If the recession’s impact on the housing market has a silver lining, it could be that homes have fallen in price, making them more affordable.

Or at least so goes conventional wisdom.

In fact, the relative strength of the Massachusetts real estate market may have shielded the Bay State from the volatility much of the country experienced in housing prices.

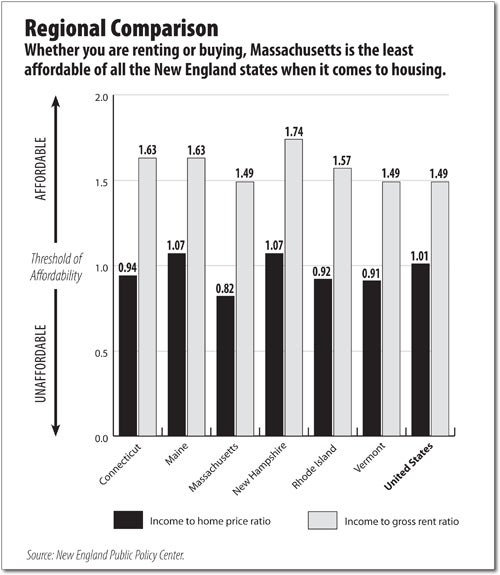

And because housing prices have not fallen as hard in Massachusetts compared to the rest of the country, the state has not been able to make gains in how affordable the homes are for residents, according to a new study from the New England Public Policy Center at the Federal Reserve Bank of Boston.

“With the decline of housing prices nationwide, we’ve seen affordability return to pre-recession levels,” said David Clifford, author of the report.

Unrealistic Ratios

Clifford measured affordability by comparing the median single-family home price with the median household income for a state.

In order for Massachusetts homes to truly become “affordable,” housing prices would have to fall by another 18 percent, Clifford said.

Tim Warren, president of the Boston-based real estate tracking company The Warren Group, said Massachusetts and New England will likely always be expensive places to live. Strong education institutions, high-paying jobs and high utility costs all contribute to the high cost of living here.

Despite the costs, according to Warren Group data, home prices have fallen dramatically during the past three years.

In 2007 the median single-family home sold for $345,000.

A year later the median home sold for $305,000 and through the first five months of 2010 the median home price has declined again to $285,000.

While prices have fallen, they are still much higher than the national average. According to the NEPPC study, in 2008 the nationwide median single-family home in the country sold for $211,000.

The lack of affordable housing in Massachusetts is a “big issue,” according to David Wlucka, a former president of the Massachusetts Association of Realtors.

Even with state incentives, such as the Chapter 40B affordable housing law, there is still a major lack of affordable housing in Massachusetts, Wlucka said.

“We need more affordable housing, but that’s just not easy to do,” he said.

But Central Massachusetts may be an outlier. The NEPPC study showed that the Worcester metropolitan area was the only region in the state that had median home prices below the median household income of first-time homebuyers.

Agent’s Perspective

Not everyone is convinced that the Massachusetts real estate economy is so peachy, however.

Jane Fine, president of Fine Properties Inc. in Shrewsbury, said much of the recent real estate market gains have likely been fueled by the first-time homebuyers’ tax credit, which recently expired.

The Warren Group reported that single-family home sales increased 27 percent in March, 46 percent in April and 37 percent in May, all compared to the year earlier.

But Fine said since the tax credit expired on May 1, business has slowed considerably.

“On May 1 everyone’s phones went dead,” she said.

She said the root cause of the depressed housing market is a lack of jobs.

“To get the housing market back, we need to fix the fundamental economic issues,” she said. “People need job security before they’re going to make a big investment like a house.”