Marlborough Officials: Have Space, Need Tenants | How will the city recover in wake of firms' departures?

When Michael Hogan looks at the southwest corner of Marl-borough, he does not see approximately 1.5 million square feet of soon-to-be vacant commercial property space.

Instead, the former mayor sees opportunity.

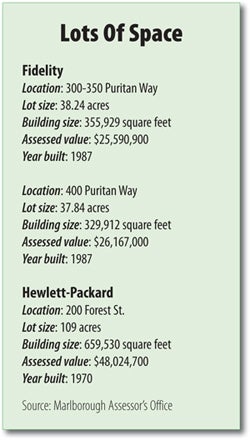

Another piece of the fallout from Boston-based Fidelity Investments’ recently announced decision to close its Marlborough campus is what will become of the more than 650,000 square feet of office space the company will be vacating by the end of next year.

The two-building complex sits directly adjacent to an even larger already-vacant commercial property site that formerly housed Hewlett Packard manufacturing facilities.

Combined, these two parcels represent one of the largest potential future development sites along the Interstate 495 corridor.

Which is why people like Hogan, who serves on the board of directors of the Marlborough Economic Development Corp. and is chairman of its commercial real estate committee, say now is a “once-in-a-generation” chance to dramatically reshape the area that used to be an economic focal point of the city.

The question is how to make that dream a reality.

Potential Plans

It’s unrealistic, Hogan said, to expect a single business would come in and occupy the entirety of the combined sites.

“I think the days of having a large single user on a campus like that are gone,” he said. “The companies we grow today are smaller, more dynamic, the workforce is highly mobile and highly educated. They’re looking for amenities.”

Those amenities include having moderately priced housing nearby and commercial retail centers, such as a fitness facility, a day-care center or supermarket — things that portion of Marlborough currently lacks.

The two sites offer the potential to do a development that incorporates such amenities, he said, or so-called smart-growth mixed-use developments.

Hogan said he’d love to see local officials pass legislation that would create tax breaks for companies that are willing to develop or invest in the area, particularly for companies involved in next-generation technologies, like clean tech or biotechnology.

While the sites may be empty soon, Hogan said they do have some positive qualities.

They are located directly off of Interstate 495, with easy access on and off the highway.

Plus, utility infrastructure is already installed on both sites, meaning they can handle large water and sewer capacities.

“There aren’t too many sites up and down 495 that have those qualities,” he said.

Marlborough officials aren’t the only ones bullish on the properties.

CB Richard Ellis, a Boston-based commercial real estate firm, has been hired by HP to market the former HP site, at 200 Forest St.

The former HP campus is made up of six buildings, four of which are less than 5,000 square feet. The largest of the buildings is 657,000 square feet, according to records from the Marlborough assessor’s office.

The HP buildings were built in the 1970s and are in “difficult condition” and would likely require major renovation or demolition work to rehabilitate, according to Marlborough Assessor Anthony Trodella

The Fidelity site, he said, has had more recent improvements and could likely be used as a multi- or single-tenant use property.

Bigger Is Better

Christopher Tosti , an executive vice president for CB Richard Ellis, said officials shouldn’t rule out the potential of large-scale tenants using the sites. When a company with hundreds of employees has a requirement for a property, there aren’t that many options for them to pursue.

While it’s obviously not great news to see two major vacant properties in such close proximity, Tosti expressed optimism that something will eventually happen with them.

“These buildings will be filled again,” he said.

While there is potential for the sites, Arthur Bergeron, chairman of the Marlborough Economic Development Corp., said it’s impossible to predict when reuse plans for the sites would be finalized.

In the meantime, Bergeron said there may be ways the city could work to offer short- or mid-term tax breaks for owners who carry the properties while determining a long-term reuse plan.

That, he said, would prevent a developer from coming in and being rushed into using the site for a short-term gain without taking into account long-term planning considerations.

What Bergeron doesn’t want to see, he said, is hurrying to do something that may not be the best long-term interest of both properties.

While officials in the community can talk as much as they want about what they would like to see at the sites, the reality is that the buildings’ owners, Fidelity and HP, will ultimately have the final call in determining what happens.

Bergeron said it is therefore up to local officials to take the initiative to work with both owners to encourage possible dual-redevelopment opportunities involving both properties.

A Fidelity spokesperson said the company is in the process of selecting a commercial real estate firm to help the company market the lease or sale of the complex.

Meanwhile, Bergeron said the city’s local economic development committee, the MEDC, has hired an economic development planning and consulting group, FXM Associates in Mattapoisett, to create a master plan for the community.

Hogan said MEDC officials have made it clear that one of the top priorities for FXM is defining reuse options for the sites.

“It’s really time to think outside the box,” Bergeron said.

0 Comments