AbbVie Embraces Its Biotech Identity

From Plantation Street in Worcester, the only indication that anything is different at AbbVie, which officially changed its moniker in January from Abbott Laboratories, is a few letters on its building sign.

But more is afoot inside the 440,000-square-foot facility, located in Worcester's biotech park, said Jim Sullivan, vice president of pharmaceutical discovery for the newly formed company.

Whereas Chicago-based Abbott is a broader sort of health care company, offering pharmaceutical, diagnostic, nutritional and vascular products — AbbVie, which Abbott spun off six months ago, is a pure biotechnology firm.

“It truly is a new type of company,” Sullivan said in a telephone interview from Chicago. “As a biopharmaceutical company, AbbVie combines the many strengths of a company like Abbott, a broad-based health care company with the agility, focus, nimbleness and spirit of a biotech company.”

Worcester’s Role

AbbVie is a global company, with annual revenue of more than $18 billion out of the gate and research and manufacturing facilities spanning from Italy to Germany to Puerto Rico.

The company has 700 employees in Worcester, where scientists work on some of the 20-plus drugs AbbVie has enrolled in clinical trials with the U.S. Food and Drug Administration, as well as on research into new molecules that might one day become the company's next blockbuster drug.

“They are also trying to find the next wave in discovery,” Sullivan said. “We believe there's still going to be (a) huge, significant unmet need in immunology and various disease stages.”

While research is happening at multiple sites around the world, Worcester has played a uniquely important role in making AbbVie what it is today, Sullivan said.

“That site has a long and successful history in the area of biologics,” Sullivan said.

Abbott bought the Worcester facility from BASF in 2000, when the latter was developing a promising rheumatoid arthritis drug, Humira.

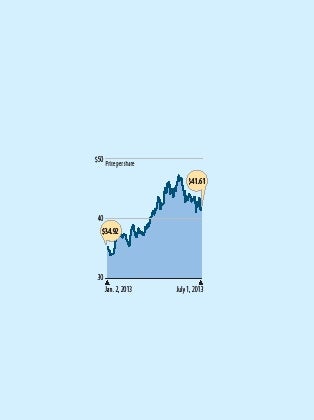

The decision worked out nicely for AbbVie, which has turned Humira into the world's best-selling drug. Its sales totaled $9.3 billion in 2012 and are projected to grow to $10.6 billion this year. The drug hit the market in 2003 and since then has brought Abbott, and now AbbVie, more than $41 billion, according to filings with the U.S. Securities and Exchange Commission.

The Next Humira?

Humira has been a golden goose for AbbVie, but analysts and others are watching the company closely to try to understand how the company might reinvent itself after the drug's patent expires in 2016.

Expiring patents, which allow for the introduction of generic versions of drugs into the market, have taken a dent out of some of AbbVie's drug sales in recent quarters. Sales of its cholesterol drug TriCor, which expired in November, fell from $1.4 billion to $1.1 billion between 2011 and 2012, which AbbVie attributed to competing generics.

But any dips AbbVie has experienced in sales of the more than a dozen drugs it has on the market have been easily overcome by increases in Humira sales, which have climbed an average of 26 percent annually over the past five years.

After AbbVie announced its first-quarter earnings in late April, BMO Capital Markets analyst Alex Arfaei wrote that he expects Humira gains to continue to offset weakening of AbbVie's other drug franchises for the foreseeable future.

“We continue to believe that Humira simply is too well entrenched and the emerging competitors do not have meaningful advantages,” Arfaei wrote. “Thus, Humira should continue to grow with the market as biologics gain deeper penetration in autoimmune (disease) markets driven by more aggressive treatment strategies.”

Busy Year For Clinical Trials

In the meantime, he added, AbbVie's pipeline is advancing well, with a number of clinical trial data presentations scheduled throughout 2013, including one for a treatment regimen for Hepatitis C and a multiple sclerosis drug the company is developing with Biogen Idec, both of which are in Phase III trials.

With Humira's patent expiring in three years, AbbVie has more than 20 drugs in development. The closest to market is a Parkinson's disease treatment called Duodopa, which allows patients to discontinue oral drugs and avoid brain surgery. An FDA decision on the treatment is expected later this year.

“That's our success long term,” Sullivan said. “It's really critical we advance and deliver the pipeline. It's one of our core strategic success factors.”

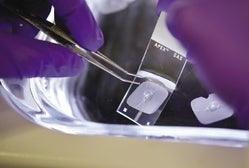

Sullivan said the Worcester scientists are working on, among other projects, early clinical tests for a new molecule the company has developed called DVD-IG, which combines the function and specificity of two or more monoclonal antibodies into one molecular entity that demonstrates drug-like properties.

Abbott first published information on the development in 2007, and AbbVie hopes it will lead to the development of drugs to target multiple disease-causing molecules.

Read more

Worcester Site Part Of Abbott Split

Enrollment Opens For WPI Biomanufacturing Training

0 Comments