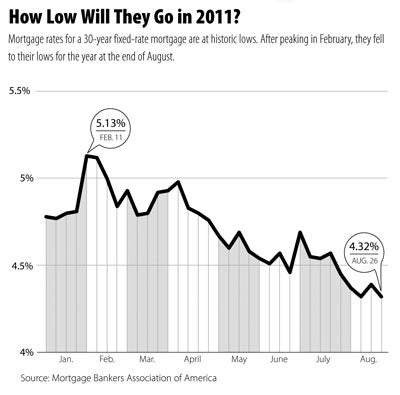

You may have heard it on the radio or seen it in a newspaper advertisement: Interest rates are at record-low levels. And for financial institutions, that could mean it’s a good time to buy a house.

According to the National Mortgage Bankers Association, interest rates on a 30-year fixed-rate mortgage during the last week of August were at their lowest levels of the year, at 4.32 percent.

“We have stepped up our marketing efforts,” said Dan Zona, president of Athol Savings Bank. “It’s a tremendous opportunity to take advantage of low rates, so we want to let our customers know about it.”

The bank, Zona said, has increased its advertising buys in traditional media, such as newspapers. But the bank is also trying new products and services to entice customers to stop by.

Shorter-Term Mortgages

Specifically, the bank, he said, has been offering shorter-term mortgages, in the 10-year range, a product that had not been offered in the past. It allows customers to pay off debt faster, and clears low-interest rate loans from the bank’s balance sheets faster, in case rates rise. While record low interest rates are a good thing for consumers, banks typically don’t want to load up their balance sheets with long-term, fixed low-rate loans because when the rates rise in the future, the banks would have lower-than-market-rate loans on their books.

The response?

“It’s been favorable,” Zona said.

Athol Savings Bank isn’t alone.

Philip Pettinelli, president and CEO of Southbridge Savings Bank, said officials there are working with an outside consultant to develop new offerings for customers.

The interest rates on deposits are low, but the assets the banks hold, such as certificates of deposits and loans, are yielding high returns. The spread between short- and long-term borrowing rates benefits banks, he said. The opportunity has meant it’s a good time for the bank to explore new service offerings for customers.

New Offerings On The Way?

For example, the bank has a Key Rewards checking account, which gives customers a premium deposit rate if they hold more than $25,000 in the account, have direct deposit and use a bank-issued debit card a certain number of times per billing cycle. Rates on those accounts are up to a full percent higher than those of traditional accounts.

By the end of the year, the bank hopes to roll out more new services on the deposit side as well. Along with them come increased marketing campaigns.

Mike Ivas, director of business development for Davis Advertising in Worcester, said it goes hand in hand that if businesses see an opportunity for customers to benefit from their products, they want them to know about it.

Ivas has noticed other trends too. Specifically, banks are increasingly targeting customers in the 18- to 30-year-old range. It’s being done by using new advertising platforms on social media websites and mobile devices.

“You’ve got to go where the customers are,” he said.