A group of legislators and policy advocates put together by Senate leadership to explore ways to modernize the state’s tax code is looking into the possibility of taxing digital goods and services like music downloads or Pandora.

The conversation is still in its early stages, but the group also appears to be leaning toward a set of recommendations that would be close to revenue-neutral, eyeing ways to offset changes like an expansion of the sales tax base with lower overall rates.

“I don’t think we at this table are going to come to some consensus to raise taxes overall,” said Sen. William Brownsberger, a Belmont Democrat and member of the working group.

Brownsberger said he thought the “safest space” for the group would be to produce a package of recommendations that didn’t significantly alter how much the state takes in from taxes.

“That’s a nice place to be for this group,” he said.

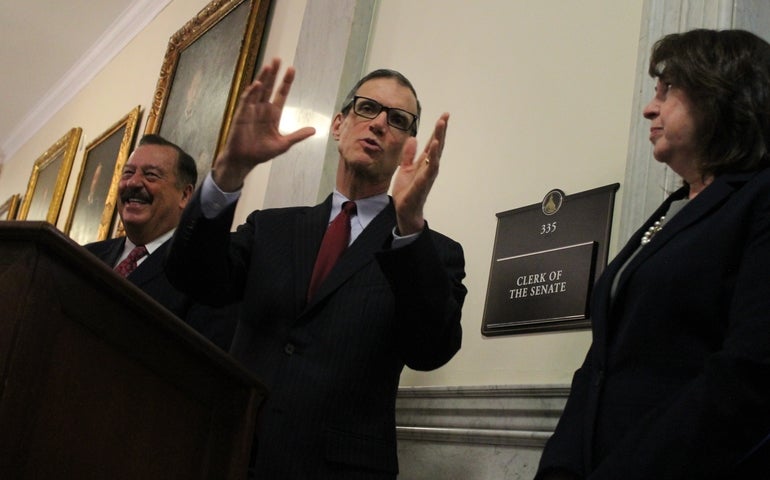

The Senate Revenue Working Group, which is being led by Sen. Adam Hinds of Pittsfield, met in public Tuesday where the chairs of its four subcommittees presented to the larger group on the topics and questions they were working through. The group’s goal is to produce a package of recommendations before the end of the legislative session in the summer of 2020 to modernize the state’s tax code.

Hinds said it’s not necessarily the goal of the group to produce a set of recommendations that are revenue-neutral, but acknowledged that “fairness” has been the focus of the group, which is also “aware that this is happening within the context of a Fair Share amendment.”

That amendment is a proposed ballot question that has been advanced by the Legislature and would go before voters in 2022 to raise close to $2 billion a year by imposing a 4 percent surtax on income over $1 million.

“I think it’s still an open conversation,” Hinds said. “The emphasis has always been, and we have a mission statement that talks about modernizing, simplifying, make more fair, and in that process we believe we will collect more revenue. How much, I think, is the question.”

The taxation of services has been a controversial policy issue in Massachusetts for decades. Gov Michael Dukakis tried to do it in the early 1990s, only to see his successor Gov. William Weld successfully repeal it.

More recently, the Legislature tried to tax software services as part of the last big revenue package to address transportation needs, but wound up rolling that back as well in the face of opposition from a major employment sector.

Former Revenue Commissioner Amy Pitter and David Sullivan, a one-time top lawyer to Gov. Deval Patrick and Senate President Stanley Rosenberg, are leading a subcommittee looking at the sales tax.

Northeastern University Professor Peter Enrich suggested that a broadening of the sales tax base could be coupled with a lowering of the overall rate.

Massachusetts Taxpayers Foundation President Eileen McAnneny said her group, which is looking at the income tax, had spent considerable time discussing the possibility of increasing the $4,400 personal income tax exemption as a way to create a more progressive income tax.

House leaders are trying to put together a package of revenue raising reforms for a vote before the end of November that would be dedicated to transportation infrastructure and public transit improvements.