Despite falling prices and increasing competition, marijuana business officials across the state, and particularly in Central Massachusetts, still see the cannabis market as primed for opportunity, with operators having to be smarter about the way they operate their marijuana businesses.

Get Instant Access to This Article

Subscribe to Worcester Business Journal and get immediate access to all of our subscriber-only content and much more.

- Critical Central Massachusetts business news updated daily.

- Immediate access to all subscriber-only content on our website.

- Bi-weekly print or digital editions of our award-winning publication.

- Special bonus issues like the WBJ Book of Lists.

- Exclusive ticket prize draws for our in-person events.

Click here to purchase a paywall bypass link for this article.

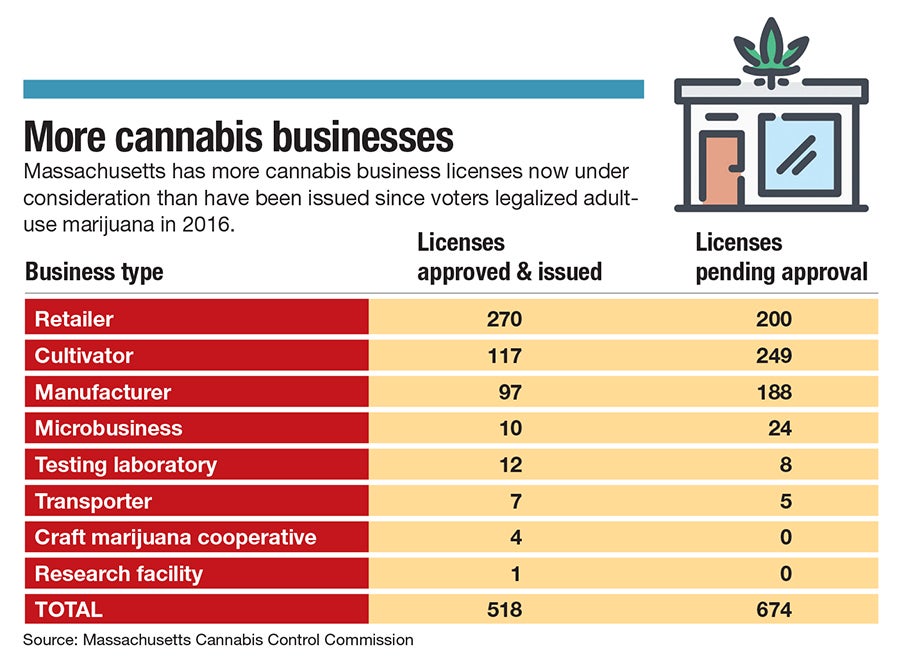

More than four years have passed since the first legal cannabis dispensaries opened in Massachusetts, and in the 52 months since the first dispensaries opened, 270 have opened their doors with another 200 in various stages of the licensing process. A new dispensary here. Another grow facility there. Now Rhode Island, Connecticut, New York, and New Jersey have legalized pot. Everyone is getting in on the act. No one wants to be left behind. Competition is rising.

The first pot shop in the state closed in Northampton in December while prices have hit a historic lows.

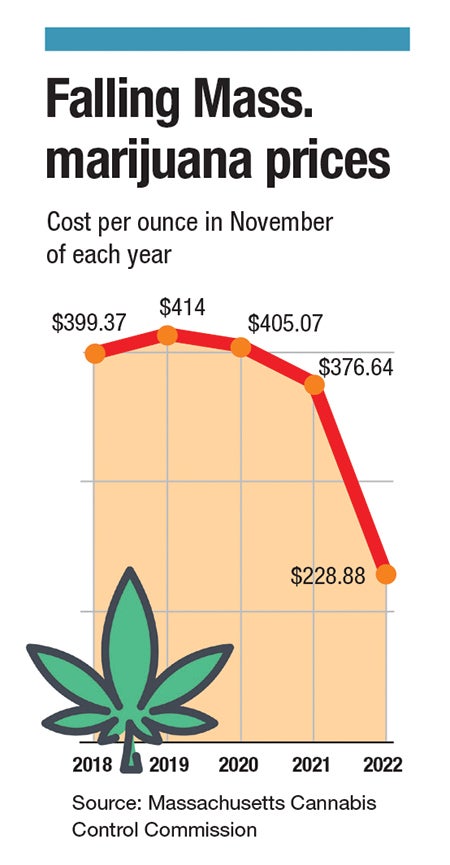

Since the first dispensaries opened in November 2018, total adult-use sales are nearing $4 billion across the Massachusetts. Prices in November reached $228.88 per ounce, their lowest point since April 2020, when the economic fallout from the initial stages of the COVID pandemic hit prices everywhere. November’s price was a 39% decrease over the previous year.

At the same time, more plants are being harvested than ever across the state, peaking at 2.7 million in November. The state is awash in cannabis with 117 cultivators in the state and another 249 in the licensing pipeline.

Despite these falling prices and increasing competition, marijuana business officials across the state, and particularly in Central Massachusetts, still see the cannabis market as primed for opportunity, with operators having to be smarter about the way they operate their marijuana businesses.

“More product and more dispensaries means more options,” said Ulysses Youngblood, president of Worcester dispensary Major Bloom. “The market is correcting itself.”

Youngblood isn’t worried about the price drop.

Major Bloom is designed to cater to people in a lower-income neighborhood, and he has built his business to be cost-effective.

Still new to people

The market is mainly correcting itself now because there’s a glut of product and not enough stores to sell it, said David O’Brien, president and CEO of the trade group Massachusetts Cannabis Business Association. He still sees the possibility of growth.

“People are still making money,” O’Brien said. “But they’re tightening belts.”

The cinching is happening from investors, said O’Brien. The capital markets have slowed for fear of an economic slowdown with publications like Bloomberg and Business Insider reporting a recession is looming, which means investors are holding onto their money for fear they may not get back the returns they envision.

“Capital markets, all types, are tight all over [the place],” O’Brien said.

For local cannabis operators, the slowdown in price isn’t too big of a fear at first because as people have more options and there are more grow facilities, the excess product was going to eventually drive the price down.

For Marc Rosenfeld, one of the co-owners of CommCan, Inc., which has a facility in Medway and dispensaries in Millis and Southborough, the worry comes from multi-state operations coming into Massachusetts with cash and investments. The multi-state groups have product, money, and teams built on pushing themselves into the crowded marketplace. They can bully smaller businesses and drive down the price of products without worrying about covering the numerous overhead costs it takes to open a facility or dispensary.

“They’re not here to run a business,” Rosenfeld said about multi-state cannabis operations. “They just want market share.”

For Rosenfeld, it’s important, especially with something like marijuana, for people to trust the product they’re buying, including knowing how and where it was grown.

“It’s important for people to understand what they’re buying. Legal cannabis is still new to people,” Rosenfield said.

Overly regulated

While legal pot may seem new, the business of buying it isn’t. The illegal marijuana market bubbled under the surface.

Robin Goldstein is an economist and author of “Can Legal Weed Win? The Blunt Realities of Cannabis Economics” and sees the drop in price point and the closure of a store in Northampton not so much as an issue with viability of the marijuana business in Massachusetts, but due to regulations and costs hampering it.

Goldstein, who grew up in Northampton and is the director of the Cannabis Economics Group in the Department of Agricultural and Resource Economics at the University of California, Davis, said because legal marijuana has to look like an Apple Store due to all of the safety precautions and regulations, the market is too tight and can’t reach everyone it needs to, which is why people still buy from the black market.

Take The Source in Northampton, for example, which was the first dispensary in the state to close when it did so on Dec. 16. It opened within blocks of six other dispensaries, meaning the stores were competing for the same clientele. As Goldstein sees it, there aren’t too many marijuana shops; there’s just too many hoops to jump through, and communities cluster stores together.

Worcester, too has this same issue, Goldstein said. Four of the city’s 13 dispensaries are in the Canal District. Near Beaver Brook and Curtis Pond, three stores are in close proximity while other parts of the city, like Tatnuck, don’t have any.