Brokers and property owners use innovative thinking in seeking to keep plazas full

Photo | Timothy Doyle

Bed Bath & Beyond announced in February it would close its Hudson location.

Photo | Timothy Doyle

Bed Bath & Beyond announced in February it would close its Hudson location.

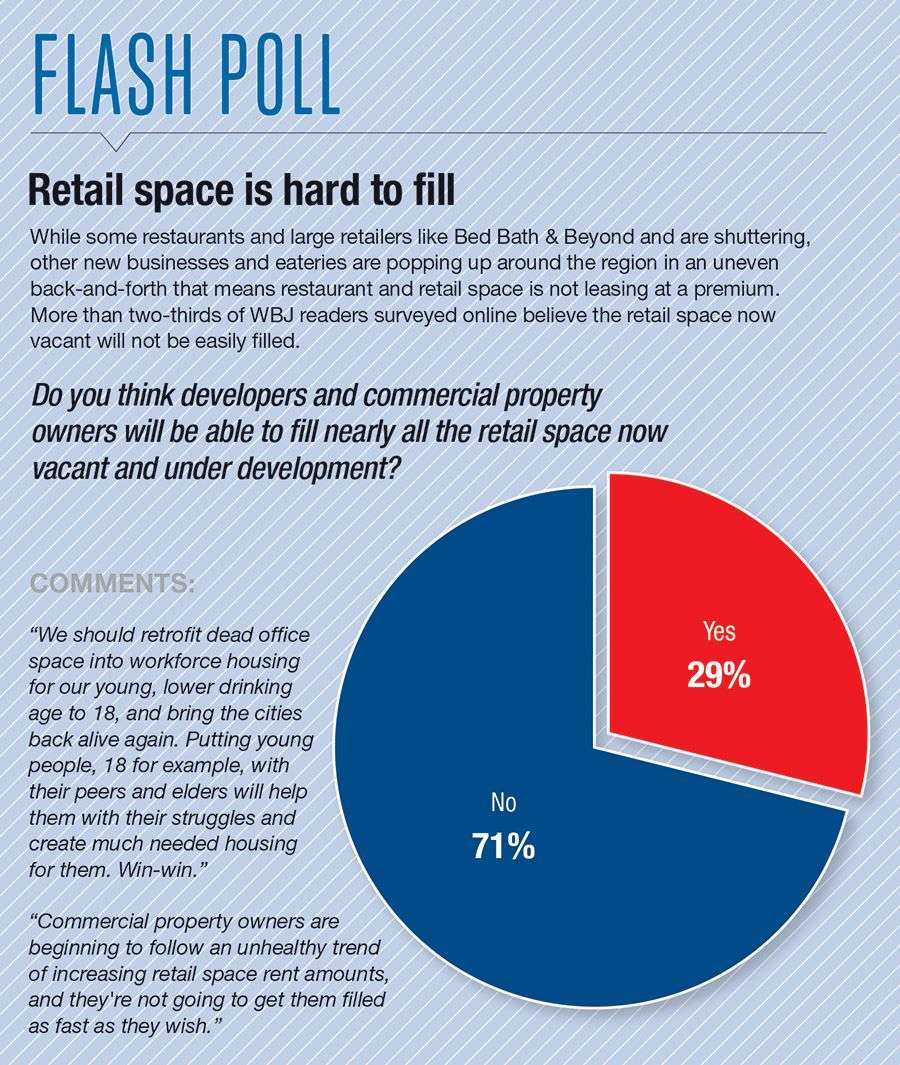

After struggling through the coronavirus pandemic, national retailer Bed Bath & Beyond finally threw in the towel and announced it was declaring bankruptcy on April 23.

Central Massachusetts property owners will be stuck with tens of thousands of square feet of retail space to be abandoned by Bed Bath & Beyond, regardless of whether the retailer retains any stores after it emerges through bankruptcy. Factors like construction costs, interest rates, inflation, and consumer lifestyle shifts pose hurdles for retailers and property owners, but local brokers are optimistic they can fill that space as the industry experiences a post-COVID resurgence and innovative new concepts for retail space are hitting the marketplace.

“Coming out of COVID, retail has been at its peak,” Ben Starr, a partner at Boston commercial real estate firm Atlantic Retail. “There has been an increase in leasing velocity across retail.”

Bed bath & bankrupt

When a large retailer shuts down, it affects not only its employees and customers, but it leaves behind swaths of empty retail space across the nation. In February, Bed Bath & Beyond announced it was closing all but 360 locations, down from more than 1,500 at its peak. Among those to be closed were locations in Hudson and Leominster. The lone remaining store in Central Mass. will be in Auburn, which could shutter depending on the bankruptcy.

The Auburn location is a co-tenant with a Shaw’s Supermarket, at a location once home to Service Merchandise. The owner of that shopping center is ISM Holdings Inc. of Boylston, according to the Town of Auburn. Bed Bath & Beyond leases 21,779 square feet there, according to research firm CoStar.

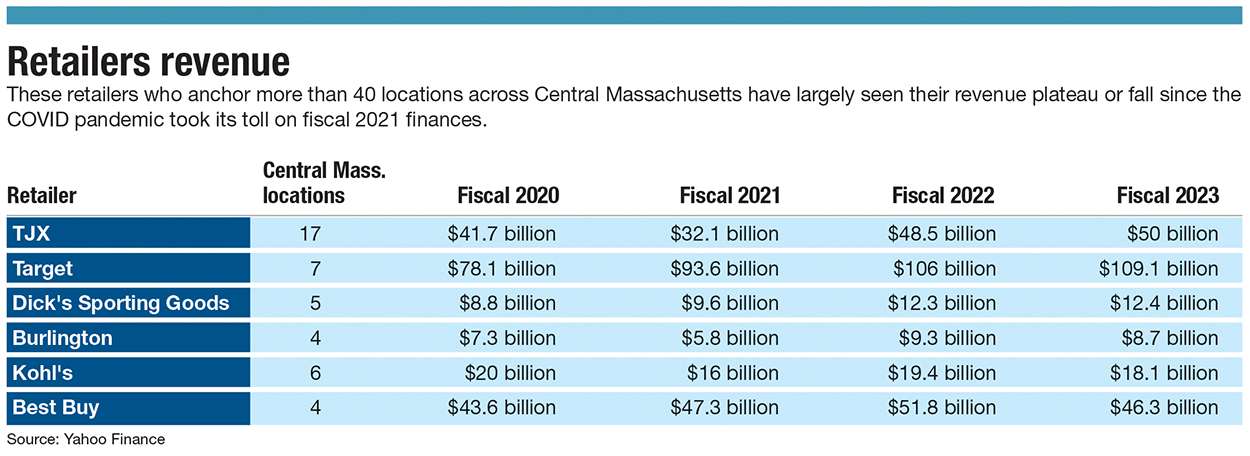

In Leominster, Bed Bath & Beyond leased more than 43,000 square feet of space from Lisciotti Development Corp. of Leominster at the Orchard Hill Park shopping plaza. The plaza is home to a Kohl’s and Dick’s Sporting Goods and has further construction underway. Best Buy and Target have stores at the plaza, but the developer sold those properties.

In Hudson, Bed Bath & Beyond leased 25,000 square feet from SullivanHayes Northeast of Farmington, Conn. at The Shops at Highland Commons. That nearly 1-million-square-foot plaza is anchored by Cabela’s, Market Basket, TJ Maxx, and Lowe’s.

Replacing vacated retailers

Property owners may not have to wait long to refill those spaces, although not everyone agrees it is a rosy environment.

As an example, Starr referenced Shrewsbury Crossing II, a retail plaza in Shrewsbury owned by First American Realty, Inc. of Worcester. That plaza has empty spaces left behind by previously closures of Bed Bath & Beyond, Pier 1 Imports, and Bob’s Stores. In 2022, that space was filled by At Home, a home furnishings superstore that combined the vacant spaces into one.

Worcester commercial real estate brokerage Kelleher & Sadowsky Associates said in its 2023 Commercial Real Estate Outlook for the first time since 1995, more new stores are opening than closing, and analysts expect this trend to continue despite fears of a recession.

In 2022, Framingham-based TJX opened 120 new stores in the United States across five brands: T.J. Maxx (15), Marshalls (35), HomeGoods (44), Sierra (19), and Homesense (7).

The City of Northborough announced in December a HomeGoods, a Marshalls, and a Sierra would all be opening at Northborough Crossing.

While Starr sees strength in the retail real estate market locally, global consulting firm Deloitte sees challenges for the retail industry, according to the firm’s 2023 Retail Industry Outlook.

Deloitte US economists Daniel Bachman and Akrur Barua expect retail sales to be affected by a slowing economy, reduced consumer purchasing power due to inflation, and increased spending on experiences like dining and sporting events they missed during COVID.

Deloitte sees a bright side with retailers coming out of the pandemic. Companies have learned resiliency, learning to adapt, which will be helpful if there is an economic downturn.

“Retailers learned to be better at retail,” said Starr.

Starr remains bullish on retail properties despite potential economic headwinds. The only problems he sees are with high construction costs and interest rates making buildouts expensive, and a lack of available space going forward.

Even if retailers to fill large spaces prove difficult to find, the owners of plazas can find creative solutiond from sub-dividing space to finding non-traditional users, said Todd Alexander, executive vice president, specializing in retail at Kelleher & Sadowsky.

Alexander mentioned the rise in popularity of trampoline parks and other indoor recreation. He and Starr mentioned the rise in popularity of pickleball.

Though an indoor pickleball facility has yet to move into a retail space in Central Mass., an 80,000-square-foot facility housing 28 indoor pickleball courts is slated to open in June in Stamford, Conn.

In Leominster, Mark and Christine Emma, opened a Launch Entertainment franchise in a former Toys “R” Us store at The Mall at Whitney Field. The facility features trampolines, bowling, a rock climbing wall, and an arcade.

Reusing retail properties doesn’t have to be all fun and games. In Worcester, the Registry of Motor Vehicles opened a location in a former Big Y supermarket at 50 Southwest Cutoff in August.

In March, a New Hampshire company proposed to convert a vacant retail space in Fitchburg into 80,000 square feet of self-storage. The proposal includes three small storefronts.

Larger retailers who have relied in the past on expansive indoor mall anchor spaces may soon be a bigger part of the outdoor shopping plaza scene.

Macy’s and its subsidiary Bloomingdale’s have been opening 20,000-40,000-square-foot locations in outdoor plazas. Bloomie’s and Market by Macy’s are smaller versions of the retail giants. Macy’s told CoStar after having success with locations it had opened already it expects to accelerate the rollout of these new stores in 2024.

Christmas Tree Shops of Middleborough, which has locations in Shrewsbury and Natick, is declaring bankruptcy as well. The retailer plans on closing 10 of its stores while it restructures. Time will tell if CTS and its once parent company Bed Bath & Beyond’s bankruptcy are part of a larger trend or just two companies that failed to adapt to changing conditions.

With a wide range of potential uses, and economic uncertainty on the horizon, it’s hard to say what plazas in the future will look like, but brokers seem to feel that they will be filled one way or another.

0 Comments