Soaring Cotton Costs Pinch Retailers | Price jumps will likely be passed onto consumers

What do a drought in China, restrictions on Indian exports and flooding in Pakistan all have in common?

Those global events have all contributed to an historic spike in cotton prices that have made it more expensive for some retailers do business here in Central Massachusetts, a reality that will affect consumers at the cash register.

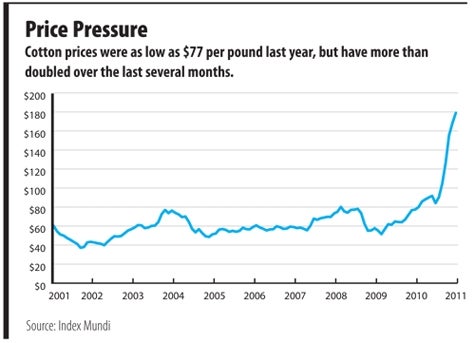

Cotton prices are at all-time highs, hitting $2.19 per pound this month. That is nearly triple the price per pound from the same period last year, when cotton was trading at 77 cents.

With cotton mills in Massachusetts mostly a thing of the past, locally impacted businesses enter into the picture further down the supply chain. From jeans to T-shirts to bedding, retailers say they have no choice but to increase some of their prices.

Professional Outfitters

Trippi’s Uniforms in Shrewsbury has been selling uniforms for nurses, police officers, chefs and postal workers for the past 90 years. They don’t make the uniforms, but buy them in bulk from a manufacturer.

The fourth-generation family members who now run the store are used to fluctuations in prices, usually from 20 to 40 cents, said co-owner Linda Trippi.

But Trippi described the recent increases as “crazy.” She said that wholesale prices the store pays have gone up by several dollars per unit.

“It’s across the board,” Trippi said. “Everything that has cotton has been going up.”

Though the Trippi family had heard that price increases were coming, it was not until they received vendor price sheets in January that they realized how steep the increases would be.

Trippi said the store will have no choice but to pass increased costs on to customers, but just how much to raise uniform prices is a delicate balancing act.

“We don’t want to raise prices so much that people aren’t going to be able to buy them,” she said. “We don’t want to put people off.”

At WOW Dancewear on Stafford Street in Worcester, owner Barbara Prokopovich said that like Trippi, she has had to raise prices. But she ran into what she views as an even bigger problem: shortages in supply.

The California-based company that supplies ballet sweaters that are popular among dancers in the winter and spring ran out of them for nearly a month recently, she said.

Prokopovich said she is worried that a similar shortage could happen in the back-to-school shopping season in late August, the busiest time of all for dance retailers.

For now, Prokopovich is paying several dollars more per item at wholesale and has been forced to mark up prices in her store.

“If all of a sudden I have sweaters that are going to cost $30, who is going to buy them?” she asked. “You have to use your head and say, ‘Do I want some profit, or no profit?’ ”

For certain items, such as leotards, some of her vendors have started offering products heavier on microfibers, but in general, cotton is a tough material to get away from in the dancewear industry, she said.

Medical Use

At Fairlawn Rehabilitation Hospital in Worcester, which has 110 beds that have to be outfitted with linens, Controller John Flaherty said that cotton is far down on his list of concerns when it comes to rising prices. These days, food and energy prices are what he is keeping an eye on.

Flaherty said that the hospital has a contract through which it rents the linens from a company that picks them up, washes them and drops them off.

He said there has not been any indication from the vendor that the contract price could increase in the future, but said it is not out of the question.

“It really hasn’t hit my radar yet,” Flaherty said.

But for the businesses who are being impacted, there are not many choices, said Jack Healy, director of operations at the Worcester-based Massachusetts Manufacturing Extension Partnership.

When a core ingredient becomes much more expensive, a business can raise prices, make a slimmer profit margin or, in the case of Prokopovich’s leotard vendor, find an alternate material.

“If they can make that switch, they’re going to do that,” Healy said.

There is usually some warning when commodity prices are going to rise and this time is no different, Healy said.

But it is larger manufacturers who can take advantage of that information by locking in prices through futures contracts. Small businesses are essentially stuck, Healy said.

“Invariably, at some point in time, they will really have no choice but to pass the price on,” he said.

0 Comments