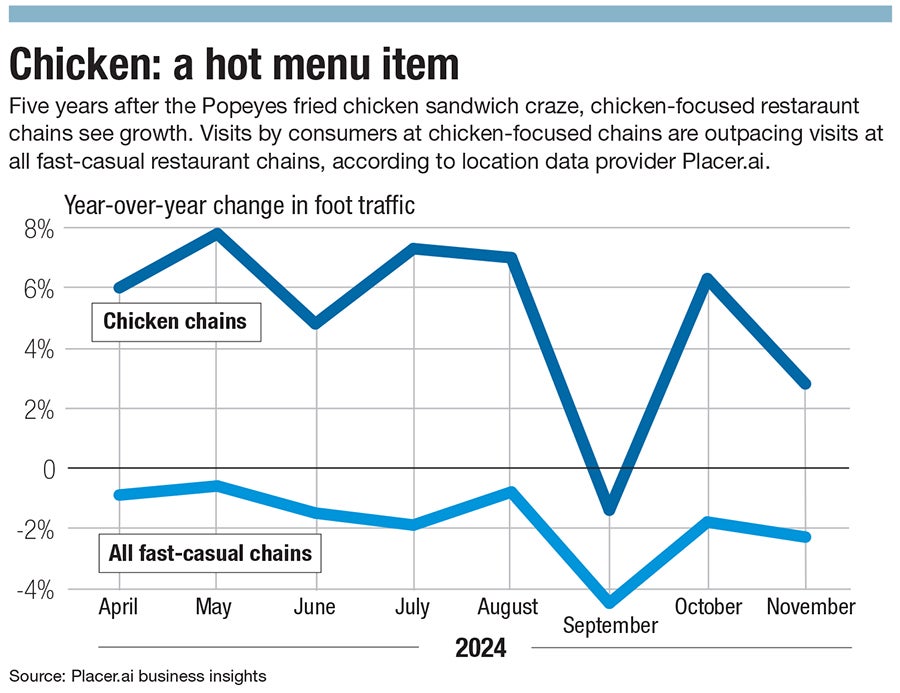

The fried-chicken trend first became a topic of popular discussion in 2019, the year Miami-based Popeyes Louisiana Kitchen debuted its fried chicken sandwich. Since then, the interest in fried chicken has only grown, bringing along a flood of chicken-focused fast-casual restaurants.

Get Instant Access to This Article

Subscribe to Worcester Business Journal and get immediate access to all of our subscriber-only content and much more.

- Critical Central Massachusetts business news updated daily.

- Immediate access to all subscriber-only content on our website.

- Bi-weekly print or digital editions of our award-winning publication.

- Special bonus issues like the WBJ Book of Lists.

- Exclusive ticket prize draws for our in-person events.

Click here to purchase a paywall bypass link for this article.

You don’t have to be a restaurant trend expert to have noticed the rapid increase in fried chicken-focused restaurants in Worcester and elsewhere in Central Massachusetts.

The explosion of establishments focused on fried chicken is hardly a phenomenon limited to the region, as 2,800 fast-food and fast-casual restaurants focused on chicken opened between 2019 and 2024, while 1,200 burger-focused restaurants closed their doors during the same time period, according to a May article from The Atlantic, citing restaurant industry analysis firm Circana.

The fried-chicken trend first became a topic of popular discussion in 2019, the year Miami-based Popeyes Louisiana Kitchen debuted its fried chicken sandwich. While fast-food giants add and subtract items to their menus all the time with little fanfare, Popeyes’ sandwich unexpectedly exploded in popularity. The chain sold more than 203 million in the first year it offered them, according to a Popeyes press release at the time.

Popeyes’ sandwich success coincided with the rapid growth of Georgia-based Chick-fil-A, which added about 1,000 stores between 2010 and 2020, including its first in Massachusetts.

Chick-fil-a grew its sales per unit by 62% between 2018 and 2023, according to stats from Chicago-based Aaron Allen & Associates, a global restaurant strategy firm.

Neither brand had a standalone Central Massachusetts location in 2010. Flash forward to 2025, Popeyes has locations in Worcester and Leominster, while Chick-fil-A has restaurants in Worcester, Framingham, Hudson, Marlborough, and Westborough and is planning a second Worcester restaurant.

But the fried chicken craze hasn’t just been limited to long-tenured fast-food brands, as establishments big and small have sought to cash in on the phenomenon.

Newer chains like Dave’s Hot Chicken (Framingham and Worcester) and Korea-based bb.q Chicken (Shrewsbury) have opened locations in Central Massachusetts, while independent restaurateurs like the owners of Worcester-based NU Kitchen are also looking to earn their share of the fried chicken market with NU Chicken, an eatery planning to open on Worcester’s Park Avenue in late July.

“It's the main focus,” said Joshua Van Dyke, co-owner of NU Kitchen. “We’re really excited to get open and get some feedback. This would be a fun one to scale and grow as well, but we’ll start with Worcester as the home base and the first NU Chicken location, and we'll see if there's more in the future.”

Both Dave’s and NU Chicken have cited Worcester’s large college-age demographic as a key factor in the market’s appeal.

The fried chicken renaissance largely comes down to both high consumer interest and relative ease of production, with fried chicken recipes originating in Tennessee and South Korea playing a key role in keeping the momentum going.

“The trend also fits squarely within fast casual’s sweet spot: indulgent enough to feel like a treat, affordable enough for repeat visits,” Aaron Allen, founder and CEO of Aaron Allen & Associates, wrote in an email to WBJ.

Trendy chicken

More people are turning to chicken in general as a dinner staple; Americans consumed 102.6 pounds of chicken per capita in 2024, up 21% from 2004 and gaining ground on red meat, which had a per-capita consumption of 110.4 pounds in 2024, according to stats from the U.S. Department of Agriculture.

With younger generations in particular, consumers have no problem having chicken as a main course almost every night of the week, said Al Graziano, the franchisee behind Dave’s Hot Chicken locations in Framingham and Worcester.

“I have some college students in Worcester who order from us five times a week,” Graziano said.

The frequency of visits from customers makes chicken–focused franchises like Dave’s stand out, said Graziano, who is a former franchisee with Jersey Mike’s Subs.

“We look at frequency in terms of food categories,” he said. “Chicken is one, particularly among young adults from 18 to 25, where customers have no problem eating it two, three, or even four times a week. Whereas other categories, the frequency might not be as high.”

Fried chicken’s broad appeal and restaurants’ ability to customize it with a variety of seasonings and sauces make it a hit with customers, said Allen.

“Fried chicken’s appeal cuts across demographics – kids to Millennials, urban to suburban, carnivore to flexitarian,” Allen wrote.

From a business perspective, fried chicken works well for profit margins because its simple core ingredients allow for operational efficiency, with modern, easy-to-run fryers allowing for high throughput.

“Operators love it because the margins are juicy, the supply chains are mature, and the prep can be scaled from food trucks, to fast casual, to fine dining,” Allen wrote.

Nashville, Seoul

Fried chicken recipes from near and far are finding new audiences in today’s increasingly global culinary scene. In June, Seoul, South Korea-founded franchise bb.q Chicken opened its first Central Massachusetts location in Shrewsbury, one of 3,500 stores across 57 countries.

This followed the April 2024 opening of the first Cluck & Crispy Chicken location in Worcester, a brand which has since opened a location in Fitchburg in a quest to become a national player in the fried chicken space.

Korean-style fried chicken uses a starch-based batter and is generally thinner and crisper than its American counterpart, according to food-focused website Chowhound.

Another new style of fried chicken now part of the national culinary scene is Nashville hot chicken, which is smothered in a spicy oil-based sauce.

The dish traces its roots back to the 1930s, according to a 2023 article from CNBC, but has become a national phenomenon, with mentions of Nashville hot chicken on menus increasing 65.7% between 2020 and 2025, according to food service research and consulting firm Technomic.

The Dave’s Hot Chicken franchise in particular has seen meteoric growth since being founded as a small pop-up in a Los Angeles parking lot in 2017. The brand was acquired by Atlanta-based Roark Capital Group in June for a value of $1 billion. Dave’s has attracted investors including rapper Drake, actor Samuel L. Jackson, and former First Lady of California Maria Shriver, according to the Los Angeles Times.

“I was approached by Dave's, and obviously with the chicken craze of recent years, I was super interested,” Graziano said. “I went to look at it in LA and fell in love with it right away, and realized New England didn't really have anything new and refreshing in that category.”

After opening the first Dave’s location on the East Coast in Newton, Graziano opened a Dave’s in Framingham in July 2023 and the Worcester location in August 2024.

With Worcester, he saw potential in the city’s demographics.

“I saw a similarity, and even better density, out in Worcester compared to Boston,” he said. “It's also a blue-collar town with hard-working people. I think those types of that demographic really do well with quick-service-style restaurants.”

Another entry in the Nashville hot chicken category of the impromptu Worcester chicken restaurant competition will soon be NU Chicken, a sister restaurant of health-focused NU Kitchen, which has a location on Chandler Street in Worcester, as well as spots in Somerville and Newburyport.

Health(ier) fried chicken

While fried chicken isn’t exactly a healthy food, NU Chicken is hoping to serve up Nashville hot chicken without a side of regret, said NU Kitchen co-founder Aaron Smith, who founded the concept alongside Van Dyke. The new restaurant plans on frying chicken in avocado oil, after perfecting the recipe at their Newburyport location.

“We would always go and get fried chicken, but we wouldn’t always feel great about it after,” Smith said. “So we wanted to create something that wasn’t necessarily healthy, but healthier, using real ingredients.”

The growth of big chicken chains like Popeyes and Chick-fil-A, rapidly-growing firms like Dave’s and bb.q Chicken, as well as mom-and-pop competitors like Cluck & Crispy Chicken and NU Chicken, has longtime fast-food stallworths like McDonald’s and KFC in a bit of a pickle, with brands from all sides pecking away at their chicken market share.

In 2019, months before the Popeyes sandwich debuted, an independent group of McDonald’s franchisees penned a letter to the company’s corporate office, demanding a better fried chicken sandwich recipe to compete with Chick-fil-A.

“Chick-fil-A’s results demonstrate the power of chicken,” the group wrote, according to CNBC, comparing their call for a better sandwich to President John F. Kennedy’s pledge to land on the Moon. McDonald’s launched its response, the McCrispy sandwich, in 2021.

KFC, once the main fried chicken fast-food option, saw its market share fall to competitors in 2024, according to Restaurant Dive. In June, the company responded with a new ad campaign featuring an angrier-looking version of Colonel Sanders on its packaging to acknowledge customers’ recent displeasure, alongside the phrase, “He ain’t smiling until you are.”

Time will tell if a scowling colonel will bring back customers to KFC. It will also tell if NU Chicken can succeed at 318 Park Ave., a location previously occupied by another chicken-focused spot, B.T.'s Fried Chicken and BBQ, before it closed in February.

Despite B.T’s closure, NU Chicken’s owners are confident the restaurant’s straightforward chicken-focused menu will make it a success with both customers and as a business.

“It’s the simplicity of the menu that sold us on the whole thing,” Smith said.

Eric Casey is the managing editor at Worcester Business Journal, who primarily covers the manufacturing and real estate industries.