When the first recreational cannabis dispensaries in Massachusetts opened in November 2018, their parking lots assumed a festive air as people lined up, sometimes for hours, to get the newly legal product. Nearly five years later, legal cannabis has become an unremarkable part of the state economy.

Get Instant Access to This Article

Subscribe to Worcester Business Journal and get immediate access to all of our subscriber-only content and much more.

- Critical Central Massachusetts business news updated daily.

- Immediate access to all subscriber-only content on our website.

- Bi-weekly print or digital editions of our award-winning publication.

- Special bonus issues like the WBJ Book of Lists.

- Exclusive ticket prize draws for our in-person events.

Click here to purchase a paywall bypass link for this article.

When the first recreational cannabis dispensaries in Massachusetts opened in November 2018, their parking lots assumed a festive air as people lined up, sometimes for hours, to get the newly legal product. Nearly five years later, legal cannabis has become an unremarkable part of the state economy.

It has far surpassed cranberries as the state’s top crop, and it reached nearly $1.5 billion in sales in 2022. Today, cannabis businesses and the state and local leaders who regulate them are figuring out what normal is going to look like for an industry still unlike any other.

Among the newest players in Central Massachusetts is Cannabis of Worcester, a dispensary opened on Millbrook Street in mid-April. The independently-owned operation took shape after one major multistate cannabis operator, Trulieve Cannabis, bought rival Harvest Health & Recreation. Because Truelieve already owned three Massachusetts dispensaries, the maximum allowed by the state, Harvest’s plan to open the Worcester location fell through.

The change in plans echoes a shift toward smaller operators been happening across the industry, said Steve Bowman, chief operating officer at Cannabis of Worcester. When legalization began, the most significant suppliers in the market were large companies that didn’t just grow the crop but also packaged and sold it.

“Vertically-integrated companies, back in the day, were just making profit hand over fist because they were the only game in town,” Bowman said. “Two to three years ago, independent retailers would struggle to get product, to be honest with you. It was in the interest of multistate operators and other vertically-integrated companies to just sell to each other.”

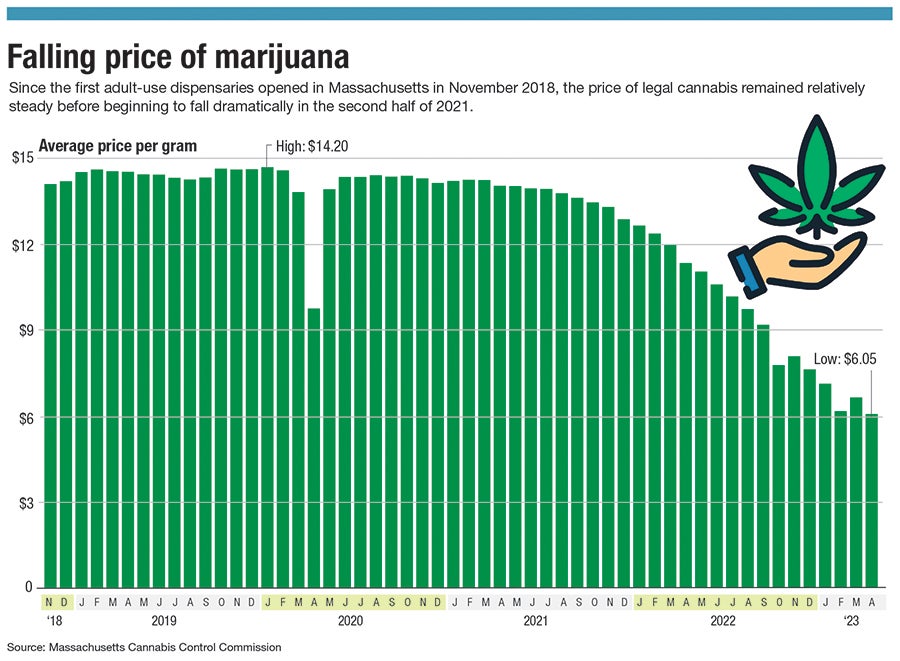

But, over the past couple of years, the number of growers, and the amount of supply on the market, has risen dramatically. This is clear in price information collected by the state’s Cannabis Control Commission. The average cost of a gram of cannabis flower hovered fairly consistently between $14 and $15 from 2018 until May 2021. After that, it began falling dramatically, hitting $11.03 in May 2022 and then plummeting to $6.05 in April 2023. The low prices present a challenge to growers, but Bowman said they’re a boon to companies like his.

“Now the tables have kind of turned, so that we’re sitting here and we have people from all over the state that want to talk to us to get their product on our shelves,” he said.

The burden on smaller players

Still, cannabis is not an easy industry for small operators to enter. That’s an issue that’s very much on the mind of CCC Chair Shannon O’Brien.

“Because it’s so heavily regulated, it’s incredibly expensive to get into the game,” O’Brien said.

One of the CCC’s central missions is promoting equity. The commission offers special support for entrepreneurs and communities disproportionately impacted by the War on Drugs, as well as enterprises owned by people of color, women, and veterans. O’Brien said even these efforts can face headwinds due to heavy regulation. For example, the commission offers an exclusive option for equity applicants to start cannabis delivery services, but it hasn’t been the success she had hoped.

“The significant regulatory burden that we place on this license class has made it almost impossible to become profitable,” she said.

One issue is a rule saying there must be two company agents in a delivery vehicle at all times, something O’Brien said the state may reconsider. There are also similar issues across other parts of the industry, such as a requirement of businesses keep surveillance videos for 90 days, often leading to significant fees for cloud storage.

CCC is looking to the example of the state’s Alcoholic Beverages Control Commission, which tries to work cooperatively with the companies it regulates, O’Brien said. For example, when the agency held a series of in-person meetings with licensees to answer questions, rather than just focusing on punishing rule-breakers, violations were cut in half.

“Massachusetts is one of the friendlier cannabis economies in the country, both in terms of the regulators being more proactive than in other places and listening more deeply,” said Max Simon, CEO and co-founder of Green Flower, a California-based company providing training for cannabis professionals.

Green Flower partners with Worcester Polytechnic Institute to offer programs for entrepreneurs and workers in the cannabis industry, as well as professionals like accountants and attorneys who work with cannabis companies. One of the company's big focuses is helping people navigate complicated legal and financial rules.

Waiting on federal changes

While streamlining at the state level could help with those issues, complexities arise from the fact that cannabis remains illegal under federal law. Federal prohibition makes banking exceptionally complex and expensive for cannabis companies. It prevents interstate sales of cannabis products.

“I don't know when the day will ever come that we could order a truck of products from Colorado,” Bowman said. “It could happen, we just don’t know how long.”

Simon is optimistic the federal government will eventually deschedule cannabis, removing it from the Controlled Substances Act. More immediately, Congress is considering measures to provide cannabis businesses with better access to loans and other financial services.

“I do think we’re getting to a place where the cannabis issue at the federal level is not something that can be ignored any longer,” Simon said.

Cannabis cafes

Meanwhile, back at the state level, CCC is considering how to roll out social consumption sites, such as cannabis cafes under a law passed last year. O’Brien said she has questions about making sure that it’s done in a way that protects public safety. For example, she said there is no tool like a breathalyzer to estimate a person’s level of impairment if they get behind the wheel after indulging.

“We don’t have those standards,” she said. “We don’t have the science.”

One of O’Brien’s priorities is facilitating scientific research on cannabis, including questions regarding short-term impairment, longer-term health concerns related to cannabis use, and medical benefits of the plant. She’s looking at how to bring together the state’s universities, hospital systems, and biotech industry to work on these issues.

Despite all the unknowns, though, in some ways cannabis really is becoming just another industry. As it gets off the ground, Cannabis of Worcester is using techniques familiar to a local cafe or microbrewery: hanging work by local artists, hosting block parties and craft fairs, and connecting with the wider Worcester community on social media. Compared with the stigma still attached to cannabis just a few years back, Bowman said, increasingly broad swaths of the public seem comfortable connecting with a friendly neighborhood dispensary.

“In all honesty, I feel like there’s been something of a shift,” he said. “The perception’s changed a lot.”