A new report gives a rare picture into downtown Worcester’s office market.

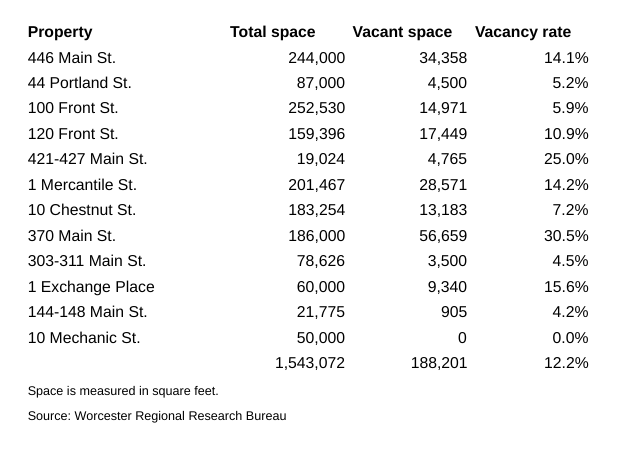

A dozen major office buildings with more than 1.5 million square feet of space between them have a vacancy rate of 12%, according to a study released Thursday by the Worcester Regional Research Bureau.

That puts the market behind Greater Boston’s, which averaged 10.2% vacancy in the fourth quarter of 2019, but ahead of much of MetroWest, as reported in December by the Boston real estate firm Perry.

The rate in Boston proper is 6.9%, and it’s 2.9% in Cambridge, with Kendall Square having just 0.7% of its space empty in one of the most in-demand technology office markets. Framingham and Natick combine for a 10.2% vacancy rate, according to Perry, while the Boroughs — Marlborough, Northborough, Southborough and Westborough — had 15.8% of their office space empty.

Downtown Worcester lease prices are more in line with the Boroughs and other areas along the I-495 belt, while not remotely approaching prices that landlords are able to receive in Boston or Cambridge or closer-by neighborhoods.

The 12 office buildings analyzed by the Worcester Regional Research Bureau had per-square-foot rates ranging from $20 to $27.50. The I-495 belt as a whole averaged $22.55, according to Perry, with the Boroughs averaging $19.06. For Framingham and Natick, the average was $32.09, while rates in Kendall Square were a stratospheric $111.46.

The Research Bureau highlighted that stark price difference and called it an opportunity for Worcester.

As the real estate market soars in Boston, small and medium-sized businesses are looking outside of the central Boston market for office spaces to accommodate their growth, the report said.

“Measuring the availability and attractiveness of office spaces in Worcester’s [central business district] will highlight what Worcester has to offer businesses looking to relocate or take their first steps, and where developers may want to focus their investments in efforts to continue bringing in new businesses. Worcester’s [central business district] has the opportunity to attract maturing companies in an evolving economy,” the WRRB report said.

The last time the Research Bureau analyzed the downtown office market, in 2011, it looked at a far broader array of buildings, not just 12 of the largest, making comparisons difficult. For that report, Class A office space, the most highly sought, had a vacancy rate of 16%. Per-square-foot lease costs then for Class A space was $11.

Among those excluded from the latest report was an empty 300,000-square-foot building on Chestnut Street that last included Unum among its tenants. The building is larger than any sampled in the report but is not actively being marketed for use. Worcester’s Krock family bought the building in 2018 for $1.9 million.

The highest lease rates in Worcester are being found at Worcester Plaza, the glass tower at 446 Main St. sold in October for $16.5 million. The price on the 24-story tower was well below its assessed value of $25.1 million, and roughly $59 per square foot.

The tower was bought by Synergy Investments, a Boston commercial real estate firm, which says it plans renovations to the building. The tower’s vacancy rate was 14.1%.

Downtown’s largest office building by square footage, 100 Front St., had a vacancy rate of 5.9%.