Looking at IPG Photonics’ earnings reports can be staggering.

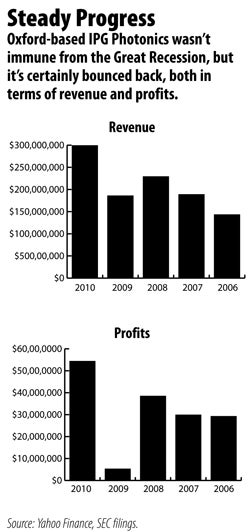

Revenues for the Oxford-based company have doubled since 2006 to almost $300 million last year, which is up 61 percent from 2009. Profits for the company were up tenfold in 2010, reaching $54 million, a record for the company. And the current fiscal year is off to a good start. First-quarter net income is six times greater than the level for the previous year.

The robust growth at IPG even attracted Lt. Gov. Timothy Murray, who toured the company’s Oxford headquarters May 26. The company said that it has already hired 137 new employees this year, bringing its total Oxford workforce to more than 570. It has plans to add at least 30 more jobs before the end of 2010.

Analysts who track the publicly traded manufacturer say the company has an estimated 70-percent market share in the fast-growing sector of fiber-optic lasers, which are of a higher quality, more energy efficient and more powerful than conventional lasers.

And the multinational company is diversified with sales across Asia, Europe and North America.

“The entire laser group of companies is closely linked to the world industrial economy and obviously that has improved,” said Mark Miller, a former Silicon Valley physicist who now tracks IPG Photonics for Noble Finance Capital Markets.

While “just about everyone is looking good compared to 2009,” Miller said he expects IPG to be poised for additional growth in the coming years.

Disruptive Technology

Valentin Gapontsev, a Russian physicist, founded IPG Photonics in 1990 after a 30-year career in academics studying laser technology. The company has a 261,000-square-foot headquarters in Oxford and other manufacturing operations in Germany and Russia with more than 1,400 employees worldwide, including about 490 in the United States.

As recent as the early 2000s the company struggled to be profitable, absorbing a $49-million net loss in 2002 on $22 million in revenues.

The economic downturn of the past few years hurt the company as well, with net income dropping to just $5.4 million in 2009.

But as the global economy has picked up, so too have profits.

“They’ve seen a nice recovery in their business as the global economy has improved,” said James Ricchiuti, who follows IPG for the New York-based research firm Needham & Co. “Historically, they’ve been a pretty rapidly growing company, so I think this is really just a return to their growth rate.”

IPG is the “only player in the market” with commercial high-power fiber lasers, Ricchiuti said. The technology distinguishes IPG from other laser makers and is helping the company steal market share from other material processing companies, he added.

IPG’s fiber-optic lasers are used in material processing, including stamping semiconductors, cutting thick, dense steel and welding certain metals. A variety of industries use the lasers, including car and ship builders as well as manufacturers.

IPG’s lasers generally have a higher upfront cost, Ricchiuti said, but they are more cost and energy efficient over the long-term because they do not require a gas to power them, as many conventional cutting lasers do.

So is the growth sustainable?

Maybe not at the 2010 rates, Ricchiuti said, but IPG likely will continue to see its historical growth of 20 to 30 percent in coming years, he said.

IPG management is also expecting the upward trend to continue. While company officials did not return phone calls seeking comment, in a recent earnings announcement for the first quarter, CFO Tim Mammen issued guidance for the second quarter, which he expects to outpace first-quarter results. Sales are projected to range between $102 million and $110 million, up from $99 million in the first quarter.