The licensing option is a track intended to make it easier for small businesses with less capital to start making sales and earn back their startup costs, but so far licensing has been plagued with the same types of challenges and delay-induced financing issues as much larger license endeavors.

Get Instant Access to This Article

Subscribe to Worcester Business Journal and get immediate access to all of our subscriber-only content and much more.

- Critical Central Massachusetts business news updated daily.

- Immediate access to all subscriber-only content on our website.

- Bi-weekly print or digital editions of our award-winning publication.

- Special bonus issues like the WBJ Book of Lists.

- Exclusive ticket prize draws for our in-person events.

Click here to purchase a paywall bypass link for this article.

Nestled away on the wooded Route 16 in Uxbridge, just before an onramp to Route 146 South, tucked away from sight, is a small pocket of three small cannabis companies, easy to miss on a winding road peppered with churches, automotive companies and at least one animal hospital.

Uxbridge has become known for its friendly relationship with cannabis firms, which brings in revenue for the largely blue-collar, old-mill town in the Blackstone Valley. But despite the frequent headlines, the businesses are understated, providing a quiet bubble where entrepreneurs quietly chip away at their heavily regulated businesses.

The latest cannabis company in the Uxbridge enclave to get off the ground is Yamna, which received the go-ahead to commence operations in late June. Run by two friends, Kevin MacConnell and Tim Phillips, the latter of which counts Uxbridge as his hometown, the pair are helping to shape a tiny subsector of the cannabis industry: the microbusiness.

Officially, the microbusiness license is for a co-located tier 1 marijuana cultivation and/or manufacturing operation, whose owners are limited to purchasing 2,000 pounds of cannabis a year and are capped at 5,000 square feet of grow space. Microbusinesses are only allowed to wholesale their products to other retailers, unless they receive delivery approval, which is limited to economic empowerment businesses and social equity program participants. Yamna, whose official licensed name is Blackstone Valley Naturals, is neither.

The small business license carries a residency requirement – licensees have to live in Mass. for at least a full calendar year before they are allowed to apply.

Although designed to help small cannabis businesses get off the ground in an industry dominated by large, cash-flush corporations, the road to commencing operations was slow for the new microbusiness. The licensing option is a track intended to make it easier for small businesses with less capital to start making sales and earn back their startup costs, but so far the wait time between applying and opening their doors has been plagued with the same types of challenges and delay-induced financing issues as much larger license endeavors.

“At the time, [the microbusiness license] seemed like it was a great idea because it was just one application that was for two licenes, and it seemed to fit everything great for us,” said MacConnell, seated with Phillips at their Uxbridge facility in early July.

Microbusiness licenses fees are discounted 50%, according to the Cannabis Control Commission, with MacConnell estimating the classification saving the pair about $5,000 a year. They are given license application review priority, after operating medical firms and economic empowerment applicants, which come first under state law.

For MacConnell and Phillips, who met while working in the Colorado industry before relocating to Massachusetts, their business model is akin to a craft brewery. Like a craft beer company, they plan to coexist with the big players, providing consumers with a specialty alternative to mainstream cannabis options. And as is typically the case with their craft beer counterparts, their products will be available at a premium.

Aside from flower, which will be sold in jarred eighths, Yamna’s main focus is its signature cannagar – a cannabis cigar. Its cigars are different than the standard pre-rolled joints available at dispensaries around the state because each one includes two grams of ground flower – no shake or trim – with a hollow central chamber for optimal burning and a 24-karat gold paper wrapped around the end, intended to be a unique final touch.

But their product is about more than simply heightened aesthetics.

“What we’ve seen with going tighter and making that air hole is we’re doubling, if not tripling, the burn rate of a normal pre-roll,” Phillips said.

The Yamna cannagars are intended to be an upscale alternative to standard pre-rolls, which is why they retail for about $50, compared to about $15 for the typical pre-rolled joint.

“As you know, different costs money, different gets expensive,” Phillips said.

“We don’t want to be antagonistic,” he continued. “We just want people to know that there is a different tier.”

He likened the concept to different types of liquor sold for different prices.

A long wait

The Yamna business model is simple enough at face value. And as only the second fully operational cannabis microbusiness in Massachusetts, there’s not much competition to speak of.

So little, in fact, Yamna has actually collaborated with the other microbusiness – Gibby’s Garden. This collaboration was likely helped by the fact Gibby’s Garden operates next door, in the same building. Right down the road is Caroline’s Cannabis, which was the state’s first small business marijuana retailer.

Yamna and Gibby’s even went through the licensing process at virtually the same time, with Gibby’s maintaining about a five month lead.

“We got to connect with them and watch what the steps were like,” MacConnell said. “But also though, it was also stressful to see that they were ahead of us and yet they also still had no idea why it was taking so long for them.”

The lengthy wait times involved in getting a cannabis business off the ground have become a point of contention in the state’s young industry, particularly for small businesses and those falling under the disadvantaged business umbrella, including those owned by minorities, women, members of the LGBTQ+ community, veterans and people with disabilities. The oft-repeated refrain from critics is it’s unsustainable to pay for and maintain business property while waiting to get through the application approval process. Applicants often have to eat their rent for months or years before they are allowed to start even attempting to bring in revenue.

The problem is exacerbated by traditional bank loans remaining virtually impossible to secure while cannabis remains illegal on the federal level, and is even further complicated by venture capital firms and large multi-state corporations who are known to offer funding in exchange for large stakes in would-be small businesses.

As the clock ticks on, entrepreneurs find they have few palatable options.

This was the case for Yamna, which took two years to be given final approval, as well as Gibby’s.

For Gibby’s, run by Kimberly and Fred Gibson, the formal application process from start to finish lasted 13 months, culminating in their final approval to commence operations on June 30, 2019. That timeline doesn’t include the process of developing a community host agreement with the town and securing real estate, both of which must be done beforehand.

The process required a lot of patience and the Gibsons said they relied on family and friends feeling confident enough to continually invest in the promise of a startup in what is generally quite a lucrative field. Both the Gibsons and MacConnell and Phillips funded their businesses through family and friends.

“If you’re not familiar with running a cannabis business, you have to do a lot of figuring it out yourself,” Gibson said.

She described a phone call with a lawyer during the application process who said he could guarantee obtaining their license if they agreed to pay him $100,000.

“We never heard from him again, but that’s what some of the bigger licensees can do,” Gibson said. “They can pay somebody a salary like that to do this work, or they can buy a third-party consultant.”

A thorough process

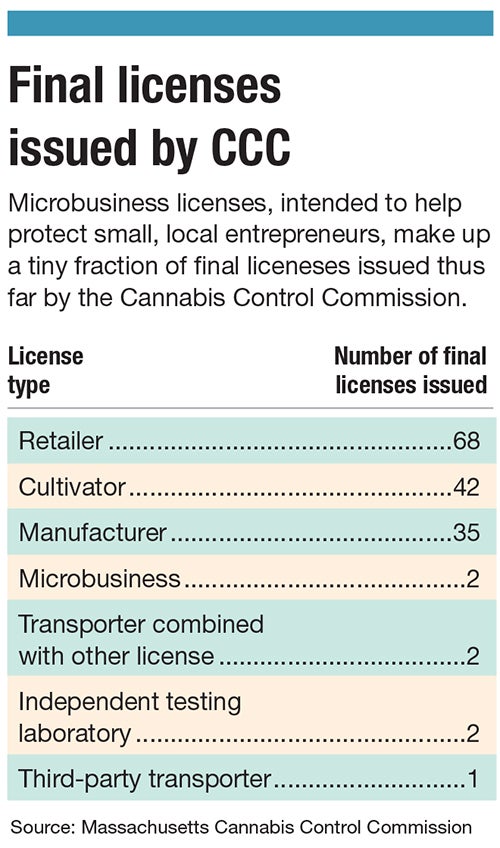

The Massachusetts cannabis microbusiness license was conceived as a licensing model to promote small, local business by requiring less capital, further incentivized by lower fees, said CCC Chairman Steven Hoffman.

“We have nothing against the bigger players, but we want to make sure there’s space for these smaller entrepreneurs to participate in this industry and the microbusiness license category is an attempt to do so,” Hoffman said.

Aside from Yamna and Gibby’s, Hoffman said, six microbusinesses have provisional applications and five more are under review. While it’s difficult to ascertain precisely why the microbusiness application pool remains significantly smaller than the hundreds of applications vying for the more traditional license options, Hoffman pointed to two challenges applicants often have: navigating the host agreement process required to take place between companies and towns before submitting applications, and obtaining capital and financing.

But once an application is actually submitted, a lot of work has to happen behind the scenes, too.

Once a licensing application is submitted to the CCC, Hofman said, four things happen. First, an intake review verifies the application is complete. If any information is missing, CCC will request the applicant to supply any necessary materials. Then, once the application is deemed complete, the CCC has 90 days to take action. During those 90 days, the CCC performs background checks on applicants, which are done through a third-party and typically take two to three weeks.

Thirdly, the commission verifies host agreements with the towns to make sure local regulations have been met. Hoffman said towns have 60 days to respond. If they do not respond, the CCC assumes there are no issues. The fourth and final step is when the commission dives into the actual application, wherein the objective is to review the business plan and assure it is structured in such a way the business will be able to meet regulatory requirements.

Only after all of those steps is an application submitted to the full commission for review for a provisional license. Once a provisional license is issued, he said, the timeline falls back to the applicant, who he said must notify the CCC when they are ready for the final inspection.

“We have adopted a deliberately moderate pace in terms of rolling out this industry, specifically to allow all the smaller players to catch up and not have the market completely developed and mature before they had a chance to catch up in terms of the licensing process,” Hoffman said.

Hindsight is 2020

In reflecting on their experiences starting their microbusinesses, the teams behind Yamna and Gibby’s were of slightly different minds.

The Yamna team was divided on whether or not they would apply for a microbusiness license if they had an opportunity to re-do the process. MacConnell said he would have strongly considered simply applying for a traditional tier one cultivation license and manufacturing license, since they didn’t ultimately save any time during the application process.

Phillips was slightly more optimistic, noting the opportunities for microbusinesses appear to be expanding, particularly under new regulations to allow businesses like theirs to eventually deliver their products directly to consumers.

“There might be some cool things coming to the microbusiness platform that can be super valuable to the community as well as us, so it’s kind of a lottery still,” Phillips said.

The Gibsons, in turn, did not hesitate to say they would choose the same licensing option again. Although it was hard work – Fred Gibson lamented sleepless Sunday nights stressing about funding – giving up was never an option.

“It was not even a consideration,” he said.

In that vein, their advice to others looking to break into the state’s microbusiness model is to be as prepared as possible.

“Really crunch the numbers, have an incredible team behind you and don’t ever give up,” he said. “Just keep plugging – there will be good days and there will be bad days. Just keep the faith.”

“Understand that it’s a marathon,” Kimberly Gibson added.

Once your business is up and running, she said, the revenue is real. And quick.