Endowments In The New Economy | Schools' choice: Weather financial storms or find shelter

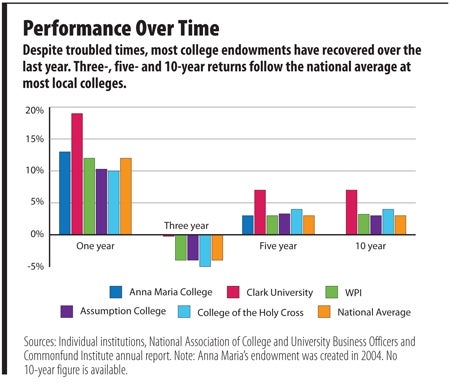

Like anyone else who spends a lot of time thinking about investments, the people who manage the endowments of Central Massachusetts colleges and universities have had a bumpy few years. For the most part, endowments saw their values plunge in the financial crash of late 2008 and then climb up again, sometimes quite rapidly.

Along the way, managers faced questions about whether, and how, to change what they were invested in, and the questions still persist today. While some money managers argue that the economy has reached a “new normal” in which it’s impossible to bank on double-digit stock market returns, others point to the major gains of the past two years and say moving to more conservative strategies could be a huge mistake.

Different Strokes

Anna Maria College in Worcester took a cautious approach early on. President Jack Calareso credits the college’s board of trustees with a decision to move most of the endowment into fixed-income accounts just as the recession was beginning to be felt.

“We really didn’t have the impact that a lot of schools did when the bottom fell out of the market,” he said.

Calareso said Anna Maria is in a somewhat different situation than many schools simply because it has a much smaller endowment. It’s grown over the last few years despite the downturn, but still stands at less than $5 million. The board was worried that the recession could essentially wipe out the college’s investments, Calareso said.

Today, he said, Anna Maria remains less aggressive than it might have been five years ago.

“The people that I talk to are not sure we’re out of the woods yet,” he said.

On the other side of the risk spectrum, and at a much higher total dollar amount, Worcester Polytechnic Institute’s endowment has emerged from the financial crash bruised but healing rapidly.

“We went through a soul-searching process like everybody did back when things were imploding in ’08,” said Jeffrey S. Solomon, WPI’s executive vice president and CFO. “We said, you know what, it’s painful, but we’re taking a long-term approach. We did not make any changes, which turned out to be the absolute right approach.”

Solomon said the college’s endowment peaked at $405 million around the middle of 2007, fell as low as $280 million after the crash and is now back to around $306 million.

The College of the Holy Cross also kept its course steady through the market storms.

“When you have perpetuity as your time horizon, it does provide you with a luxury that other people managing other pools of capital don’t have,” said Timothy Jarry, chief investment officer at Holy Cross.

Christian McCarthy, treasurer at Assumption College, said that institution also took the long view for the most part, making few changes as the markets jumped up and down. But he said the college did put more money in fixed-income accounts in the wake of the crash, in part because managers felt demand might drive the prices of those sorts of investments up.

“When people are panic stricken, you tend to have flight to high-quality fixed income,” he said.

Inflation Worries

Clark University is also essentially staying put, according to James Collins, vice president for administration and finance.

Collins said that, in view of some economists’ concerns about inflation, the conventional wisdom about what constitutes a risky investment may be reversed. If inflation were to skyrocket, bonds could be a bad place to have much money, making the typical institutional strategy of investing more in equities and real assets a better bet.

“We do feel that in such an environment that owning assets is probably better than owning financial assets,” Collins said.

If colleges and universities aren’t necessarily changing the way they invest their money, most seem to be at least considering changing how they spend it. In the past, it’s been fairly standard practice for schools to spend a bit under 5 percent of their endowment each year, which meant a portfolio would need to earn around an 8 percent annual return to cover fees and keep up with inflation. Now, financial managers say they’re wondering if that’s sustainable.

Solomon said WPI’s spending rate had stood a little over 5 percent, but it’s now being brought down to five and could potentially be reduced even further as the university continues to look at how markets perform over time.

Solomon said cutting that spending can be painful, but WPI is in a good position because its revenue sources are diverse. Between graduate tuition, research revenues and corporate and professional programs, as well as fundraising, he said the university can avoid putting too much pressure either on the endowment or undergraduate tuition rates.

In general, the local colleges are far less dependent on their investment returns for operating revenue than endowment giants like Harvard and Yale. WPI gets about 14 percent of its budget from its endowment, and at Assumption the figure is just 2 percent. Anna Maria takes that to the extreme. Instead of pulling money out each year, it actually puts a percentage of its annual operating budget into the endowment.

“To draw down money from such a tiny endowment isn’t going to change life on campus,” said Calareso.

Meanwhile, he said Anna Maria, like all the other colleges out there, will keep looking at its investment practices and hoping it bets right.

“If it was easy to figure this out we’d all be doing the same thing,” he said.

0 Comments