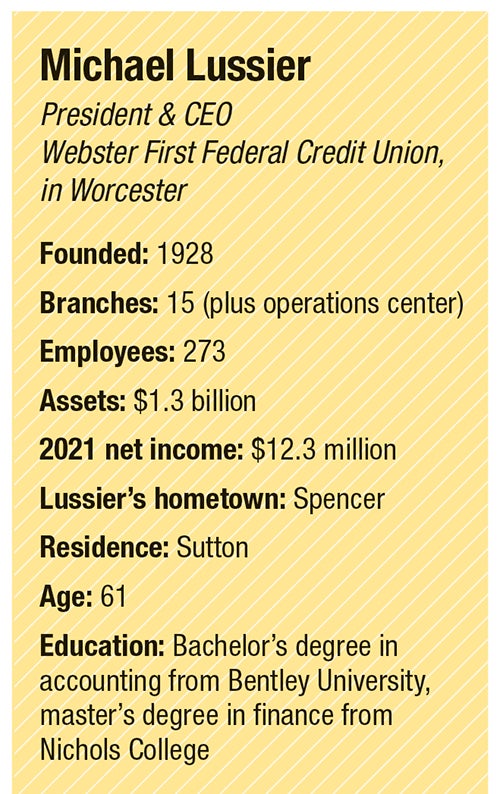

Michael Lussier has led Webster First Federal Credit Union as CEO since 1990, having first started there in 1987 as chief financial officer.

Get Instant Access to This Article

Subscribe to Worcester Business Journal and get immediate access to all of our subscriber-only content and much more.

- Critical Central Massachusetts business news updated daily.

- Immediate access to all subscriber-only content on our website.

- Bi-weekly print or digital editions of our award-winning publication.

- Special bonus issues like the WBJ Book of Lists.

- Exclusive ticket prize draws for our in-person events.

Click here to purchase a paywall bypass link for this article.

Michael Lussier has led Webster First Federal Credit Union as CEO since 1990, having first started there in 1987 as chief financial officer.

With interest rates rising and the economy flirting with a recession, how’s business at the credit union been?

Good. The economy is still doing ok in the banking world.

The rising interest rates are impacting home lending, and we are seeing the housing market starting to switch to a buyer’s market. The market for people refinancing their homes is slowing. However, there’s still a strong market, as people are buying homes.

Interest rates went up 0.75 of a point and more increases are expected to come. That impacts people with equity lines of credit and adjustable rate mortgages. It also impacts small businesses with certain kinds of loans.

How much in loans do you typically have out to small businesses?

Right now, we have $140 million in small business loans. Those range in size from $50,000 to $7 million. We don’t have loans out to any larger, major corporations. We handle a lot of mom-and-pop stores and other businesses like that.

So, how is Webster First performing overall?

Of all the credit unions in the nation with more than $1 billion in assets, we have the highest capital-to-asset ratio, which is in excess of 17%. Typically, a credit union is considered adequately capitalized if it has a 6% ratio and well capitalized at 7%.

How else do you try to set yourself apart from the competition?

We stand out through personal service and customer service. We also have a lawyer and an insurance agency in house, so we can close on loans a lot quicker than most institutions.

We don’t need to have loans approved by boards either, so we can get clients answers much faster.

We try to serve our members well and do it efficiently. Over the course of my time here, we’ve had 14 mergers with other financial institutions that were all well suited to us. It is a matter of having a nice steady way to grow, without losing sight of who you are.

This is your 35th year at Webster First. How has the industry changed over the years, especially recently?

The fintech industry is a lot more heavily involved now. People want speed and efficiency, and they aren’t necessarily interested anymore in sitting down and having a cup of coffee to talk about their financial needs and goals.

So much more of the industry is automated with technology now. We spend millions of dollars each year on fintech.

What’s the future going to hold for banking, credit unions, and Webster First?

Speed and efficiency are going to drive everything. What I find is the ability to have artificial intelligence generate that speed and efficiency is going to be the future.

Soon, banks will have a form on their website that can offer an instantaneous approval or decision on different types of loans. We’ll load the software with different metrics set by our boards and our vast knowledge of the industry, and then the AI will use that information to make decisions.

The industry is going to be even more competitive in the future.

What about the immediate future?

We’ve been in a low interest-rate environment for so long, and now we have to adjust to higher interest rates.

A lot of our business clients are in construction, and they still have plenty of business in the pipelines for the next several years.

Everything is remaining strong for our business clients.

This interview was conducted and edited for length and clarity by WBJ Editor Brad Kane.