Because they offer virtually the same services, credit unions and banks are often synonymous among consumers.

But with credit unions reaching record membership levels both locally and nationally, it seems people may be taking a closer look at the differences between their local credit union and banks when they decide where they want to bring their business.

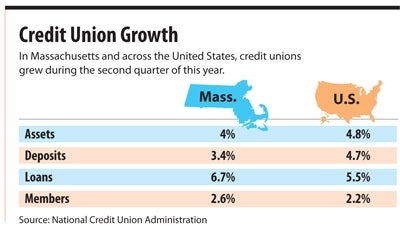

According to the National Credit Union Administration (NCUA), the government agency that oversees and provides data on federally-insured credit unions, membership at U.S. credit unions reached a record high of 95.2 million in the second quarter of 2013, which ended June 30. At the same time, loan volumes grew 2.3 percent in the second quarter, and 5.5 percent in the last four quarters – the strongest growth stretch since 2009. In all, U.S. credit unions exceeded $1 trillion in assets in spring 2012, a milestone the Credit Union National Association attributed to record membership growth.

Growth among Bay State credit unions kept pace with or exceeded national levels in the second quarter, with annual asset growth of 4 percent, a loan growth rate of 6.7 percent, and membership growth of 2.6 percent. And in Central Massachusetts, four of the top five credit unions saw their assets grow, while all five increased membership – in most cases by thousands.

Dan Egan, president of the Marlborough-based Massachusetts Credit Union League, said there are two major drivers accounting for the growth.

First of all, banks – particular the large, national institutions – developed an image problem during the Great Recession, according to Egan. He said there’s a sense of disenchantment that has prompted customers to give credit unions a second look, despite the conveniences offered by big banks, such as many ATM locations. Credit unions are member-owned and operated, he noted, giving them a more democratic feel.

In addition, Egan said, credit unions are attracting people who want lower service fees for things like out-of-network ATM use, lower interest rates on loans and higher rates on savings.

Despite the perceptions, deposits at area banks have grown recently. Bank of America, for one, saw deposit growth of nearly 50 percent in Central Massachusetts from 2008 to 2012. (See related story, Page One.) In a recent interview with the Worcester Business Journal, Edwin Shea, Central Massachusetts market president for Bank of America, said the bank is putting more control in the hands of geographic markets, a directive of CEO Brian T. Moynihan.

Broader Appeal

Historically, credit unions largely represented the working class, with institutions forming to serve the workers of a certain company, church parish or union. Today, they serve a wider demographic, Egan said.

“People recognize the advantages of the cooperative structure of credit unions,” Egan said. “Certainly the appeal of credit unions is more widespread and probably more diverse across economic lines.”

That’s not to say area credit unions haven’t retained some of their original culture.

In some cases, people with ties to the founders still keep accounts with Central Massachusetts credit unions. This is true at Leominster Credit Union (LCU), which was founded in 1954 by a group of local businessmen and still serves longtime members, according to its president, John O’Brien. He said LCU’s tight-knit culture continues to draw new business.

“Dealing with a local financial institution is appealing to a lot of members,” O’Brien said.

While LCU’s asset base declined slightly in the second quarter of 2013, O’Brien said that was due to a strategic plan to cut back on the credit union’s investment business – a move other credit unions are also making as yields are poor due to low interest rates set by the U.S. Treasury Department.

Overall, LCU has roughly doubled its assets since 2007, which O’Brien attributed to “deepening relationships” with customers by increasing the number of products each customer has with LCU, plus a rebounding real estate market that has bolstered the mortgage business.

Of course, there are plenty of local banks available to people wary of large financial institutions, and they rival local credit unions in terms of hometown appeal, according to Doug Petersen, president of Fitchburg-based Workers’ Credit Union.

“Certainly, in general, the larger banks really had a black eye from a PR standpoint,” Petersen said. But he noted that people don’t generally view small, local banks through the same lens.

Workers’ has had a strong year for growth, with deposits on track to grow 15 percent on an annualized basis; 18 percent for loans, Petersen said. The credit union continues to expand, with its newest branch recently opening in Chelmsford.

Solid performance has Marlborough-based Digital Federal Credit Union (DCU), the region’s top credit union in terms of assets, expanding its reach, with plans to open new branches in Fitchburg and Lexington this fall. But DCU Spokesman John LaHair doesn’t think DCU’s success, or that of the wider industry, is simply a matter of big banks’ image troubles.

“It’s … simply consumers searching for lower-cost alternatives to banks,” LaHair said.

But like Petersen said, community banks don’t necessarily fall under that category. Ellen McGovern, senior vice president of marketing at Clinton Savings Bank, said her bank has also experienced growth coming out of the Great Recession. At 20,000 members, the bank’s deposits increased just over 7 percent since 2011.

Like credit union officials, McGovern said people are more likely to look to their community bank over a larger, national competitor. She added that Clinton Savings views its main competitors as those larger banks, rather than local credit unions.

The credit union industry is consolidating. According to the NCUA, there were 6,681 credit unions doing business in the second quarter ended in June, an annualized decrease of just above 4 percent since December 2012.

Michael Rooney, chief financial officer at Central One Credit Union in Shrewsbury, expects that trend to continue, as tight margins force small credit unions to join up with larger competitors. n

(Rick Saia of the WBJ staff contributed to this report.)