Experts: Foreclosure Crisis Far From Over In The Bay State

It’s been easy in recent months for state officials to claim that the Bay State’s economy is on the upswing and well on its way to a full recovery.

The jobless rate has been on the way down and is well below the national rate, and the housing market, while certainly not the picture of health, is not as dire as it is in harder-hit regions like the South and Southwest.

Home prices have even seen increases in recent months, according to The Warren Group, a Boston-based real estate tracker.

But the foreclosure mess that has weighed the economy down for more than three years may not be over, according to the region’s bankers and real estate experts.

Much like it is in other areas of the economy, the job market still isn’t good enough to ensure that homeowners can’t fall into unemployment and eventually lose their homes.

The problem is especially prominent in the Fitchburg-Leominster area, where unemployment lingers around 12 percent while the state’s overall rate is below 9 percent.

“I do not think it’s over,” said Martin Connors, president of Rollstone Bank and Trust in Fitchburg. “Unemployment nationally is close to 10 percent, and unemployment in Fitchburg-Leominster is close to 12 percent, and in a lot of the foreclosures we’ve been involved with, the common theme is job loss.”

Rollstone’s $325-million retail loan portfolio is about 64 percent residential loans.

“It’s hard to think that it’s over when the economy is the way it is,” Connors said.

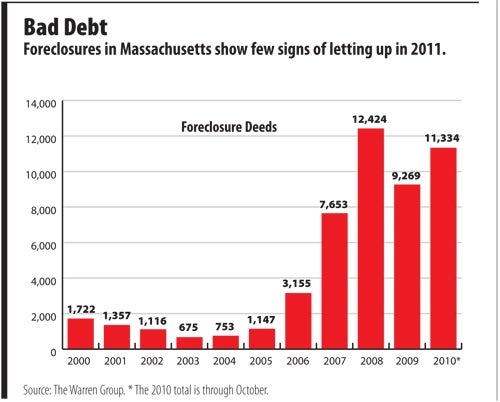

The numbers back up Connors’ perceptions. As of October, there have been more foreclosures this year than in each of the past three years. Through the first nine months of the year there were 11,334 foreclosures, according to The Warren Group. At the same time last year there were 7,710, and 10,615 in 2008. Still, Vincent Valvo, group publisher at The Warren Group, said foreclosure petitions slowed down in the middle of 2010.

“It hasn’t been a situation where fewer people are being foreclosed upon, it’s a situation where the technicalities are slowing down the process dramatically,” he said.

A moratorium on foreclosures by national banks because of lawsuits concerning faulty paperwork slowed down the rate of foreclosures. But Valvo argues that that could actually be a bad thing.

“Anybody who has had a three-day cold or looked over at their co-worker that has been sniffling for months can appreciate the notion that you want bad things to pass quickly,” Valvo said.

Furthermore, a slowdown because of legal holdups could create a backlog of foreclosures that will come to a head in 2011, suggested David Wluka, a Sharon-based real estate agent and past president of the Massachusetts Association of Realtors.

The problem is not with the small, local community banks, but rather with large, national lending institutions, which are far more unlikely to renegotiate loans with homeowners to avoid foreclosures, according to Wluka. One solution, he said, is for the large national lenders to give authority to local community representatives to negotiate with homeowners or brokers.

For other local bankers, there is a clear connection between unemployment and the foreclosure crisis. Still, foreclosures will continue to be an issue if people continue to be out of work, said Richard Leahy, president of Webster Five Cents Savings Bank.

Nex year “is going to continue to be a difficult environment,” Leahy said. “I do think things are improving, but they are improving at a very slow pace. With unemployment being so high and real estate values more than likely staying flat, we’re going to find more people running out of their savings and resources. I, unfortunately, think we still have a lot of foreclosures to work through in the general economy.”

Freelance writer Matthew L. Brown also contributed to this story.

0 Comments