to offer discounts banned on the recreational side of things. Medical cards are now allowed to be obtained almost instantly through telehealth doctor appointments.

Plus, medical dispensaries like his will provide products to customers to help pay them back for the money they spent on acquiring a medical card.

Still, with demand falling where it does, the days of the stand-alone medical dispensary in Massachusetts may be coming to an end. With the booming recreational market, Cooper said he doesn’t know of any medical dispensary owner who doesn’t want to eventually co-locate an adult-use operation on the same site.

“Anyone who is paying for a license and the length of time and real estate expenses, it’s just good business, if you can, to do both,” Cooper said.

It sounds simple enough, but adding a recreational-use retail operation can be challenging in some municipalities, where local regulations provide roadblocks to expansion. Cooper knows this problem well -- the city of Cambridge, one of two cities where Revolutionary Clinics operate, placed a two-year moratorium on allowing anyone who isn’t a person of color or other economic empowerment applicant from opening a retail store.

Cooper – who is suing the city in an attempt to undo the rule – said municipal regulations like these stand to threaten the health and longevity of the medical marijuana industry, and he fears challenges like these could lead to a complete market collapse.

Not that bad

Not everyone in the field is as convinced the situation is so dire.

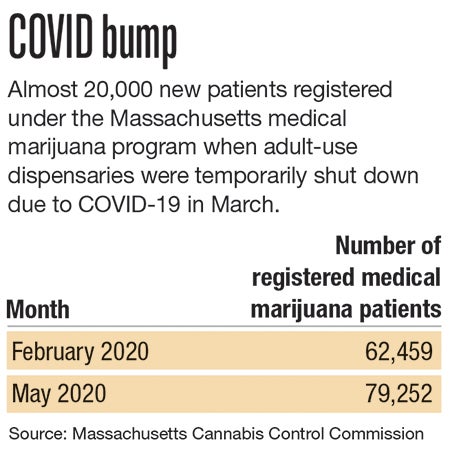

Brandon Morphew, marketing director for Temescal Wellness, which operates a co-located medical and recreational dispensary in Hudson, said business has been healthy on the medical side of things. He said, particularly, the spike in medical cards reported by the CCC during the recent two-month nonessential business lockdown, which temporarily shuttered recreational sales in an effort to stem the spread of the coronavirus.

From Morphew’s vantage point, medical sales have been consistent, even before that spike. Like Cooper, he said medical consumers have better financial benefits and many of the new medical card holders will choose to renew their permits in the future.

“They will continue using the medical cannabis program because there are multiple benefits,” he said.

Matthew Huron, CEO of Good Chemistry, which operates dispensaries in Colorado and Worcester, has a reputation for vocally and passionately supporting the medical side of legal cannabis. Like Morphew, he said medical sales have been steady – even increasing – since the shop first opened.

“The number of medical patients we are seeing continues to moderately increase, although we do serve a larger number of adult-use customers,” Huron said in an email.

A nod to the inescapable overlap between medical and adult-use marijauna, he characterized the two as working together. When asked how the adult-use market has impacted the medical market, he said Good Chemistry’s recreational operations help support the company’s medical marijuana operations.

“Medical cannabis has remained intact in other markets across the country, and we believe it will continue to do so because it addresses the needs of thousands of people who seek the benefits that medical cannabis provides,” Huron said.

Commission support

CCC Executive Director Shawn Collins echoed similar sentiments, saying when the commission took over the medical marijuana program, there were about 59,000 registered patients. As of May 2020, there are roughly 80,000. That number, which includes the roughly 20,000 new registered patients signing up during this spring’s non-essential business closure, suggests the program had stayed relatively consistent, even before the spike.

That said, Collins said the commission tries to make a point of keeping an eye on the relative health of the medical marijuana industry, in large part to ensure patients retain and maintain access to medicine they rely on. Combined with moves meant to streamline the patient registration process, the CCC is making medical cannabis a priority, he said.

As for municipal regulations butting heads with medical dispensary operators, Collins said it has always been important for those types of debates to take place at the local level.

“That’s the most appropriate venue for these conversations,” Collins said.

To opponents of legal cannabis, the propensity for some marijuana users to quickly opt-in to the medical side of things when recreational sales were temporarily banned statewide might serve to diminish the argument cannabis is, in fact, a substance to be used medicinally. But Cooper compared it to those who use over-the-counter versions of drugs vs. those who use prescriptions.

Just because a product was obtained on the customer-facing side of the pharmacy doesn’t necessarily make its impact less medicinal, he said.