Saving customers time and money in exchange for their loyalty is at the heart of why companies like Starbucks — and now, Framingham-based convenience store and gas station chain Cumberland Farms — offer customers the option to pay with their mobile phones.

While retail giants such as Target, Wal-Mart and Best Buy are developing mobile loyalty programs and payment options, small and mid-size businesses stand to gain by offering mobile payments, according to a study released by Stamford-Conn.-based information technology research firm Gartner. Cumberland Farms is one of the latest retailers to jump on board and let customers pay at the pump with their smartphones.

Cumberland Farms launched its pilot mobile payment program through PayPal in Massachusetts in April 2012.

“We knew mobile communication is a big part of our customers’ lives,” said Kate Ngo, Cumberland Farms’ senior manager of brand strategy. “We just wanted to dip our toe in … A lot of retailers are struggling with the role of mobile.”

But the results were encouraging: 86 percent of customers who tried Cumberland Farms’ SmartPay mobile payment option returned to use it again.

“Although we saw a high rate of loyalty, we wanted to extend it through a discount,” Ngo said.

In January, the company rolled out another option for customers throughout its 11-state market to pay by phone. By partnering with the National Payment Card Association, consumers can now pay by debiting their checking accounts linked to the mobile application in addition to PayPal. Customers receive 10 cents off every gallon of gasoline when they pay by this method.

“One of our largest expenses is the interchange fees for credit cards for Cumberland Farms. It’s a huge expense for the retail industry. We’re able to use those savings and pass it along to customers,” Ngo said.

The Numbers

Worldwide mobile payment transaction values are estimated to have increased by 61.9 percent, from $105.9 billion in 2011 to $171.5 billion in 2012, according to the study by Gartner, conducted in May 2012.

Nationally the number of mobile payment users is projected to grow from 32.8 million last year to 46.5 million in 2013. Following the success of Starbucks’ mobile app, which has garnered more than 70 million transactions since its launch in January 2011, analysts expect other merchants to come up with their own mobile payment apps.

For online payment vendor, Adyen, which has an office in Westborough, clients continue to request mobile payment options. In 2011, mobile payment transactions accounted for 3.5 percent of all transactions among Adyen clients. In 2012, that tripled, to 10.5 percent.

“It’s definitely the trend,” said Peter Caparso, president of Adyen North America.

Retailers are choosing a variety of ways to integrate mobile technology into their businesses. At Cumberland Farms, customers enroll in the SmartPay Check-Link program in the store or online. Similar to setting up direct deposit, a verification process is required. Then, customers can download the app on their phones or opt to receive swipe cards.

“People are still curious and question the security (of paying by phone). Also there’s the physical experience of a card,” Ngo said.

Through the app, customers are prompted to sign in, and the phone’s GPS function locates the gas station where they are. Then, they must identify the gas pump they’re using, select the grade and pick up the pump before a signal is sent to a server that turns on the pump.

“When we launched the SmartPay pilot, we were the first to launch a mobile app that would authorize the pump. We were the only people to have this functionality,” Ngo said.

Down the line, the company would like to give exclusive offers, rewards deals and relavant information and news to Cumberland Farm customers through SmartPay.

“I think it all comes down to convenience. The mobile experience is faster and more efficient. It’s better than digging through your purse,” she said.

In a study released in December by Beverly-based international research firm Latitude of more than 900 smart phone-enabled consumers, 80 percent said they were interested in a “mobile wallet,” especially if it were to replace having to carry cash or credit cards.

Security was not a major concern or deterrent to using mobile payments by the study’s participants.

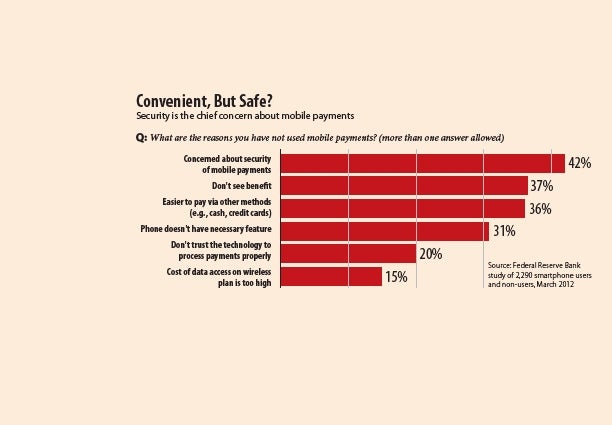

However, researchers compared their findings to a study of 2,290 smartphone users and non-users released last March by the Federal Reserve that identified security concerns as the biggest impediment to adopting mobile payments.

Among the smartphone-enabled consumers in the Latitude survey, the size of a mobile phone’s screen and some mobile sites’ limited functionality were the two main deterrents. Additionally, 61 percent said they have a better opinion of a brand when they have a positive mobile experience.