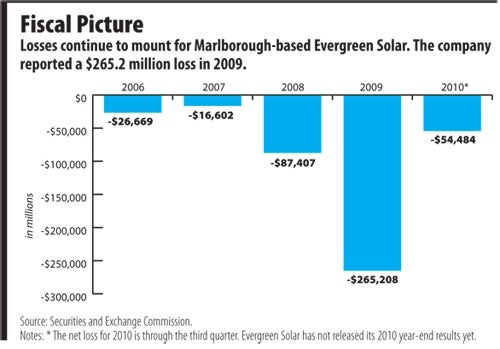

Evergreen Closes Plant, Plans Debt Restructuring

With the New Year, officials at Marlborough-based Evergreen Solar hope to have a dramatically new financial makeup.

The company is seeking shareholder approval to restructure almost $300 million worth of outstanding debt in an effort to lower the company’s borrowing costs. It also plans to take out $40 million worth of new debt.

In addition, management announced plans to close its new Devens plant, cutting 800 workers, a move that is expected to generate more than $350 million in short-term costs.

Evergreen’s rapid restructuring of debt and facilities is clearly about survival for the startup. But analysts and financial experts say their moves come with serious risk.

Instead of a traditional loan, Evergreen has most of its liabilities in convertible debt, a specialized form of borrowing that allows businesses to leverage their public stock to garner lower borrowing costs.

The problem is that Evergreen’s stock has plummeted in recent months and has recently been booted off of the major Nasdaq trading exchange because it was trading below $1 per share.

That left Evergreen executives in a precarious position, according to analysts who follow the company. Officials had to figure out a way of improving the company’s stock price while reducing the company’s debt burden. All this has to be done while Evergreen is dueling with other solar panel manufacturers in the United States and China that are making more competitively-priced products.

Now, other businesses may be able to learn some lessons from Evergreen’s issues, particularly about the pros and cons of using alternative forms of financing.

Convertible debt, which represents most of Evergreen’s outstanding liabilities, is a debt instrument that gives investors making the loan the option of collecting the borrowed money in the form of either money or the company’s stock, explains Kenneth Sanginario, a co-founder of NorthStar Management Partners, a business advisory firm with offices in Westborough and Natick.

For investors that make the loan, convertible debt is a way to get upside potential: Instead of just getting cash back for the money they lend, investors can instead get company stock worth the same amount. If the stock grows, the investor wins by getting a greater return. The investor is also protected because if the stock drops, then they have the option to get the borrowed money back in cash plus interest.

There’s an incentive for the business to use convertible debt as well. Because debt issuers have more of an upside when using convertible debt, interest expenses on convertible debt are typically lower than traditional forms of borrowing.

But using convertible debt can have its downsides, explains Mike Refolo, a partner at the Worcester-based law firm of Mirick O’Connell. For one, if the company’s loan is repaid in the form of stock, it can dilute the power of existing shareholders in the company.

Furthermore, Refolo said it’s important for businesses to set the price at which the debt can be converted into stock. If the price is too low, investors can take advantage of a low stock conversion price, then flip the stock at a higher price through short selling. This too dilutes the company’s stock and usually leads to the stock falling in price, or what is known as a “death spiral.”

Because Evergreen has more than $300 million in convertible debt outstanding, company officials are looking to convert some of its debt into longer-maturing debt with lower interest rates. Despite the potential downsides of using convertible debt, Evergreen is looking to raise up to $40 million in new convertible debt.

Shareholders of Evergreen stock will have an opportunity to vote at the end of the month to approve the recapitalization plan.

But even if Evergreen has a plan for restructuring its debt, it’s not clear the company will be able to do exactly what it wants, according to Christine Hersey, who follows Evergreen as an analyst at Wedbush Securities in Los Angeles.

“Investors are aware the company has a fair amount of debt right now … What is not clear is whether this conversion to longer-maturity debt will actually go through smoothly,” she said.

Company officials referred comments about the recapitalization plan to filings it has made with the federal government.

Evergreen has not been alone in issuing a large amount of convertible debt, according to Hersey. Before the stock market crashed, convertible debt seemed like a good way to raise capital.

But Evergreen has some issues outside the recession, its stock price and debt levels. The company built its strategy around using less silicon to produce solar panels, according to Eric Wesoff, an analyst with Green Tech Media in San Francisco. This was an advantage when the cost of silicon was high a few years ago, but the price has dropped more than 80 percent within the last few years.

So, the company has been forced to find other ways to cut costs, which is why Evergreen is ramping up production at its Wuhan, China facility and closing its Devens plant.

0 Comments