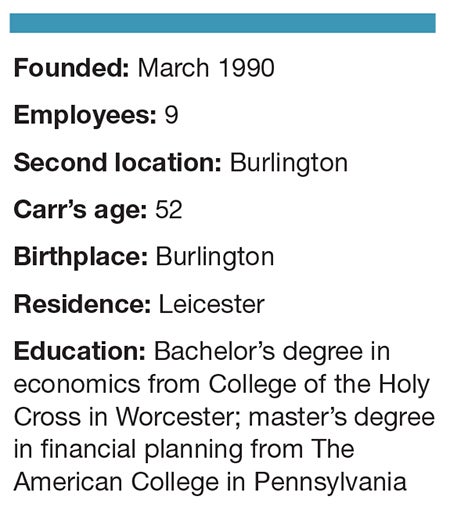

For the past 30 years, Richard Carr has helped his clients, many of whom are business owners, prepare for and weather financial storms. As the coronavirus pandemic upends the economy, Carr and his team at Carr Financial Group Corp. in Worcester are figuring out what the future will look like.

Get Instant Access to This Article

Subscribe to Worcester Business Journal and get immediate access to all of our subscriber-only content and much more.

- Critical Central Massachusetts business news updated daily.

- Immediate access to all subscriber-only content on our website.

- Bi-weekly print or digital editions of our award-winning publication.

- Special bonus issues like the WBJ Book of Lists.

- Exclusive ticket prize draws for our in-person events.

Click here to purchase a paywall bypass link for this article.

For the past 30 years, Richard Carr has helped his clients, many of whom are business owners, prepare for and weather financial storms. As the coronavirus pandemic upends the economy, Carr and his team at Carr Financial Group Corp. in Worcester are figuring out what the future will look like.

Why did you start your own firm?

Out of college, I actually started at a firm representing itself as independent and doing right by the clients, but then I realized it was only selling proprietary products. So, right when cold calling was a brutal way to start a business, I decided to open up my own firm.

What was it like at the beginning?

The first seven years was just building my client base and trying to do right by them. After seven years, I was able to hire my first employee.

We’ve grown from those early days to really handling sophisticated situations for clients: income tax issues, investment management issues, estate planning, such as making sure your legacy is what you hope and making sure you don’t leave behind circumstances causing conflicts in your family or business.

Really, what we do is help people with planning for the future, and that involves a lot more discussion than just money. The money is really the easy part, because money is just math. It is all those little issues life throws at you that changes those plans.

Like a global pandemic?

In my lifetime, I didn’t think I would ever live through something like 9/11, and then a few years later we almost had another Great Depression. Now here we are with the next situation. We are there to help guide our clients to change plans to each of these unique situations.

How can clients adjust to coronavirus?

We’ve helped our clients set up working remotely. We’ve helped them understand the federal stimulus law. We are trying to figure out what the economy will look like once we emerge through all of this, which is difficult because we don’t know how long it will last.

The good news is we as a country always get through it.

How is Carr handling the crisis?

I am very confident we will get through this, and we can help clients figure out the best place to move forward.

Thankfully, this happened in 2020 and not when we started in 1990. We could literally pick up all our operations and move to a completely different part of the world, and we have the technology and systems in place to make it seem to our clients like we are talking to them from our main office at 20 Park Ave.

You sound very confident.

I have a button on my desk from my sister saying, “I’ve survived damn near everything.” I’ve survived cancer twice and had an aortic valve problem in my heart, so I understand what dire circumstances truly are.

With the pandemic, we are in another one of these circumstances we all have to plan for and get through.

You’ve almost died three times?

First, I had a tumor in my abdomen, which grew and came very close to killing me. Then, I had testicular cancer, which was caught early on and was very treatable. Then I had an aortic valve replaced. I ended up going with a mechanical valve, rather than a pig valve.

Because of all I’ve gone through, I am deeply immersed in fundraising for cancer. This is my 16th year doing the Pan-Mass Challenge bike-a-thon to raise money for cancer research. I am a rider and a volunteer. This is my second year as chairman of UMass Cancer Walk & Run in Worcester. It will be held in September. We raised $780,000 last year, which was a record. This year’s goal is a huge leap, $1 million.

What is the future of Carr Financial?

We have expanded our service to be what is known as a family office. We help affluent families with all aspects of their lives, not just financial and tax matters.

I believe this is the future of the industry, as we all move away from fee-based services.

This interview was conducted and edited for length and clarity by WBJ Editor Brad Kane.