The Massachusetts House on Thursday night approved more than $915 million in borrowing over the next five years as part of an economic development bill aimed at boosting jobs and workforce development across the state.

The bill (H 4461) includes Gov. Charlie Baker’s request for $500 million to recapitalize the MassWorks infrastructure program, a “one stop shop” for cities and towns seeking state grants to build or repair local infrastructure, and authorizes roughly the same amount of borrowing overall that Baker proposed in January.

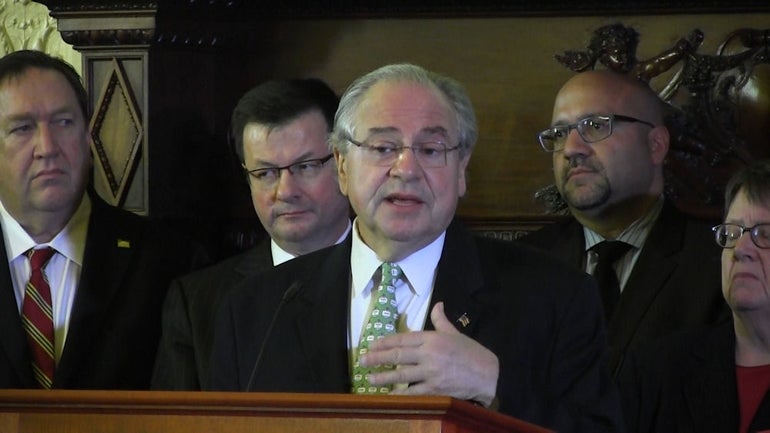

In introducing the bill to his colleagues, Economic Development Committee Co-Chair Rep. Joseph Wagner said the legislation implements “strategic policies that capitalize on the commonwealth’s assets, but also strives to improve areas of weakness.”

“Through targeted investments and policy initiatives, the legislation … provides the tools necessary to foster continued growth in the innovation economy, strengthen the manufacturing sector, support housing and infrastructure upgrades and provide the training and equipment for workforce development throughout our state,” Wagner, a Chicopee Democrat, said. “We maintained the commitment to expanding economic opportunity across the commonwealth and this bill contains a number provisions that will spur development and growth.”

The bill was approved by a 152-1 roll call vote, with Rep. Denise Provost of Somerville dissenting. Provost had previously expressed concerns about the extent of the tax credit-granting authority afforded to the executive branch and the lack of legislative oversight of that process.

Approved by the House was $45 million in funding for the Brownfields Redevelopment Fund, which Wagner called “a critical component to this state’s economic vitality and success.” The House also approved $45 million in funding for the Transformative Development Fund, administered by MassDevelopment to stimulate development in the state’s Gateway Cities.

The bill would also add fantasy sports to the list of gaming activities allowed under state law and would establish a commission to study all aspects of fantasy contests, including taxation and implications for existing gaming options.

The House stayed into the night Thursday to move the bill on to the Senate, but there was little discussion or debate of the bill throughout the day.

Of the 183 amendments House lawmakers filed to the bills, 19 were adopted, another seven were rejected and 120 were withdrawn by their sponsor before they could be considered. The remaining amendments were assembled into a consolidated amendment that was adopted with one vote.

In the six hours between the bill being introduced on the floor and its passage, only three members — Reps. Nick Collins of Boston, Provost of Somerville and Walter Timilty of Milton — had taken the floor to explain, discuss or debate amendments. Two members — Reps. Gerry Cassidy of Brockton and Brendan Crighton of Lynn — gave their maiden speeches to the chamber on the bill.

Among the amendments withdrawn was one filed by Dedham Rep. Paul McMurtry to suspend the 6.25 percent sales tax for two days in August, an effort to spur consumer spending that has become an annual event.

While tax collections have fallen short of fiscal 2016 projections and lawmakers in June lowered their expectations for fiscal year 2017 by $750 million, forcing them to retreat many planned investments, House Speaker Robert DeLeo and Senate President Stanley Rosenberg have suggested that the state could conserve money in fiscal 2017 by foregoing the sales tax holiday.

The House adopted a Rep. Collins amendment to create a tax credit program for live theater productions that make it to Broadway or off-Broadway within a year of a stop in Massachusetts. A similar tax credit was included in a job creation bill last session but Gov. Deval Patrick vetoed the measure.

The bill now moves to the Senate for its consideration where it is expected to be debated next week.