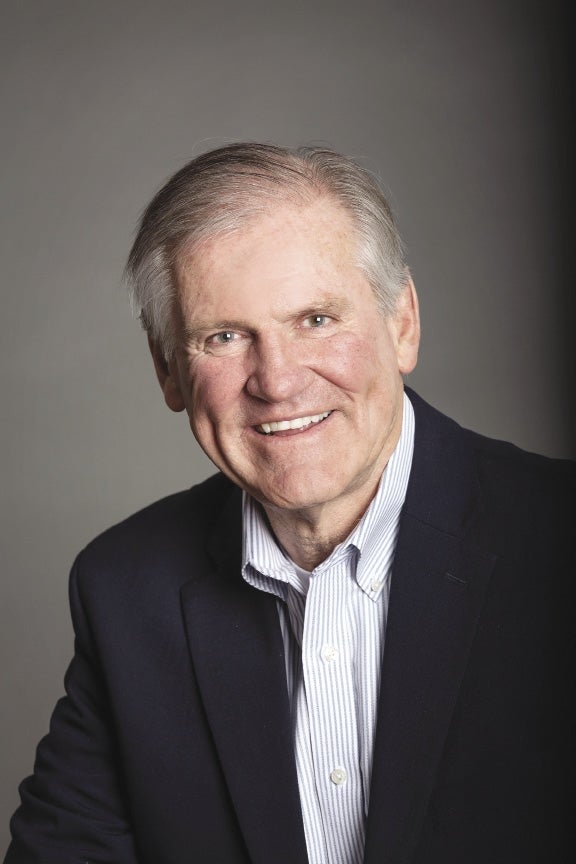

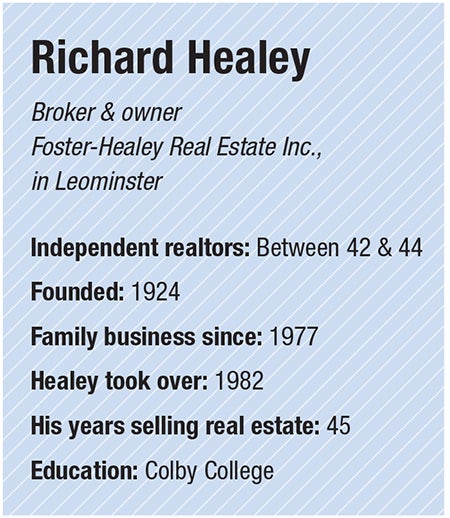

Now the residential real estate market has slowed, Richard Healey of Foster-Healey Real Estate Inc. hopes to see it settle down again and level out.

Get Instant Access to This Article

Subscribe to Worcester Business Journal and get immediate access to all of our subscriber-only content and much more.

- Critical Central Massachusetts business news updated daily.

- Immediate access to all subscriber-only content on our website.

- Bi-weekly print or digital editions of our award-winning publication.

- Special bonus issues like the WBJ Book of Lists.

- Exclusive ticket prize draws for our in-person events.

Click here to purchase a paywall bypass link for this article.

The real estate market goes through ebbs and flows. It moves with the economy. When the going is good, people get the itch to buy a home and the market opens up. When times are tough, people hold on to their money and don't go off and spend. Or so that's how it's always appeared. In 2008, the market crashed under the weight of subprime mortgages and bad loans, and it took years for it to recover. Just as it seemed like the housing market had finally arrived on solid footing, the coronavirus pandemic arrived and changed everything. People had stimulus cash and realized they didn't need to be in the office anymore. The market suddenly opened up. For a bit, it was the wild west with bidding wars and home inspections waived. The coming rise in the interest rates put a fear into people. Now the market has slowed, and Richard Healey of Foster-Healey Real Estate Inc., which has offices in Leominster and Gardner, hopes to see it settle down again and level out.

Since the pandemic, real estate has gone crazy. What have you seen in Central Massachusetts as a real estate agent?

The pandemic changed everything, of course. Everything slowed down during the initial phase, but as we slowly came out of the lockdown, people were finding more and more they did not need to go into work every day. So, from a Central Mass. point of view, we benefited since people could move out here, get more land, more space around them, and not have to go into work everyday.

But the market itself was still in turmoil. It slowly came out of that, so different people had different feelings about whether or not they were comfortable going out, looking at houses, and thinking about moving. We've suffered with inventory. Then we had a real spurt when there was a lot of stimulus money and artificially low interest rates. That caused a lot of bidding wars. People had the money to spend, but people were afraid to put their place on the market because they didn't have a place to go.

How have you been able to navigate the roller coaster as a small business owner?

Without question, it's been a challenge because you've got to work with people. There is nothing worse as a real estate agent when you're working with a buyer to tell them, “If you want to get this property, you're probably going to have to forgo a home inspection. You're probably going to have to try and find money from your parents or someone and borrow cash.” All of those things are difficult things to advise a buyer.

When advising a seller, you can see what the market and other properties sold for, but then all of a sudden the property would go sky high. Then, I would be trying to advise people on the right thing to do, and sometimes they get in these bidding wars and try to pick the right buyer out of 10 or 15 bidders. It was a real challenge.

It remains a challenge to deal with whatever changes are ahead as we go into the higher interest rates. Ultimately, people get married, people get divorced, people have kids, people have kids move out. Those are normally household-buying decisions. Trying to make the right home-buying decision is difficult when there is this pent-up demand because of the pandemic and because of the long recovery we went through because of what happened in 2006, 2007, 2008.

A normal progression would be people buying houses when they need more space, or less space, or don't have to be as close to work. Yet, those house-buying decisions are tough to fit into a really volatile market. As we come through this, hopefully, we will see this settle down.

How do you manage all of that and try to project for the future?

It’s not easy, but I've been through so many of these ups-and-downs. It’s easy to look at someone and talk to a potential buyer or potential seller about the long term: Yes, you can hold onto your house, and it might appreciate; but a house is an investment and a place to live. The same is true for a buyer: You buy now and pay a higher interest rate, or do you wait and hope the interest rates go down and the prices might go up? It really is an investment for the long term.

Is there anything else I should know about operating a real estate company?

Our job in real estate is about confidence. People buy when they feel confident real estate is a good investment.

This interview was conducted and edited for length and clarity by WBJ Staff Writer Kevin Koczwara.