As the third leader to take over GFA Federal Credit Union in three years, Mark Hettinger brings a track record of asset growth and technological innovation.

Get Instant Access to This Article

Subscribe to Worcester Business Journal and get immediate access to all of our subscriber-only content and much more.

- Critical Central Massachusetts business news updated daily.

- Immediate access to all subscriber-only content on our website.

- Bi-weekly print or digital editions of our award-winning publication.

- Special bonus issues like the WBJ Book of Lists.

- Exclusive ticket prize draws for our in-person events.

Click here to purchase a paywall bypass link for this article.

Mark Hettinger was searching for the next step in his life. His youngest of six children had packed her bags for college, and he and his wife Jaime were empty nesters. He’d spent 19 years at First Alliance Credit Union in Minnesota as its executive vice president and chief operating officer. He made a good salary, which, according to ProPublica’s nonprofit’s database, was $154,000 in 2020. But, he had his eyes scanning for something different. He was looking for the next opportunity, a chance to finally take the next step in his career and become a CEO.

Hettinger reached out to the Phoenix-based DDJ Myers, which helps credit unions with board and organization alignment, leadership training, executive searches, and recruitment, after seeing a posting for GFA Federal Credit Union’s open CEO position. He’s been monitoring the site for a bit and jumped at the opportunity. Hettinger had known the recruiting company’s CEO Deedee Myers for a long time and gave her a call.

“She thought it was a really good match for me,” Hettinger said. “Myers knowing me and knowing the board at GFA, I felt it would be a good match.”

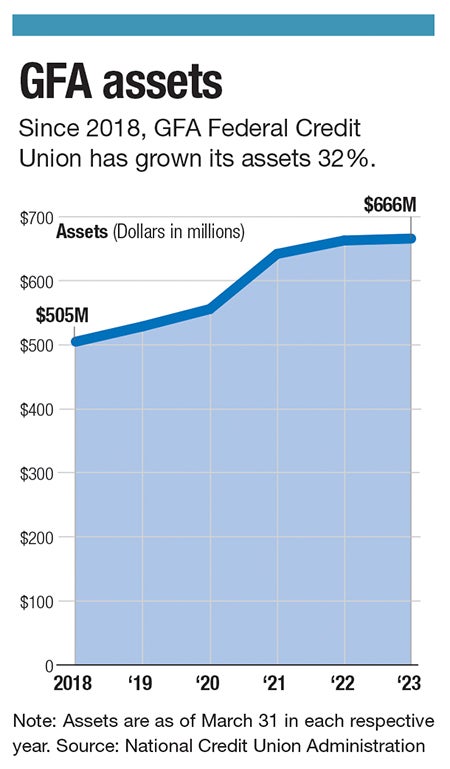

GFA was in the midst of its own search for its future. Leadership at the Gardner-based credit union had been steady for a long time, as it had four CEOs in its first 83 years, but was looking for its third leader in three years. When Tina Sbrega retired in 2021 after 12 years as GFA’s CEO and president and more than four decades of employment there, the credit union hired Joshua Brier in April 2021, but he left in August 2022 to take a job closer to home as COO at GYL Financial Synergies in Connecticut. The credit union named Daniel Waltz as the interim CEO, pulling him out of retirement, as GFA searched for its next CEO to lead the credit union with $666 million in assets, its 30,764 members, and 91 employees.

A history of innovation

In his 19 years at First Alliance, Hettinger saw the credit union based in Minnesota reach nearly 20,000 members and more than $285 million in assets. When Hettinger started, First Alliance had between $75 and $80 million in assets, and he was a big part of the growth the credit union saw over the years, said First Alliance President and CEO Michael Rosek, who worked with Hettinger for the last six years.

“Mark was a great employee. A role model for his team” Rosek said. “Certain leaders will talk about how it needed to be done. Mark will go do it and show his team and never ask them to do something he wouldn’t do.”

Hettinger helped First Alliance grow from two branches to six and was the driving force behind the credit union’s cooperative complex that included not only a First Alliance location but also a bakery and coffee shop in 2020. It was the first of its kind in Rochester, Minnesota. He helped broker the deal for the merger with AE Goetze Employees Credit Union in Lake City, Minnesota, in July 2021 and helped open an administrative branch in nearby Stewartsville.

“Our loss is GFA’s gain,” Rosek said.

That experience and expertise led the GFA board to select Hettinger to take charge of the credit union.

"The GFA Board of Directors were thrilled to find a candidate the caliber of Mark Hettinger during our nationwide search,” GFA Board Chair Doug Delay said in a written statement provided to WBJ. “Mark will bring experience, professionalism, and leadership to our members and the communities we serve.”

Setting up shop at GFA

Hettinger, who was announced as GFA's new CEO in April, has some plans to connect to members and get involved in the community. He wants to network, grow the credit union, and make it appealing to the next generation of members by making it more innovative.

“And then as we grow as an organization, how do we continue to meet our members and the communities in their life events where they need us?” said Hettinger. “Do they need to meet us in a branch? Do they need to meet us via text or via Snapchat or all the various channels where they want to have that conversation with their financial institution? That is where I see the direction going and where I've had experience with that in Minnesota.”

At First Alliance, Hettinger found success texting with members and the introduction of high-tech and high-touch delivery systems in branches with interactive teller machines, which provide a member a way to do a transaction via a touch screen while also being greeted at the door.

“Very much a concierge service,” Hettinger said.

Embracing the future sounds great, but at this moment, banks like Silicon Valley Bank in California, First Republic Bank in California, and Signature Bank in New York all failed since March 10, when SVB became the first to fall under government control. So, naturally, it’s something a CEO like Hettinger has to take into account as he takes control, even though credit unions are different from commercial banks in that they don’t have to make profits for their shareholders in the same way.

“We saw that during the 2008-2009 crisis banks had made some decisions that put the organizations at risk, and there were a lot of bank failures; there weren’t a lot of credit union failures,” Hettinger said. “That cooperative spirit of credit unions remains strong today because we are there for our members, not for the few shareholders that want to see a profit … We are here to make sure that your money is safe and that we are making solid investments in the community.”