Sales of triple deckers surge after recession

The triple decker has long been a staple of New England’s housing stock, especially in the region’s cities. In Worcester, specifically, these buildings grew out of the need to house a growing immigrant population that worked in manufacturing at the turn of the 20th century. To this day, according to U.S. Census data, nearly 25 percent of Worcester’s homes contain three or four living units.

When the Great Recession struck about seven years ago, it ate away at the value of all sectors of the housing market: single-family homes, condominiums and multi-family buildings.

But as the market continues to recover, the three-family investment property — specifically the triple decker — has surged ahead of the others.

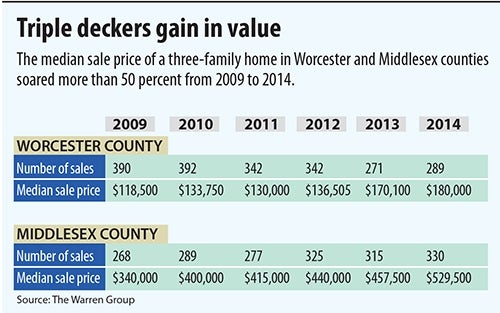

The median price of a three-family home in Massachusetts has soared 83 percent since 2009, with Worcester and Middlesex counties seeing jumps of 52 and 56 percent, respectively, according to The Warren Group, the Boston-based real estate data firm. During that span, the median price of a single-family home rose a relatively paltry 16 percent statewide, which has cemented the value of triple-deckers among investors.

The triple decker has long been a staple of New England’s housing stock, especially in the region’s cities. In Worcester, specifically, these buildings grew out of the need to house a growing immigrant population that worked in manufacturing at the turn of the 20th century. To this day, according to U.S. Census data, nearly 25 percent of Worcester’s homes contain three or four living units.

Although many of these homes are now over 100 years old, they’re in high demand as investors and first-time homebuyers flock to the unique investment opportunity they represent. For owner-occupiers, living on one floor while renting out the other units to cover mortgage and other costs remains popular, said Tom Rhealt, a Realtor at Coldwell Banker who bought his Worcester triple decker in 2007.

“They hold their value in a way that singles don’t because you are making money from this. It is a real cash flow,” he said. “It’s a part of the fabric of the city and what it is known for.”

Adding to the popularity is that these buildings are often priced in the same range as single-family homes. According to Warren Group data, the median sale price of a single-family home in Worcester in 2014 was $182,250; the median for a three-family was $180,000.

Bidding wars for some?

Demand is strong for these unique housing options, according to Dave Stead, a Worcester real estate agent and regional vice president for the Massachusetts Association of Realtors. A property with a desirable location or condition will be snatched up within days of entering the market, he said, while those with both have recently resulted in bidding wars.

Investor interest is so intense in Worcester, experts said, that it’s outstripping inventory and driving up prices. Warren Group data showed that the median price for single-family homes and condominiums in Worcester grew 6 and 18 percent, respectively, between 2010 and 2014, well below the 56 percent for three-family homes, since the Great Recession’s nadir in 2009.

Compounding the demand is that triple deckers are no longer being built, said Warren and Stead. Between the high cost of complying with modern housing regulations and the ability to get a higher return on investment with larger apartment complexes, triple deckers are not a popular option among developers.

“The triple decker was a popular style in its day, but I don’t see it being built. People who are thinking multifamily housing are thinking of doing bigger apartment complexes,” Warren said.

Even amid rising prices and lack of new construction, Worcester’s triple deckers remain a solid investment, said Jimmy Kalogeropoulos, an agent for ReMax. Local investors specializing in these properties will buy one in any condition in any part of the city, confident that they will be able to rent it out after renovations. Often, these investors are aiming for the lowest-priced options to maximize their profits from rents.

Drawing the college crowd

More specifically, triple deckers located near college campuses command higher prices and attract investors willing to put more money into them, Kalogeropoulos said. Investors know they’ll be able to get higher rents and a steady stream of renters. And, students will pay $1,500 a month for three- or four-bedroom apartments near campus, Kalogeropoulos said.

While that’s higher than elsewhere in the city, these prices are lower than on-campus housing costs.

Kalogeropoulos has seen more interest from Boston investors recently, with the Boston and Middlesex County markets tightening and becoming more expensive.

Prices east of Worcester “have gotten so out of control they can’t afford to do business anymore,” Kalogeropoulos said. “That’s going to be huge to (Worcester) in the next few years.”

The statistics indicate that all this demand is outstripping available inventory, according to Warren and Stead, with overall sales of triple deckers down through 2014. Along with a lack of new construction, most owners hold onto their triple deckers for years until they grow too old to maintain them or they tire of being landlords, Stead said.

Rhealt has seen this himself, with both his father and grandfather having compiled portfolios of triple deckers. He plans to follow in their footsteps.

“I’ll sell this when I’m 80. That’s it. I will never get rid of it,” said Rheault, who is in his early 30s.

But this constrained stock is not a concern, Stead said, since it reflects the value of these properties. He predicts that the value of triple deckers will continue to grow and demand will remain high. The continued increase in value might not be as steep as it has been since 2009, but prices will remain steady as demand continues. Kalogeropoulos feels the values will likely level off in the next five years, but that doesn’t make these properties a bad investment.

“Worcester is a great place to invest, but especially with multi-family houses,” he said. “They are affordable and , depending on what you buy, you can get a quality building.”

0 Comments