Plugging in Asia: Growing consumption prompts expansions for Central Mass. tech firms

Exports of all kinds to Asia are on the rise, but it's the technology industry that's delivering the products crucial to bringing Asian countries up to par with other developed nations.

“The numbers are just so big, and with more and more citizens moving into the middle class, the potential for businesses in all kinds of industries is just enormous,” said Kristen Rupert, executive director of the International Business Council at Associated Industries of Massachusetts (AIM).

Ernst & Young, a multinational professional services firm, forecasts that as many as 500 million Chinese could enter the global middle class by 2020 if the country continues to experience adequate economic growth. And a 2013 report by research firm McKinsey & Co. supports the notion that expendable income will rise significantly at the same time. According to McKinsey, Chinese urban household income will at least double by 2022.

“The middle class's continued expansion will be powered by labor-market and policy initiatives that push wages up, financial reforms that stimulate employment and income growth, and the rising role of private enterprise, which should encourage productivity and help more income accrue to households,” the McKinsey report said.

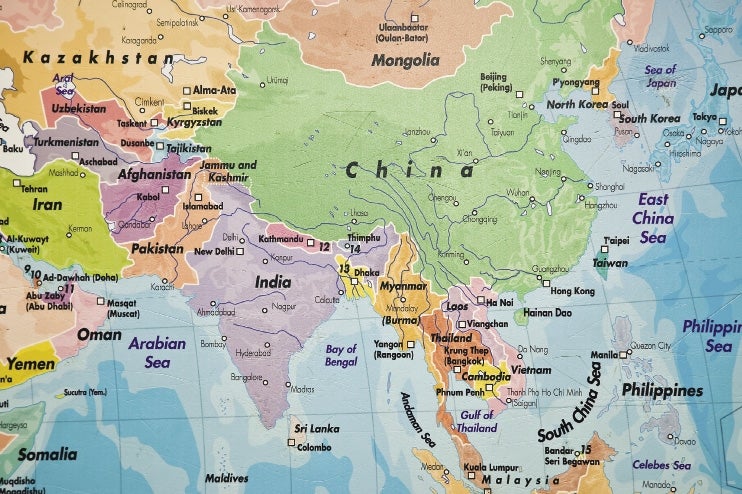

And it's not just China where middle-class consumers are multiplying. India, Vietnam and Indonesia are the top emerging economies, according to a 2010 Brookings Institute Report.

Central Massachusetts is sprinkled with companies that are scaling up operations in Asian countries to meet the demand from the growing middle-class countries on the continent; China is the clear leader with its middle class of more than 300 million.

The maturing economies of these countries are creating an increased need for the basics, such as clothes, as well as more advanced products for industry. But in the end, “it's all about meeting the demand of the people,” said Jeff Tarmy, a spokesman for Milford-based Waters Corp.

Waters, which makes laboratory testing equipment, is helping meet that demand with a new laboratory it opened in partnership with the Chinese Pharmacopeia Commission in January. The lab will serve as one of China's national technical support centers in the field of traditional Chinese medicine, which has lacked standards for measuring ingredients.

The pharmaceutical industry is the biggest market for Waters in Asia and elsewhere, Tarmy said, but the need for testing equipment from manufacturers in a number of sectors will be plentiful as the middle classes boom.

When it comes to demand for technology, rapid mobile device adoption is one trend that's touched nearly every part of the world. Because of infrastructure differences, it's happened more quickly in the West than in the East, but Asia is catching up.

This is good news for companies such as SeaChange International, an Acton-based video software maker that recently hired industry veteran David Ulmer to lead its growing Asia-Pacific region. Broadcasters there want to embrace technology giving customers access to over-the-top video services through the Internet, given the “multiscreen phenomenon” in which viewers are consuming content from multiple devices at once. But they need the infrastructure to do it, particularly in Southeast Asia, where building it is challenging because the region has thousands of islands.

“The middle class (in parts of Asia) have absolutely been unable to reach these kinds of services in a legitimate fashion up to this point,” Ulmer said.

SeaChange provides the software to deliver this content in the region, where the potential is “uncapped.” Ulmer said projections indicate there could be more digital television subscribers in Southeast Asia than in the U.S. by 2020.

Cultural considerations

Devens-based AMSC, a clean energy technology company that does a significant amount of business in Asia, is still reeling from the hit it took when its then-largest customer, Sinovel Wind Group of China, allegedly stole trade secrets and failed to pay for services.

That was crippling for AMSC. The company has tried to collect more than $450 million in damages in the Chinese court system, which has been less than favorable toward AMSC's plight.

While the AMSC case may be an extreme example of what can go wrong when doing business overseas, it's worth noting that doing business in a different country presents risks and obstacles. Rupert, of AIM, said this is a reality in China, which, compared to the rest of Asia, is a “particularly challenging place to do business,” she said.

For example, the Chinese government recently proposed new cybersecurity rules that would require tech companies that sell computer equipment to Chinese banks to provide government regulators with source code as well as build “back doors” in their hardware and software. The draft law raised the ire of technology companies that are loath to share that kind of information.

But challenges aren't unique to China. Ulmer, of SeaChange, said there's a lot of variation in how business is done from one Asian country to the next.

That's something business executives sometimes don't realize.

“Many companies will approach Asia as a single entity in the same way that many companies approach the U.S. as one entity,” Ulmer said.

For those that do, it quickly becomes apparent that a local approach is needed. For example, Indonesia has a deep connection to Islam, and religion must be taken into account when scheduling business meetings and in all interactions with clients. For a video software services company such as SeaChange, religion also impacts the type of programming that's allowed. Ulmer said hiring local staff with diverse backgrounds is vital for this reason.

'”There are deep historical and cultural differences in the countries,” Ulmer said.

0 Comments