Greater Worcester's housing starts hit a post-recession peak in 2019, as the industry looks to fight off the next slowdown

PHOTO/EDD COTE

Alex Richov, a foreman for Casa Builders, and Barbara Venincasa, a Realtor with Casa Realty Service, at Wyman Farms, a 26-unit townhome complex being built in Shrewsbury

PHOTO/EDD COTE

Alex Richov, a foreman for Casa Builders, and Barbara Venincasa, a Realtor with Casa Realty Service, at Wyman Farms, a 26-unit townhome complex being built in Shrewsbury

It’s a challenge not unique to the Worcester area: not nearly enough houses are being built to accommodate demand and keep prices from rising out of the range of affordability.

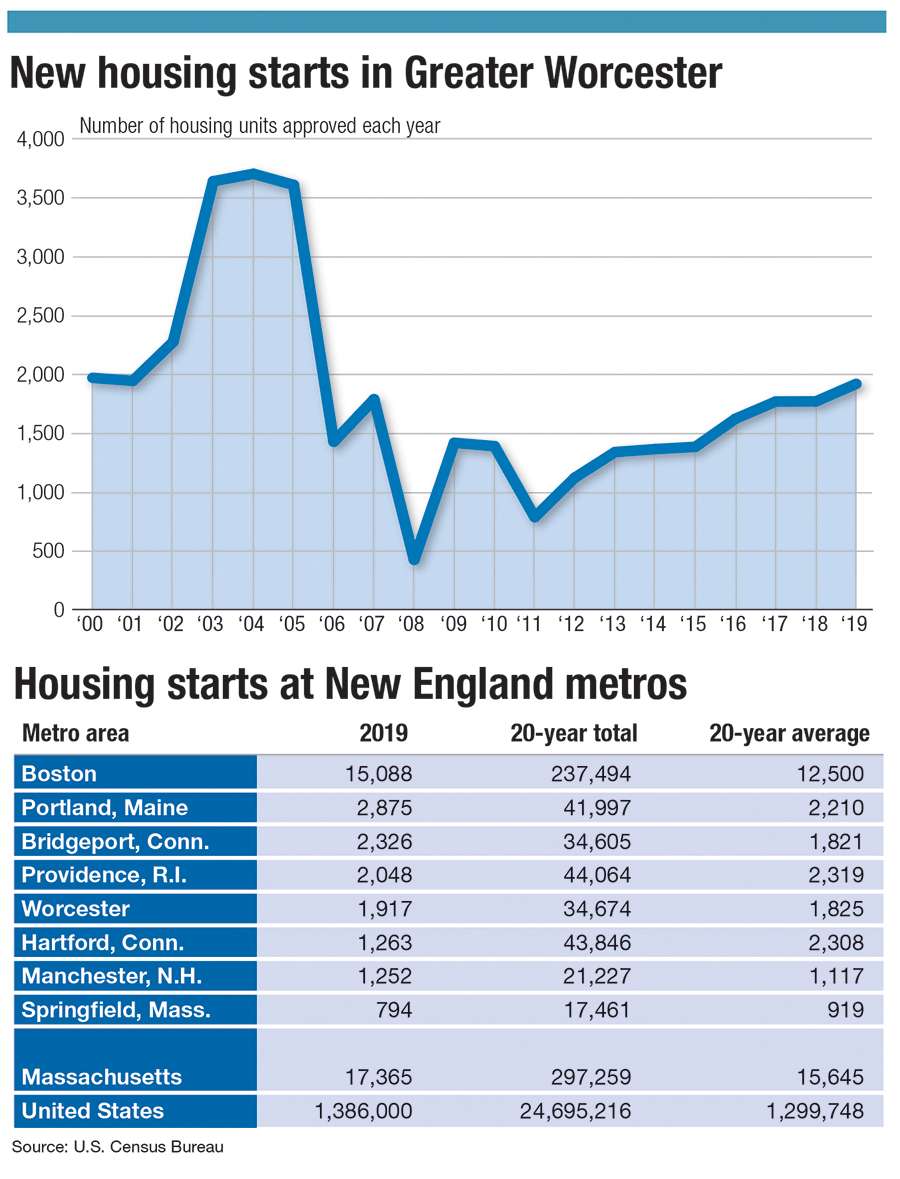

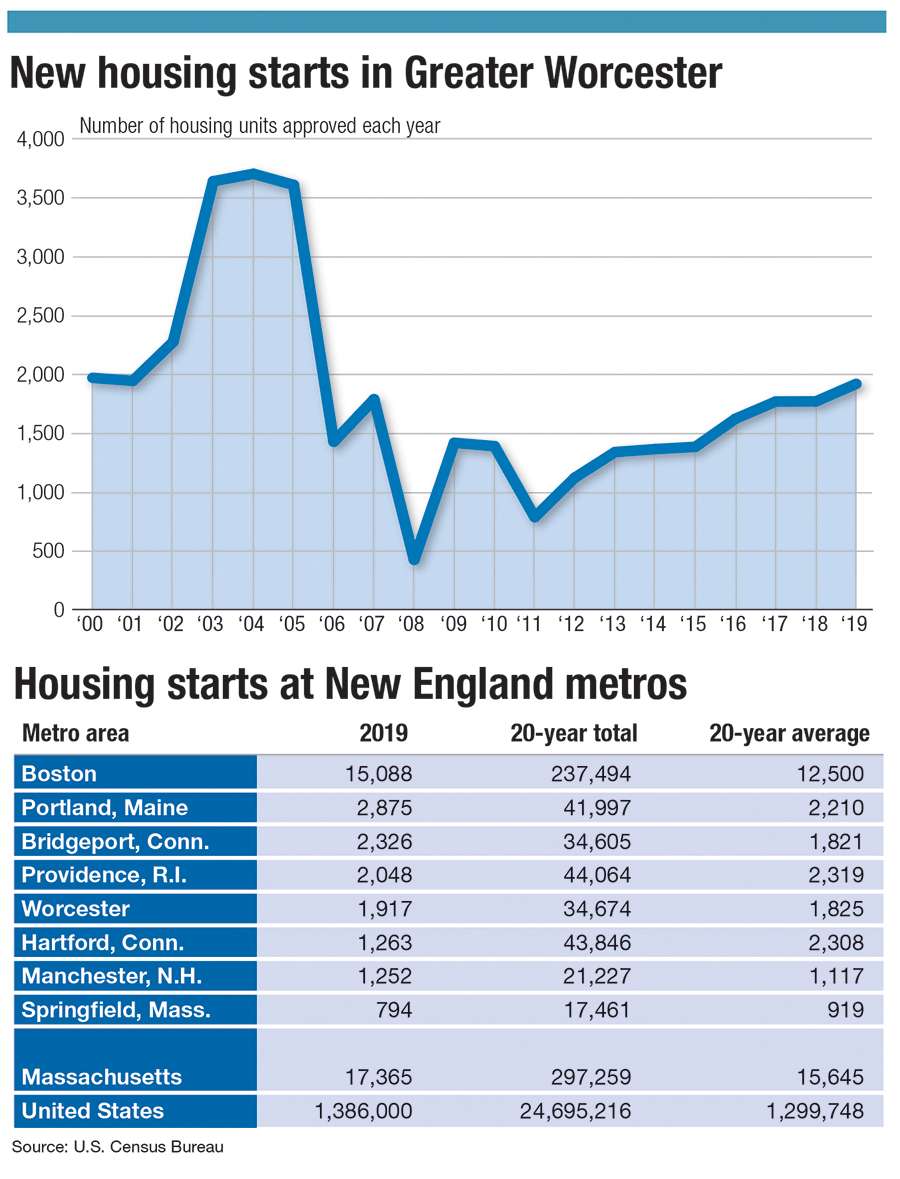

Approvals for new homes in the Worcester metropolitan area in 2019 reached the highest level since 2005, new federal data shows. The number of housing starts, as they’re called, has helped the area better meet demands of a growing population and workforce.

Now, with the coronavirus pandemic expected to cause an economic downturn, the area’s progress in slowly getting back to its pre-Great Recession peak in new housing is at risk.

Off Main Street in Shrewsbury, work is continuing on Wyman Farms, a 26-unit townhouse development for residents 55 and older.

Barbara Venincasa, a Realtor with Casa Realty Service, a sibling company to the builder of Wyman Farms, Casa Builders & Developers, has found demand has so far continued through the pandemic after site marketing began last September, she said.

Venincasa pointed to the different causes of the current expected recession – a pandemic – compared to those spurring the Great Recession, which were housing and financial crises.

“I’m hoping the comeback [this time] will be a little different, and quicker,” she said.

Mass. still needs more housing

Even before the outbreak, Massachusetts communities weren’t building nearly enough homes to meet the demand for a growing population and workforce, said Chrystal Kornegay, the executive director of MassHousing, a state agency financing affordable housing.

“I don’t think anyone disputes whether we need more housing growth to accommodate our population growth,” she said.

“I’m not sure it’s going to get any better as a result of the global pandemic because it’s going to take people – citizens, municipal officials, different groups – to get settled with everything else going on,” Kornegay added.

The Gov. Charlie Baker Administration has called for 135,000 new housing units statewide by 2025, and has given financial incentives and technical assistance to cities and towns that are friendlier to housing growth.

Despite that push – and a demand that comes with some of the country’s most expensive residential real estate – new-home growth across Massachusetts hasn’t come close to its peak before the Great Recession.

For three straight years, more than 20,000 new units were approved statewide. That rate fell to less than 10,000 annually for four straight years coming out of the recession. Those higher numbers haven't been hit again.

Anticipating trends

The Worcester area has slowly crept back up in new housing growth during the long economic expansion from 2009 to 2019.

In 2008, the number of housing units approved in the Worcester area fell to roughly 12% of the number approved three years prior. A similar drop now could undo progress in more recent years and make it more difficult to keep living affordable for many in the region.

Whether a major drop in new homes will take place in Central Massachusetts, it’s already underway nationally.

New-home construction fell in April by 30.2%, according to the U.S. Department of Commerce, reaching its lowest level in more than five years. The rate was highest in the Northeast at 43.6%.

Completion of homes already under construction fell by 8.1%, indicating that some builders are leaving home sites before work is finished.

Whether Central Massachusetts is avoiding a similar trend, some factors are working in the favor of more suburban areas, according to a report by Aaron Jodka, the managing director for research and client services for the Boston offices of the real estate services firm Colliers International.

Most Millennials – the largest segment of the population – are now in their 30s, and approaching or moving into the years when they’ll start a family and look for more space. At the same time, a price premium for building offices in a neighborhood in Boston or Cambridge has never been higher.

The pandemic may force another trend going directly against what had been popular, Jodka said: a move toward less-dense office buildings more spread out and having parking allowing people to drive in and park. That could draw more people to want to live closer to those offices instead of those in Boston.

Municipal planning officials, who regularly hold informal discussions with builders before they seek permitting, have said those early-stage talks are still taking place.

“So far, there’s still great demand out there for housing,” said Jim Brooks, a housing development director for the City of Worcester.

So far, builders have tended to find demand will continue on at some level despite economic conditions, said Tom Skwierawski, Fitchburg’s executive director of community development.

“There could be a lag time before this hits the housing market,” Skwierawski said. “In the short-term, we haven’t seen a drastic difference ... A lot of it will be borne out in the medium- and long-term.”

Construction moving ahead

Despite the pandemic and skyrocketing unemployment rates, notable Central Massachusetts residential projects are moving ahead.

A major project for downtown Fitchburg, a redevelopment of a long-vacant furniture building and adjacent fire station with more than 40 units, is expected to move ahead, Skwierawski said.

In downtown Framingham, a 270-unit development called Modera Framingham at at 266 Waverly St., is planning to begin moving tenants in by late summer.

A few blocks away, Framingham’s VTT Management is continuing work on a 75-unit development on Union Avenue across from City Hall that’s slated to be complete by early fall. VTT’s chief executive, Vaios Theodorakos, is optimistic about new housing despite his pessimism with the economy.

“This is unprecedented, beyond any scope,” Theodorakos said of the economy. “There’s no V-shape recovery.”

The firm is pressing ahead though, he said, because its units tend to be more affordable. VTT plans to break ground on an even larger project later this year a few blocks away. That site, on Kendall Street, would include 112 units.

North of downtown, a 129-unit development at the former Millwood Farms Golf Course in Framingham is continuing, too. Work on the first few dozen units at Millwood Preserve, which is for residents 55 and older, is underway.

“We haven’t really had any fallout,” said Bob Depietri, a vice president for Capital Group Properties, a Southborough developer. “The pent-up demand is tremendous right now for new housing.”

Capital Group Properties is continuing with other area developments, including a 114-unit expansion of the Salisbury Hill complex in Worcester.

Other Worcester projects continuing include more than 100 units at a former courthouse in Lincoln Square and 72 units on Wall Street.

In Upton, the 44-unit development 149 Main is slated for occupancy on July 1. In Boylston, the 66-unit project called The Brookside is expected to open to residents in September. Both are currently leasing, said Jennifer Michalik, a community specialist at Shrewsbury-based Madison Management, which is working on both developments.

“Our velocity is slower than it would normally be,” Michalik said. Ideally, she said, prospective tenants would be able to tour a site and see amenities, but they can’t these days. Still, she’s optimistic that units will still move, especially for rentals, as downsizing, job changes and other life transitions take place.

“For rentals, we’re still seeing the demand,” she said. “People still need a place to live.”

0 Comments