After a decade of work and a recent infusion of $10.5 million in equity capital, a Milford pharmaceutical firm is headed to clinical trial for its hepatitis C virus treatment, known as SB 9200.

For a pre-clinical firm with a novel treatment, securing money is no easy task, said Douglas Jensen, co-founder, president and CEO of Spring Bank Pharmaceuticals.

So seeing it come together over the past six months was “thrilling,” Jensen said.

Corralling Private Investors

Jensen and his six-person team have pitched to numerous investors over the past few years, but the company was typically seen as at too early a stage in its development and with a treatment unproven in human patients.

“I’ve done hundreds of presentations,” Jensen said. “The risk assessment was: ‘We love what you guys are doing, it’s interesting, great science, but come back when you have clinical proof.'”

But to get that clinical proof, the company needed money. So it hired New York-based investment bank Brock Capital Partners, to put together a group of high-net-worth investors and several private equity firms. Approximately 75 investors participated, Jensen said, and the company ended up raising about $2.5 million more than it had intended.

Prior to now, Spring Bank’s funding has come from the federal National Institutes for Health (NIH).

The $10.5-million Series A round will fund the crucial phase 1 trial, Jensen said.

“It’s huge for us because basically, we used NIH funding to create a technology platform that’s now moving its first drug against a major disease into human clinical testing,” he said.

The Trial

The first major test of SB 9200 is getting underway this month. The trial will provide data on safety as well as anti-viral efficacy.

The first of approximately 40 patients in the Phase 1 trial – which is taking place in Australia and New Zealand, will be dosed this month, Jensen said.

The trial will take an estimated six to nine months, and if successful, will open up further financing options, Jensen said. If successful, commercialization is still about four years away, he said.

Rooted In RNAi

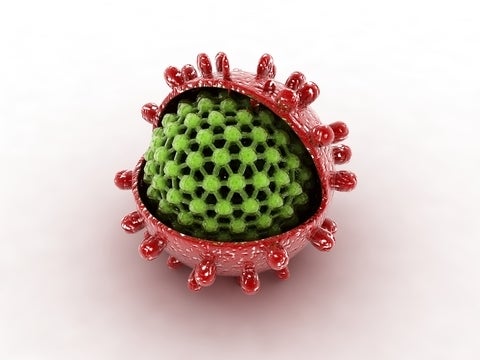

Spring Bank says its biotechnology platform is an new class of pharmaceutical rooted in nucleic acid chemistry, which has spawned RNAi and antisense therapeutics.

Radhakrishnan “Kris” Iyer, the company’s chief scientific officer, is a member of a core group of chemists whose work led to those therapeutics in the late 1980s.

But while Spring Bank’s small molecule nucleic acid hybrid platform shares some chemistry similarities with RNAi and antisense, it differs in several significant ways, Jensen said.

For one, instead of targeting messenger RNA directly, its molecules are designed to selectively interact with nucleic acid binding sites on.

Secondly, they combine a high degree of target selectivity and specificity with the drug-like properties of classical pharmaceuticals, including oral delivery, good pharmacokinetics, low side effects and ease of manufacture, Jensen said.

“As a (drug) class, we’ve got some very significantly improved pharmaceutical properties,” he said.

Spring Bank has a number of other treatments in its pipeline, including one for hepatitis B, and will looking for partners for later-stage and commercial development, he said.