The North Central Massachusetts Development Corp. in Fitchburg ranked third among U.S. Small Business Administration microlenders in Massachusetts, according to a Monday press release by the SBA.

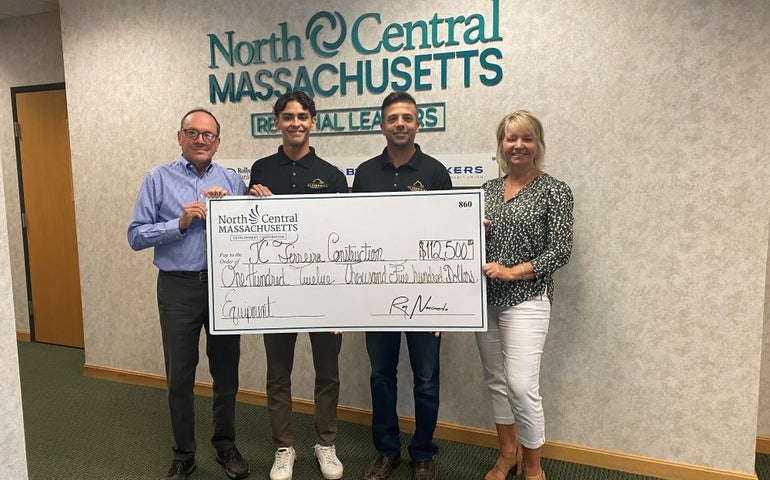

NCMDC, the lending arm of the North Central Massachusetts Chamber of Commerce, approved 10 loans totaling $247,000 in fiscal year 2022.

The organization can provide loans to small businesses up to $250,000, as part of its relationship with the U.S. Small Business Administration.

“We are proud to be recognized as one of the top microlenders in the state. Small businesses have proven to be the backbone of our economy, creating new jobs and investment and setting the stage for future economic growth. The Chamber and the North Central Massachusetts Development Corporation have made it a priority to provide small businesses and entrepreneurs with the support they need to grow and create new jobs,” said North Central Massachusetts Chamber of Commerce President and CEO Roy Nascimento to WBJ.

The SBA microloan program is one of three main lending programs for the administration. The others are 7(a) loans, the most common type, and 504 loans for major fixed assets.

SBA lending saw an increase of 1.1% in combined 7A/504 flagship lending in Massachusetts year-over-year. The 504 loan program increased the amount it lent in FY2022 by more than 18% to $245 million.

According to the report, lending to women-owned businesses increased 19.5% from 226 to 270 approvals. Veteran-owned lending increased 1.9% from 53 to 54 approvals. Lending in underserved communities, including to Asian, Hispanic, Native American and Black owned businesses, saw aggregate loan approvals of 305 over the previous year of 291 for an increase of 4.8%. Total approved dollars to underserved small businesses decreased 7.1%. The largest increase ame in lending to Hispanics, which saw an increase of 28.1% and lending to Native Americans of 66.7%.

“Together, including 7(a), 504 and microloans – the SBA with 160 lending partners, supported capital to 1,548 small businesses for $888 million in Massachusetts,” said Robert Nelson, SBA Massachusetts district director. “As Main Street continues to stabilize, we want small businesses to know that our traditional lending programs will always be accessible to help you start, grow, expand, and recover.”